1. Fed in focus: The Federal Reserve is taking the spotlight on Wednesday as it's scheduled to release minutes from its June meeting at 2 p.m. ET.

The Fed raised interest rates at that meeting, signaling the central bank believed the U.S. economy was on solid footing.

The minutes should offer clues as to what the Fed may do next, and when.

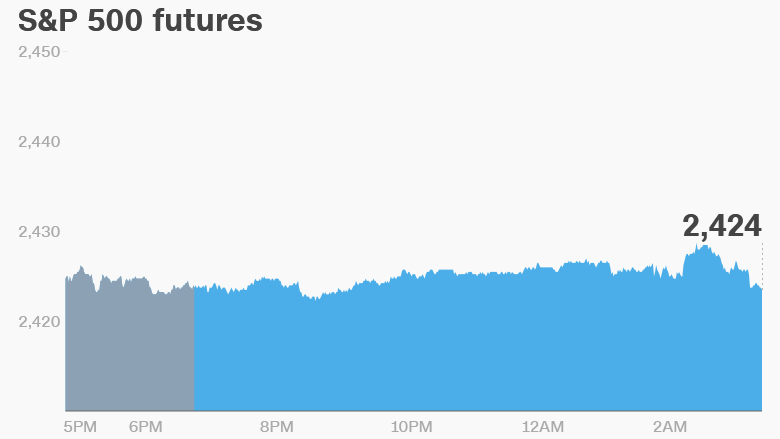

2. Keeping calm vs Going ballistic: Global investors are remaining calm on Wednesday and U.S. stock futures are holding steady despite confirmation that North Korea had launched an intercontinental ballistic missile on Tuesday.

The U.S. has requested a meeting of the United Nations Security Council on Wednesday to discuss the rogue country's increasing military provocations.

North Korean leader Kim Jong Un called the launch an Independence Day present to the U.S., adding "we should deliver big and small presents often," according to the state news agency, KCNA.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Keep an eye on -- Microsoft, automakers, airlines: Media reports suggest that Microsoft (MSFT) may lay off thousands of employees as it reorganizes its sales operations.

"Microsoft is implementing changes to better serve our customers and partners," it said in a statement. The company declined to comment on possible job cuts.

Global automakers are also in the news. Volvo announced Wednesday that every car it makes from 2019 will have an electric motor. This makes the Chinese-owned company the first traditional carmaker to fully embrace electric and hybrid production.

And Europe's top competition regulator is set to decide Wednesday whether France's PSA Group should be allowed to buy GM's (GM) Opel unit. Over the past 17 years, GM has lost more than $22 billion in Europe.

In airlines, both Emirates and Turkish Airlines confirmed that a U.S. electronics ban was lifted on Wednesday. That means passengers can now take their laptops and other large electronics devices with them into the cabin on U.S.-bound flights.

4. Italy breaths a sigh of relief: Shares in Italian banks are trading near their highest levels in over a year after the European Commission announced Tuesday that it had approved Italy's plan to bail out Monte dei Paschi di Siena (BMDPY) with about €5.4 billion ($6.1 billion).

Italian authorities are pulling out the stops to support their fragile financial sector, but must abide by European Union rules related to state aid and bank bailouts.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Wednesday -- Federal Reserve releases minutes from latest monetary policy meeting at 2 p.m. ET; Yum China (YUMC) earnings

Thursday -- U.S. ADP Employment Change report out at 8:15 a.m.; U.S. crude oil inventories data released at 11 a.m.

Friday -- Bureau of Labor Statistics releases June jobs report at 8:30 a.m.; G20 leaders meet in Hamburg, Germany