|

Making the most of $53K

|

|

August 15, 2000: 9:13 a.m. ET

Couple, off to good start financially, might pare investments, curb tech

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Kurt and Monica Lively have put down roots in Spokane, Wash. and know what they want when it comes to the big issues in life.

Invested in their careers, Kurt, 32, is happy in his job as a computer support analyst; and Monica, 28, just completed her master's in education and is working as an elementary school teacher.

They intend to have one or two children over the next few years, but they both will continue to work full-time. They intend to have one or two children over the next few years, but they both will continue to work full-time.

The Livelys live on a combined income of $58,000 per year, have $10,000 in their retirement accounts, and about $43,000 in stocks and mutual funds.

Already homeowners, they have $73,000 left to pay on their mortgage, and must pay back $22,600 in car and college loans. They do not, however, carry any credit card debt.

"We think we've got our infrastructure all set," Kurt said of their decision to invest early in their home and two new cars, which, he added, they intend "to run the wheels off of." Now, he said, the goal is to save.

Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information.

From a quick look at their expenses and their portfolio, it seems they are off to a good start.

"I think they're doing an extremely good job managing their money considering their salaries," said Frederick, Md.-based certified financial planner Deborah Voso.

Scales tipped toward large-cap growth, tech

But Voso has concerns about some of their holdings and their overall asset allocation given both Monica's wish to retire no more than 30 years from now and the couple's desire to create an emergency fund and an education fund.

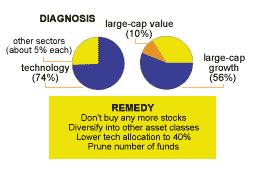

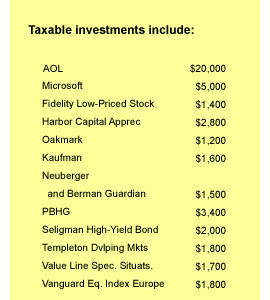

With $25,000 worth of stock in America Online and Microsoft, plus several investments of less than $3,400 each scattered among 10 mutual funds, "They are so into technology it's ridiculous," Voso said. She noted that in their taxable portfolio alone, 74 percent of their holdings are technology-based.

Ideally, she added, they should strive to have no more than 40 percent in technology, 10 percent each in services and financial stocks, and roughly 6 percent in everything else. Ideally, she added, they should strive to have no more than 40 percent in technology, 10 percent each in services and financial stocks, and roughly 6 percent in everything else.

What's more, she said, the majority of their money - 56 percent -- is invested in large-cap growth stocks, while only 10 percent is invested large-cap value stocks. (Their retirement investments are also in growth-oriented funds that are only offered by their employers.)

Stick with AOL, MSFT

That's not how Kurt intended things to be. When he began investing a few years ago, he invested $1,000 in each of 10 funds, which he chose to get equal exposure to large-cap, mid-cap and small-cap growth and value stocks, as well as bonds and international investments.

But he also decided America Online looked like a good company, and invested $1,800 in it. That blossomed into $20,000. "I hit it right," he said.

Similarly with Microsoft, "I figured I should have some," he added. So he invested $1,500 after buying AOL and has seen his investment more than triple in value.

Learn how to manage your money!

Read CNNfn.com's Checks & Balances every Monday.

Despite the stocks' heavy weighting in the Livelys' current portfolio, Itasca, Ill.-based certified financial planner Larry W. Johnson thinks the couple should keep their AOL and Microsoft holdings. "These are two great, long-term companies," Johnson said.

Voso agreed, but added, "Don't buy anymore ... With their resources, they should stay away from individual stocks and stick with mutual funds."

So about all those mutual funds ...

Indeed, if the Livelys sell anything, it should be about half of the mutual funds they own, the planners said.

"Mutual funds diversify in and of themselves," Johnson said. "When you've got 10 funds, that's information overload for no increased return."

He recommends they own no more than four or five core funds with specific objectives and holdings that don't overlap. If they're interested in saving for their future children's education, earmark one of the funds for that purpose, he said. "There's no benefit in setting up an education fund for a to-be-named child." He recommends they own no more than four or five core funds with specific objectives and holdings that don't overlap. If they're interested in saving for their future children's education, earmark one of the funds for that purpose, he said. "There's no benefit in setting up an education fund for a to-be-named child."

Both planners suggest the Livelys drop the Templeton Developing Markets Fund, which performed in the bottom 10 percent of its peer group in 1999. What's more, Johnson said, "With a $50,000 portfolio, I don't know if they need emerging market exposure," although he does recommend they have diversified international exposure of at least 30 percent.

Voso also recommends they consolidate their value investments, for instance dropping Oakmark but keeping Neuberger Berman Guardian.

She suggests selling the mid-cap growth fund Kaufman since there are stronger performers available, and getting rid of the Seligman High-Yield Bond Fund, since in her view investors as young as the Livelys should not be in bonds.

Given their already high exposure to technology, if they were to consider new funds to invest in, Voso recommends they pick those with less than 20 percent exposure to tech stocks, such as the large-cap value funds Fidelity Dividend Growth and Heritage Capital Appreciation, or the mid-cap growth fund Janus Special Situations.

Go for a perfect 10

The latter two might make good choices for Roth IRAs, Voso said, but the couple should only open those investments once they take full advantage of all tax-protected retirement plans at work.

To meet their goal of living on 70 percent to 80 percent of their current income when they retire, "They're going to need to find more savings," Johnson said.

Currently Kurt and Monica contribute 6 percent of their salary to their job-sponsored plans, both of which offer limited investment selections. Voso and Johnson suggest Kurt boost his 401(k) contributions to 10 percent of his salary. Monica, who is maxing out her contributions to the teachers' pension plan at her job, might consider putting away another 5 percent into a 403(b) plan or tax-sheltered annuity if that is available to her, Voso said.

Given their current monthly expenses and loan payments, those adjustments might be hard. If so, Johnson suggests that when they finish paying off their car in the next year or two, they continue to make the same monthly payments, but this time to their savings and investments.

Jack up the pay

Of course, it can be a little easier to save when you make more money. And since Kurt is in a relatively well-paying field, both Voso and Johnson think he could earn more than his current salary of $28,000.

Making the leap would be worth it if a) the new job allows him to maintain a lifestyle that suited him; and b) it provides him with enough of a pay hike - at least another $14,000 plus stock options, Voso said -- to justify the move.

That's because changing jobs usually means having to wait a year or more to become eligible in a new 401(k) plan, and in Kurt's case, he will lose all of his employer's matching contributions if he doesn't work at the company a full five years, since his company's 401(k) vesting policy operates on a 5-year cliff plan.

A bigger salary might also free up more cash to start an emergency fund. Until then, however, the Livelys' hope to salt away six months' salary - or roughly 40 percent of their total portfolio - is unrealistic, Johnson said. They would be better off shooting for $10,000 as a true emergency back up, which they could achieve by opening a home equity line of credit. He noted, however, that they shouldn't borrow from that unless it was absolutely necessary and they should make sure they both have adequate health and disability insurance in the meantime.

Fortunately for the Livelys, discipline more than salary is the key to building solid savings. And if Kurt knows one thing it's this, he said: "I was raised to be a saver."

If you would like to be considered for our Portfolio Rx feature, send an e-mail

to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name in an upcoming story. Please include a daytime phone number so we may reach you.

* Disclaimer

|

|

|

|

|

|

Voso Associates

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|