|

Sara Lee slims down

|

|

August 16, 2000: 11:17 a.m. ET

U.S. Foodservice buys Sara Lee's food service unit; CEO pleased with price

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Sara Lee Corp. agreed Wednesday to sell PYA/Monarch, the No. 4 U.S. food service distributor, to U.S. Foodservice for $1.57 billion in cash, continuing the company's ongoing efforts to refocus on its core packaged-goods businesses.

The rich sale price, which was higher than analysts anticipated Sara Lee could garner for the unit, essentially ends plans to take the PYA unit public, as Sara Lee originally anticipated under a reorganization plan launched earlier this year.

PYA's sale marks the first of four businesses Sara Lee expects to shed as part of an internal push to refocus the company's operations on three core areas -- food and beverage, intimates and underwear, and household products.

"We were very pleased with the results," C. Steven McMillan, Sara Lee's chief executive officer, told CNNfn.com. "We had a number of very interested buyers in this business. This is obviously much, much more attractive than the IPO."

"I certainly think this sale is a positive," said Andrew Lazar, an analyst with Lehman Brothers. "For a food service business, it's a great price and probably better than investors were planning on."

The key to the deal, McMillan said, was not only the high sale price, but also an undisclosed long-term supply agreement between Sara Lee's U.S. food and beverage manufacturing business and Dutch supermarket titan Royal Ahold, U.S. Foodservices' parent company.

Ahold is currently PYA's fourth-largest customer worldwide and the agreement ensures Sara Lee will continue to produce a significant portion of the food distributed by the company.

U.S. Foodservice maintains No. 2 ranking

The sale will leave U.S. Foodservice firmly entrenched as the No. 2 U.S. food service company, with annual sales exceeding $12 billion. It also will reunite two companies that were splintered as part of the leveraged buyout craze in the 1980s.

PYA currently ranks as the leading food service company in the Southeast, has nearly 40,000 customers worldwide and sales exceeding $2.7 billion last year. The company distributes dry, refrigerated and frozen foods, primarily under the Monarch brand name, as well as paper supplies and food service equipment to institutional customers and restaurants. PYA currently ranks as the leading food service company in the Southeast, has nearly 40,000 customers worldwide and sales exceeding $2.7 billion last year. The company distributes dry, refrigerated and frozen foods, primarily under the Monarch brand name, as well as paper supplies and food service equipment to institutional customers and restaurants.

PYA and U.S. Foodservice operated as one company for 22 years before a leverage buyout of the firm's northern division split the operation into two in 1989. When Royal Ahold purchased the Columbia, Md.-based U.S. Foodservice in March for $3.9 billion, McMillan said he realized Sara Lee would be better off exiting the business.

"We either had to exit the business or become a much larger player," McMillan said. "When they [purchased U.S. Foodservice], we figured this was one of the businesses that we would be better out of."

The sale "is a mild positive," said Terry Bivens, an analyst with Bear Stearns. "They would have gotten between $1 billion to $1.2 billion after tax, so from a valuation standpoint, they probably come out ahead."

The deal is expected to immediately add to Royal Ahold's earnings per share and provide costs savings of more than $30 million during the first year, since the two operations utilize the same technology infrastructures.

"The acquisition is a perfect fit, as the cultures of the two companies are similar and their activities complementary," Bob Tobin, chairman of Royal Ahold's U.S. operations, said in a prepared statement.

Coach IPO still on track

Sara Lee (SLE: Research, Estimates) has filed with the U.S. Securities and Exchange Commission to take its Coach leather subsidiary public later this year. The company has left open the possibility of selling that unit, which generates annual sales of $550 million, but McMillan said that was unlikely.

"I think Coach will be a superb IPO," he said. "I'm very pleased with the progress, I'm very pleased with the business right now. So I would be very surprised" if it was sold.

Two Sara Lee units that remain for sale are sports- and casual-apparel maker Champion, which has annual sales of $500 million, and International Fabrics, a $400-million-a-year maker of raw materials used in intimate apparel. Sara Lee recently acquired International Fabrics through its purchase of British fiber maker Courtaulds.

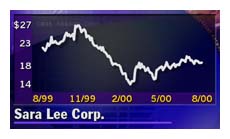

Sara Lee's stock climbed as high as 19 on Wednesday, but closed the day at 18-3/4, up only 1/8.

|

|

|

|

|

|

Sara Lee Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|