1. Brexit breakthrough: Britain and the European Union reached a Brexit milestone on Friday, breaking a deadlock that allows talks to move onto a crucial second phase.

Negotiations will now turn to trade and the terms of a transition that would allow businesses in the U.K. to adapt to life outside the bloc.

The pound posted a mild reaction to the deal, gaining 0.2% against the dollar.

Investor enthusiasm may be limited because trade talks promise to be difficult.

"Let's remember that the most difficult challenge still ahead," said European Council President Donald Tusk. "Breaking up is hard. But breaking up and building a new relationship is much harder."

2. Jobs report: The U.S. economy continued its strong jobs-creation run in November.

The data show employers added 228,000 jobs and unemployment remained at a 17-year low of 4.1%.

The report echoes other signs of strength: The economy grew 3.3% in the most recent quarter, its best performance since 2014.

3. Shutdown averted, for now: The dollar edged higher against other major currencies after lawmakers voted for a short-term spending bill that will keep the federal government running for another two weeks.

The major obstacle is what comes after December 22, when the government runs out of money once again.

All eyes will be on the White House, as Trump and top congressional leaders try to resolve policy differences so Congress can pass a long-term spending bill before Christmas.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Global overview: Stocks markets are closing out the week with a bang.

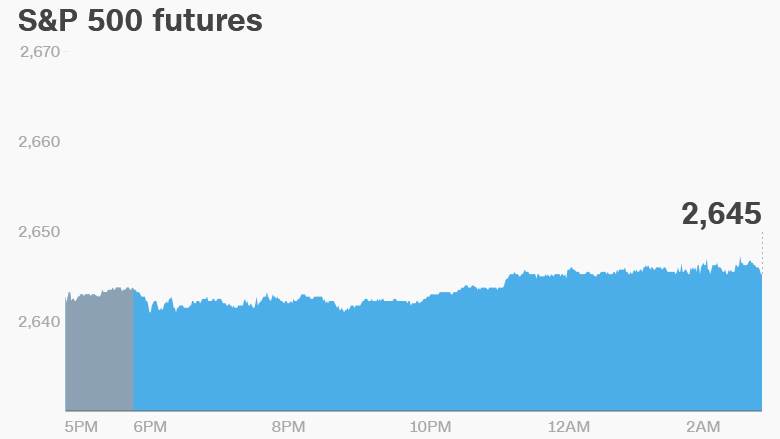

U.S. stock futures were higher. Major European and Asian markets were in positive territory.

U.S. crude oil futures gained 0.7% to trade just above $57 per barrel.

The one big loser of the day was bitcoin, which continued its wild ride. It plunged more than $2,500 after hitting new record on Thursday.

The Dow Jones industrial average and the S&P 500 both gained 0.3% on Thursday, while the Nasdaq added 0.5%.

5. Companies and economics: Shares in Japan Display shot up 9% in Tokyo on a report that Apple (AAPL) might start using LCD screens in future smartphones.

A preliminary reading of the University of Michigan's Consumer Sentiment Index for December will be released at 10 a.m.

Chinese exports and imports data came out stronger than expected, pointing to healthy global trade.

"We expect exports to continue to perform well in the coming months on the back of strong global demand," said Julian Evans-Pritchard, China Economist at Capital Economics.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Friday -- Jobs report