1. Tariff reaction: Traders are hitting the sell button after President Trump tweeted Friday that "trade wars are good, and easy to win."

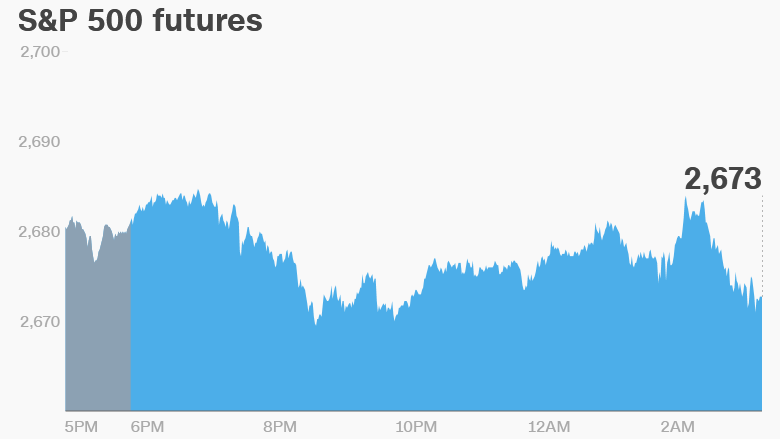

US stock futures dropped following the tweet. The Dow and Nasdaq were headed for losses of 0.8%.

Trump announced plans on Thursday for heavy tariffs on steel and aluminum imports, which sparked fears that this could lead to a trade war.

Investors are worried Trump's protectionist stance could set off a wave of retaliatory moves that would hurt businesses from South Korea to Canada.

The US is the world's biggest importer of steel and aluminum, so the introduction of import tariffs is expected to ripple throughout the global economy.

European markets declined on Friday, with some indexes down by more than 2%. Asian markets closed with losses.

Steelmakers were hard hit. In Europe, ThyssenKrupp (TKAMY) was down 3%, Salzgitter (SZGPY) dropped by nearly 5% and ArcelorMittal (AMSYF) was off by 4%. China's Baoshan Iron & Steel and Japan's Nippon Steel (NISTF) both dropped nearly 4%.

The stock market selling kicked off on Thursday after the steel tariff announcement. The Dow Jones industrial average dropped 1.7%, the S&P 500 fell by 1.3% and the Nasdaq declined 1.3%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Brexit focus: UK Prime Minister Theresa May will deliver what's billed as a major speech on Brexit.

According to excerpts from the speech, she will say that Britain and the EU should be able to forge a deeper and broader free trade agreement than anywhere else in the world.

May has said that she wants trade between the UK and Europe to be "as frictionless as possible" after Brexit.

But what will be possible outside the EU's internal market and customs union?

"There can be no frictionless trade outside of the customs union and the single market," Donald Tusk, president of the council of all 28 EU member states, said on Thursday. "Friction is an inevitable side effect of Brexit. By nature."

3. Stock market movers -- Gap, Nordstrom, American Outdoor Brands: Shares in Gap (GPS) were up 9% premarket after the company reported better-than-expected earnings.

Shares in Nordstrom (JWN) were down 4% premarket after the retailer published disappointing results on Thursday.

Shares in American Outdoor Brands (AOBC) were set to tank 12% after it posted rough quarterly earnings. The company, which owns the Smith & Wesson brand, reported a 33% drop in sales from the previous year, and profits that sank 65%.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

4. Coming this week:

Friday — Earnings from Foot Locker (FL), JCPenney (JCP) and JD.com (JD), University of Michigan releases its final Consumer Sentiment Index for February