1. Nervous markets: Global markets are heading for a third consecutive day of losses amid growing tensions between North Korea and the U.S.

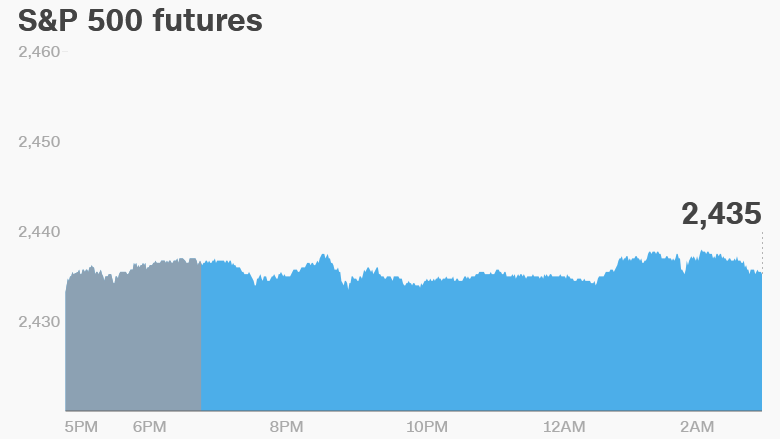

U.S. stock futures were pointing to a weaker open on Friday.

European markets were also in the red following a negative session in Asia.

Investors are increasingly nervous: The VIX volatility index, a closely-watched "fear gauge," is up 70% since Tuesday. Meanwhile, the CNNMoney Fear & Greed Index has swung firmly into the fear zone.

President Trump took aim at North Korea again on Thursday, saying that his earlier threat to unleash "fire and fury" may not have gone far enough.

The latest rhetorical escalation comes after North Korean state media reported that the country's military leaders were working on a proposal to launch four intermediate-range missiles into the sea less than 25 miles off Guam's coast.

The Dow Jones industrial average closed 0.9% lower on Thursday, while the S&P 500 dropped 1.5% and the Nasdaq shed 2.1%.

2. Google cancels town hall: Google's (GOOGL) diversity scandal took another awkward twist on Thursday when CEO Sundar Pichai canceled a scheduled all-hands staff meeting just moments before it was set to begin.

The town hall meeting was meant to address concerns over a controversial essay published by a former employee.

Pichai said that questions from employees had been leaked and that, in some cases, specific employees' identities were revealed, exposing them to harassment and threats.

3. Snap troubles: Shares in Snap (SNAP) fell sharply in extended trading after it reported a steep loss, disappointing sales and weak user growth.

Losses at the Snapchat parent ballooned to $443 million in the second quarter, a nearly fourfold increase from the same period last year.

The messaging service added just 7 million new daily active users in the quarter, falling short of estimates.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Stock market movers -- Nvidia: Shares in Nvidia (NVDA) plunged 7% in extended trading despite releasing a strong earnings report that topped Wall Street's forecasts. The stock is up 54% so far this year.

5. Earnings and economics: J. C. Penney (JCP) is scheduled to release its earnings before the open Friday.

The Bureau of Labor Statistics will publish its July inflation report at 8:30 a.m. ET.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Friday -- U.S. inflation report; J. C. Penney