Welcome to takeover Tuesday!

Investors are toasting a massive deal between the two biggest beer brewers in the world, Anheuser-Busch InBev (AHBIF) and SABMiller (SBMRY). It will be one of the biggest acquisitions in corporate history.

Here are the key things you need to know before the opening bell rings in New York:

1. Merger mania: The company that makes the popular Budweiser beer -- AB InBev -- has agreed to buy its main rival SABMiller for £68 billion ($104 billion).

The combined firm will be the world's largest beermaker by far, with nine of the world's top 20 beers by volume.

Most SABMiller shareholders are being offered £44 ($67.59) per share in cash. Meanwhile, the two biggest shareholders -- Altria (MO) and Colombia's Santo Domingo family -- will have to accept cash and stock worth roughly £39.03 ($60) per share.

Shares in SABMiller shot up by about 8.5% in London trading, while AB InBev shares are rising by 2.5%.

Watch shares in smaller brewers on Tuesday. Molson Coors (TAP) shares could move on expectations that the company may pick up some beer brands that the new mega-group is forced to sell to get regulatory approval for the merger.

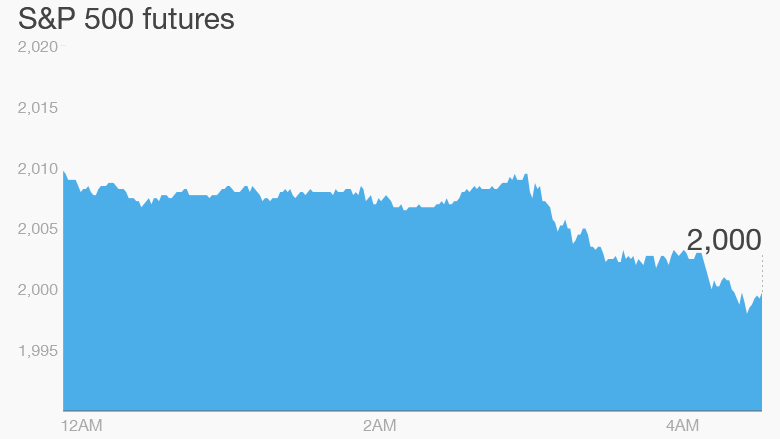

2. Stocks dip down: It looks like the Dow Jones Industrial Average's seven-day winning streak is about to come to an end.

U.S. stock futures are slipping into the red and there's a negative mood in stock markets around the world.

European markets are slipping in early trading, with many indexes down by about 1.5%.

Asian markets mostly ended with losses.

3. Market movers -- FMC, Barclays: Shares in the chemical giant FMC Corp (FMC) plunged by nearly 10% in extended trading after announcing that the decline of the Brazilian real will hurt its performance in the second half of 2015.

Shares in Barclays (BCS) in London are falling by about 3% as newspapers report that Jes Staley, a former JPMorgan (JPM)banker, is set to take over as CEO of the British bank within the next two weeks. Barclays had been moving away from investment banking since the financial crisis. It declined to comment on the reports.

4. Quarterly earnings: Johnson & Johnson (JNJ) is among a handful of companies opening their books before the trading day begins.

After the close, firms including Intel (INTC) and JPMorgan Chase (JPM) will report results.