1. The Comey show: Former FBI director James Comey will deliver the most anticipated Congressional testimony in years when he speaks on Thursday about his interactions with President Trump.

Comey was fired by Trump last month as the FBI was in the midst of conducting an investigation into Russian efforts to interfere with the U.S. election.

Comey's prepared testimony said Trump directly asked him to "let go" of an investigation into former national security adviser Michael Flynn.

"The greater the political outrage, the greater the importance to markets," said Paul Donovan of UBS Wealth Management. "Political outrage is time consuming -- time spent being outraged is time that cannot be spent on fiscal policy or on providing leadership."

2. U.K. election: Polls have opened in the U.K., 52 days after Prime Minister Theresa May called for a surprise general election.

Only two people have a realistic chance of being the next Prime Minister: May, the incumbent, or Jeremy Corbyn, the leader of the Labour party.

Investors will begin reacting to the vote around 5:00 p.m. ET when a key exit poll is released.

The pound will be the best barometer of market reaction in the hours after the polls close.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Yahoo vote: Yahoo shareholders will vote on Thursday whether the company should be sold to Verizon (VZ) for $4.5 billion. It's widely expected to be approved and Yahoo shares are rising in premarket trading.

It will mark an end for the once pioneering company that was founded 22 years ago. Former Google (GOOGL) exec Marissa Mayer tried to reshape Yahoo (YAHOF) with a focus on media and mobile, but ultimately failed. She'll receive a $186 million payout.

4. Alibaba excitement: Shares in Alibaba (BABA) are jumping premarket after the Chinese company forecast impressive sales growth that blew past analyst expectations.

5. Crude awakening: Investors will be keeping an eye on oil after crude prices fell by just over 5% on Wednesday.

Investors hit the 'sell' button after seeing a report showing a bigger-than-expected build up in U.S. crude inventories.

Crude futures have now steadied and are trading around $46 per barrel.

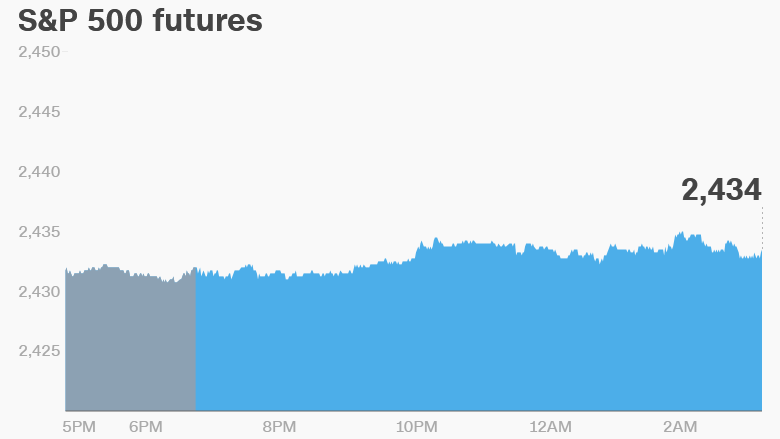

6. Global market overview: There's very little enthusiasm in global stock markets right now.

U.S. stock futures are essentially flat.

European markets were mixed in early trading as investors wait for the European Central Bank to release its monetary policy decision at 7:45 a.m. ET. Economists expect policy to remain unchanged but predict that ECB president Mario Draghi will acknowledge Europe's improving economic picture.

Most Asian markets posted small gains.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Thursday - Yahoo (YHOO) shareholders vote on Verizon (VZ) deal; U.S. treasury Secretary Steven Mnuchin meets with House members over debt ceiling; Former FBI director James Comey to testify before Senate; U.K. election

Friday - Apple (AAPL) CEO Tim Cook delivers MIT commencement speech