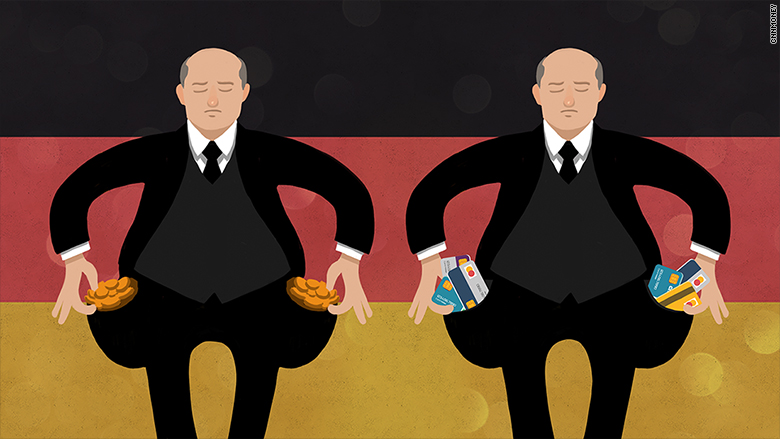

Germans are falling out of love with cash.

Less than half of the money spent in Germany last year was cash, according to a survey conducted by the Bundesbank.

The central bank said it's the first time that cash has not made up a majority of money spent. Cash transactions now account for 48% of money spent, down five percentage points from 2014.

Germans have not switched to credit and debit cards as quickly as people in other developed economies, preferring instead to use banknotes and coins for their purchases.

The average German wallet contains €107 ($132) in cash, according to the Bundesbank. That's one of the highest amounts in Europe, and far more than the roughly €30 ($37) typically found in French and Belgian wallets.

Related: Cash is still king in the digital era

Germans told the central bank that there were a few reasons why cash had remained popular for so long.

Many said it's a more private way to pay, and they believe it's faster.

More than three quarters of Germans said they were worried that some people wouldn't be able to cope in a cashless society.

Seventy-one percent said cash was a good way to teach children about money, and 64% said using cash gives them greater control over their expenses. Credit cards are much less popular than debit cards.

Related: Britain won't stop putting animal fat in its cash

The preferences shift, however, depending on how much money is being spent.

Germans still use cash in 74% of individual transactions, with that share rising to 96% when €5 ($6.20) or less is being spent. Only when it comes to paying €50 ($62) or more do Germans prefer card or electronic payments.

Americans use cash for 32% of individual transactions, according to the Federal Reserve Bank of San Francisco. The figure stands at around 50% in Finland, the Netherlands and Estonia.

Some observers argue that cash will remain in demand around the world.

San Francisco Fed President John Williams wrote in November that cash is convenient, and it doesn't require a bank account or a mobile phone. In emergencies, it's good to have stashed under the mattress.

A quarter of Europeans keep cash at home as a precautionary reserve, according to the European Central Bank.