|

Tough times for retailers

|

|

August 15, 2000: 7:20 a.m. ET

A slowing economy, high oil prices and 'fashion malaise' make shoppers frugal

By Staff Writer John Chartier

|

NEW YORK (CNNfn) - Brenda Lopez is more concerned about price than style or designer when shopping for clothing. Although the booming economy has given her more to spend, prices always seem to go up with her salary, the 40-year-old telemarketer said.

Joe Corsetti, and Steve Lee, both in their early 30s, would like to spend less on clothing, but their jobs in telecommunications sales require they shell out hundreds of dollars a month on designer suits and accessories.

But when it comes to casual wear, both men are more frugal.

And Lenore Marks, a 25-year-old performer, has to buy her own expensive costumes when she dances in a show, although she can deduct the cost from her taxes. But in shopping for weekend clothing, she considers herself as much of a bargain hunter as anyone else.

Finding a way to attract and keep such diverse shoppers is the challenge facing retailers. As consumers who have run up a whopping $627 billion in credit card debt, now face rising interest rates, retailers are having difficulty attracting them to the cash register. Skyrocketing oil prices are also putting a crimp on spending while foul weather and "fashion malaise," have also caused consumers to hold on to their wallets a little tighter.

"You've had a series of announcements over the last several weeks indicating a softness in retail," said Michael Exstein, a retail analyst with Credit Suisse First Boston. "You've had other indicators, which I think really tells you you're up against really difficult comparisons [with year-ago figures]. Something's gone wrong with the apparel business in this country."

The unprecedented economic growth of the past decade will continue, experts say, thought at a much slower rate. And retailers are struggling to adjust to the slower pace.

"This trend is going to be with us for the foreseeable future. Growth will continue and will be very strong, but it will be more moderate than it was last year," said Kurt Barnard, president of Barnard's Retail Trend Report in Upper Montclair, N.J. "Make no mistake about it - this growth will continue. Consumer spending will continue to grow, but it's not going to suddenly stop or go back. It will continue at a more reasonable pace."

Profit warnings all around

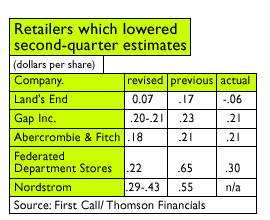

More than a dozen retailers have issued profit warnings on their second-quarter earnings in recent weeks and several now say they expect to miss Wall Street estimates for the second half of the year, which includes the back-to-school season and the all-important winter holiday season.

Kmart (KM: Research, Estimates), Gap Inc., Land's End (LE: Research, Estimates), Federated Department Stores (FD: Research, Estimates), Saks (SKS: Research, Estimates), Abercrombie & Fitch (ANF: Research, Estimates), Urban Outfitters (URBN: Research, Estimates), and Bon Ton (BONT: Research, Estimates) are just some of the more familiar names that have lowered second-quarter expectations.

And Wal-Mart (WMT: Research, Estimates), the nation's No. 1 retailer, said last week that it expects lower third-quarter results.

The slew of warnings come even as the U.S. government Friday reported retail sales for July increased 0.7 percent from June levels to $270.6 billion. Analysts, who had forecast a 0.4 percent rise, worry that the figure means the economic slowdown experienced in recent weeks may only be temporary, prompting the Federal Reserve Board and its Chairman Alan Greenspan to raise interest rates for the seventh time in a year when it meets in a week.

Sluggish sales have prompted retailers to hold end-of-summer clearance sales in early August, a few weeks earlier than normal, in order to get a jump on the back-to-school season. But a cool summer, particularly in the Northeast, has even dampened the clearance sales.

On July 28, upscale specialty retailer Nordstrom (JWN: Research, Estimates), surprised analysts when it warned investors that its second-quarter profits would come in between 39 cents and 43 cents a share instead of the 55 cents a share Wall Street had predicted.

Not only did the company blame sluggish summer clearance sales, but also lower sales at its annual anniversary sale, a unique event among retailers in that it offers discounted fall merchandise to consumers before the season begins, giving analysts an early glimpse at the coming fall season.

"I think they made a lot of fashion changes, but there's been a general malaise in women's fashion apparel," said Steve Kernkraut, a retail analyst with Bear Stearns. "What's somewhat concerning here is that Nordstrom has transitioned totally to fall earlier. Is their fashion not on target, or is the consumer really concerned about the rising gas prices?"

Consumers tapped out

Analysts agree that economic factors play an important part in people's spending habits, but in this case, it's not as though the economy is in trouble. In fact, it remains strong.

Americans, still prospering but tapped out from a whopping $627 billion in credit card debt (10 percent more than a year ago), have become bargain hunters in the wake of cautionary interest rate hikes by the Fed.

"Americans are basically tapped out," Barnard said. "On top of that you have the rip-off at the gasoline station, and over the last three four years Americans have been on a wild home-buying binge, so now they're saddled with rather steep mortgages every month.

"Basically you're seeing a public with good incomes, is hard at work, but is tapped out," he added. "All the reports from the chains indicate that at best they are on a level with last year, and in many, many cases they have fallen below last year. Even those companies that have had a very good July are still below what they were last year."

Lopez, the telemarketer and self-described bargain hunter, reflects that analysis.

"I think things are good right now," she said. "The economy is doing good. I just got a raise. For work, I will spend a little more. You want to look nice. You don't get a second chance to make a first impression," Lopez added as she toted shopping bags through the Manhattan Mall on a recent cloudy Monday.

But with six interest rate-hikes since June, 1999, shoppers are more hesitant to run up their charge cards.

"I like to bargain hunt. When there's a sale I'll buy two of the same suit in alternate colors. That way I can mix and match my outfits," Lopez said.

Who's got the look?

For all the economic pressure, a malaise in fashion, particularly in women's apparel, has also impacted sales. People already have enough Capri pants, blue shirts and khaki everything in their wardrobes, causing even cash-rich, spend-happy youths to spend a bit more money on electronics, music and other items than on clothes.

Experts say apparel makers have had a hard time trying to keep up with an ever-quickening pace of changing fashion trends, inadvertently causing a glut of some items.

"I think everybody is having had a difficult time," Exstein said. "I think in general it's been a very tough apparel cycle, and I think particularly if you're depending on (designers) Tommy (Hilfiger) and Ralph (Lauren) and Liz (Claiborne), apparel has slowed down." "I think everybody is having had a difficult time," Exstein said. "I think in general it's been a very tough apparel cycle, and I think particularly if you're depending on (designers) Tommy (Hilfiger) and Ralph (Lauren) and Liz (Claiborne), apparel has slowed down."

Industry experts agree.

"The atmosphere I think is somewhat confused. Confused because the retail industry, no matter how it looks from the outside, you can't move as quickly as fashion," said Jack Herschlag, executive director of the National Association of Men's Sportswear, a New York-based trade group. "You cannot respond as quickly to something, particularly if you're manufacturing overseas."

Gap Inc. (GPS: Research, Estimates), which owns Old Navy and Banana Republic along with its flagship Gap stores, lowered its second-quarter earnings estimate to between 20 and 21 cents a share from 23 cents a share on August 2. The company ended up posting earnings of 21 cents a share last Thursday, a penny ahead of analysts' revised expectations.

Gap also warned that it might miss second-half targets. The main problem the company cited has been inventory and fashion problems at Old Navy.

Other specialty apparel retailers that cater mostly to teenagers and young adults, such as Abercrombie & Fitch and Urban Outfitters, have also warned on their second quarter results.

"The fashion industry has been going crazy. People just aren't shopping as much - period," said Audrey Guskey, a professor at Duquesne University who tracks retail trends. "They're not shopping on weekends, not hanging out in malls. People are just very busy. They don't have the time to pursue shopping as a hobby. People are being cautious with their money as well. They're just not spending as we had probably in the late 80s."

Guskey agrees that consumers have become a bit more frugal in the wake of rising borrowing costs and slowing growth, adding that Internet shopping is also likely having an impact. But not just because it siphons sales from actual stores. Guskey said shoppers are a lot less likely to impulse buy when they're sitting at home in front of the computer in slippers.

"People are trying to be cautious and save their money," she said. "People are shopping more at the discounters. If you look at the department stores, they're not doing as well."

The shift to casual workplace dress has also hurt apparel sales, industry watchers say. More and more companies have loosened up dress codes, which has consumers confused on what is and is not acceptable in the workplace.

"We are still suffering the effects of the change from traditional business apparel to casual apparel," said Tracy Mullin, president and chief executive officer of the National Retail Federation. "Those (casual apparel brands) carry much lower price points and people still haven't figured out what casual is. There's no real direction for fashion. People don't know what direction it's going, and for women this is a big issue."

Still, Mullin and other sector watchers believe that despite the economic slowdown and the company warnings, retailers will have a prosperous holiday season, though not at the same levels as the last few years.

"I think there will be a good Christmas. It's what most of the industry lives for," Herschlag said. "One reason is that the election will be behind us. Assuming that the economy is stable and if everything else is stable, the public's mind won't be on politics and foreign relations and they can get back to looking for what they want and buying it."

|

|

|

|

|

|

|