1. Seeing red: Global stock markets are waking up to rising political risk in Washington.

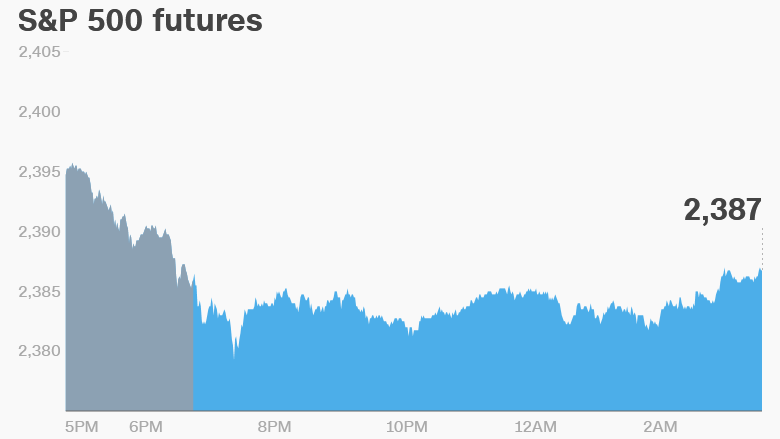

Many international indexes were lower and U.S. stock futures were heading south. The U.S. dollar weakened against other major currencies.

The moves followed news that President Trump asked former FBI Director James Comey to end an investigation into former national security adviser Michael Flynn.

The stunning reports -- denied by the White House -- deepened the political turmoil engulfing Trump's White House and intensified concerns among investors about the president's ability to push through his big economic plans.

"The inflammable allegations have spooked both currency and equity markets," said Stephen Innes, a senior trader at online broker Oanda. "Foreign exchange dealers are in flat out sell-the-dollar mode."

Both the S&P 500 and Nasdaq hit record highs on Tuesday, extending a major rally that took hold following Trump's election in November. Despite the current wobble, Trump's presidency has been a boon for U.S. stocks.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Laptop ban in focus: Top European and U.S. officials will discuss aviation security on Wednesday. The U.S. is considering an expansion of the U.S. laptop ban to include flights from Europe.

The laptop ban bars passengers from bringing electronic devices into the cabin if they're larger than a smartphone.

Expanding the ban could disrupt the global aviation industry and slam U.S. tourism. There are more than 350 flights a day from Europe to the U.S.

U.S. carriers Delta Air Lines (DAL), United Airlines (UAL) and American Airlines (AAL) operate the largest number of flights between Europe and the U.S.

3. Market movers: Shares in Colgate-Palmolive (CL) were rising premarket after a media report suggested the firm's CEO is considering a possible sale.

Quarterly results could mean big moves for retailers Target (TGT) and American Eagle (AEO). They're both releasing earnings before the open.

Cisco Systems (CSCO) and Victoria's Secret owner L Brands (LB) will announce earnings after the close.

Gold prices increased by about 0.6% to trade around $1,245 per ounce as investors put their money in safe-haven assets.

The weekly U.S. crude inventory report will be released at 10:30 a.m. ET.

Download CNN MoneyStream for up-to-the-minute market data and news

4. Developers unite!: Google (GOOG) is hosting an annual developer conference on Wednesday.

CEO Sundar Pichai and other executives will take the stage in Mountain View, California to announce the company's latest hardware and software news.

5. Coming this week:

Wednesday -- Target (TGT), American Eagle (AEO) earnings; U.S. crude oil inventory report

Thursday -- Alibaba (BABA), Walmart (WMT) and Gap (GPS) earnings

Friday -- Foot Locker (FL) earnings