1. Media mega deal: Disney (DIS) is buying a huge chunk of 21st Century Fox (FOX) in a deal that promises to reshape the media industry and help the entertainment giant fend off digital rivals such as Netflix.

The $52.4 billion all-stock deal will combine two of the biggest players in Hollywood.

Shares in Fox and Disney both advanced in premarket trading.

Disney is getting Fox's movie studio, the cable channels FX and National Geographic as well as Star India and Fox's stake in European pay-TV provider Sky.

Prior to the deal closing, 21st Century Fox will separate the Fox broadcasting network, Fox News Channel, Fox Business Network, and some national sports networks into a newly listed company that will be spun off to shareholders.

2. Net neutrality decision: The U.S. Federal Communications Commission (FCC) is set to vote Thursday on a repeal of Obama-era net neutrality protections.

Net neutrality rules bar internet providers like Comcast (CCVCL) and AT&T (T) from deliberately speeding up or slowing down traffic from specific websites and apps in order to prioritize their own content.

FCC chairman Ajit Pai's plan would lift those bans -- and likely boost those companies. (AT&T is in the process of acquiring Time Warner, which owns CNN.)

Democrats have called on the FCC to delay the vote.

3. Central bank time: The U.S. Federal Reserve raised interest rates on Wednesday. Investors attention now turns to the European Central Bank and the Bank of England.

The central banks are not expected to announce rate hikes, but investors will be looking for hints on their strategy for the coming year.

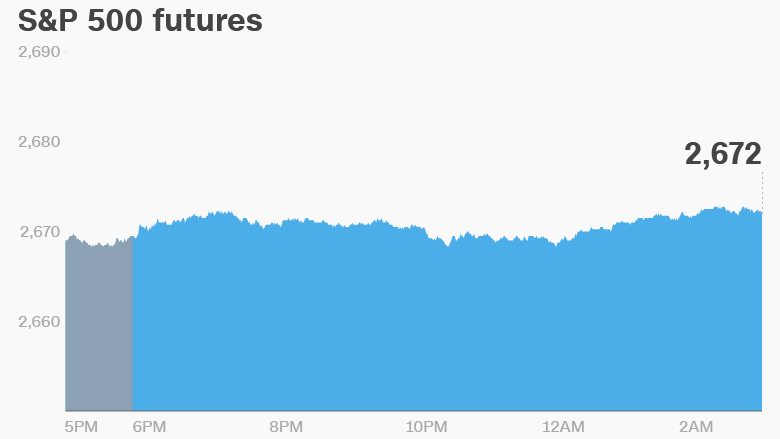

4. Global market overview: U.S. stock futures were higher.

European markets opened mostly lower, while Asian markets ended mixed.

The Dow Jones industrial average hit a record high and moved closer to 25,000 on Wednesday after Congressional leaders struck a tentative tax overhaul deal. The index added 0.3%.

The S&P 500 closed flat and the Nasdaq gained 0.2%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Costco (COST), Adobe (ADBE) and Oracle (ORCL) will release their results after the closing bell.

The U.S. Census Bureau will publish data on November retail sales at 8:30 a.m. ET.

The International Energy Agency said it expects U.S. oil production to rise again in 2018. It predicts that global supply will grow at faster rate than demand next year.

"2018 may not necessarily be a happy New Year for those who would like to see a tighter market," the agency said in a report.

There's more good news in Germany: The IFO Institute has raised its growth forecast for 2018 from 2% to 2.6%

"The German economy is in great shape," said IFO President Clemens Fuest.

European Union leaders are gathering for a summit in Brussels on Thursday and Friday. High on their agenda: Brexit.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Thursday -- November U.S. retail sales; Bank of England rate decision; European Central Bank decision; Costco (COST) and Oracle (ORCL) earnings; IEA oil report; EU summit

Friday -- EU Summit