When big shocks come along like the one ripping through Greece, many investors want to pull their cash from the market. But they usually end up regretting it.

Savvy investors use these market scares to scoop up more stocks at a discount.

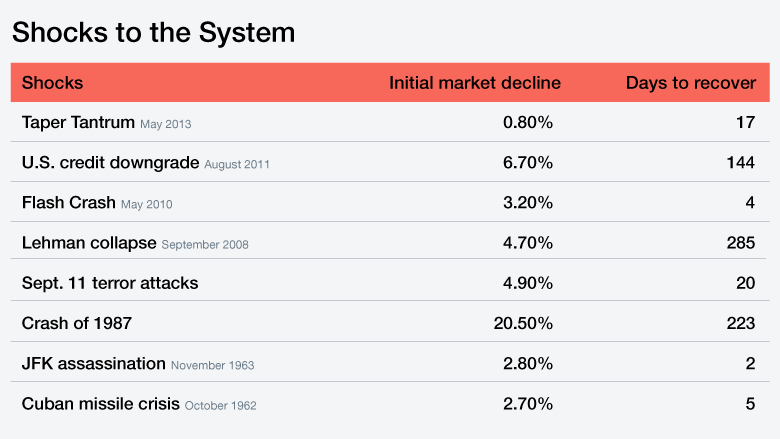

Just look back at history. An S&P Capital IQ analysis of the last 70 years of market shocks -- including ones like the 2010 Flash Crash and Sept. 11 terror attacks -- shows that the U.S. stock market has a knack for weathering most storms that come its way.

The median S&P 500 decline the day after a shock to the system was 2.4%. That's pretty close to what happened on Monday when the market tumbled over 2% in response to Greece's failure to reach a new bailout deal with its creditors.

In the past, it took the stock market a median of just eight days to bottom out after a shock, according to S&P Capital IQ.

Fast recovery: In fact, the S&P 500 recovered all of that lost ground in a mere 14 calendar days. That's pretty reassuring to those worried about how a Greek default or exit of the eurozone may impact their portfolios.

"As history has shown, prior market shocks have usually proven to be better opportunities to buy than bail," Sam Stovall, chief investment strategist at S&P Capital IQ, wrote in a note to clients.

Related: Catch up on the Greek crisis...in 2 minutes

Is Greece another Lehman? Of course, there is no guarantee that history will repeat itself this time. The 2008 collapse of Lehman Brothers shows how investors and world leaders can underestimate the impact of a single event. The S&P 500 plummeted 4.7% after Lehman filed for bankruptcy. It took the market 285 days to recover from that.

Yet that epic bankruptcy didn't occur in a vacuum. It happened in the midst of a bear market in stocks and the scariest economic crisis since the Great Depression.

Related: The very big risks of the Greek crisis

Buying on the cheap: Stovall's analysis shows that shocks that occur during bull markets -- like the one we're currently in -- typically resolve themselves quickly. That allows opportunistic traders a window to scoop up stocks on the cheap.

That's more or less what happened during the last market shock, which took place in May 2013. Dubbed the "Taper Tantrum," stocks retreated 5.8% over 33 days as investors freaked out over signs that the Federal Reserve would dial back on its bond-buying stimulus. After bottoming out, the S&P 500 got back to even 17 days later.

Related: The best stocks of 2015

No panic yet: While U.S. stocks certainly responded negatively to the Greek situation on Monday, investors didn't exactly freak out.

"The market lost steam as the day went on, but the market was orderly -- there was no panic," Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, wrote in a report.

That's because Greece doesn't seem to represent the threat to the global economy that it did just a few years ago. Most of Greece's debt is now held by other governments an the International Monetary Fund, not other banks. That helps contain some of the fallout. Conditions in Spain and Portugal have also improved, which makes a spillover effect less likely.

That's little consolation to people in Greece, but it should come as a relief to U.S. investors watching the situation unfold overseas.

"While the situation is volatile, the problems of Greece seem far less threatening to the global economy and markets than they do to the Greek economy itself," David Kelly, chief global strategist at JPMorgan, wrote in a note to clients.