|

PPI, retail sales tame

|

|

September 14, 2000: 9:05 a.m. ET

Wholesale prices fall unexpectedly in August; retail sales gain half of forecast

|

NEW YORK (CNNfn) - Wholesale prices fell unexpectedly in August and retail sales posted a smaller-than-expected gain in the month, government reports showed Thursday.

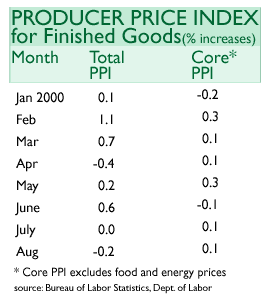

The Labor Department reported the Producer Price Index, a measure of inflation at the wholesale level, posted a 0.2 percent drop in the month, far weaker than the estimates of analysts surveyed by Briefing.com, who had forecast a 0.1 percent rise. It was the first decrease in that measure since April. The PPI was unchanged in July.

A drop in energy and food prices led the index lower. Food prices fell 0.7 percent while overall energy prices were off 0.2 percent. Wholesale gasoline prices were off 2.8 percent. Natural gas prices also were lower, but electricity costs rose, though the increase was smaller than in July.

The so-called "core" PPI, which excludes often-volatile food and energy prices, showed a 0.1 percent rise, but that also was below the Briefing.com survey, which had forecast a 0.2 percent gain. Core PPI was up 0.1 percent in July.

Numbers should please Fed

The inflation figures are closely watched for signs of the future of Federal Reserve action on short-term interest rates. In an effort to curb inflation the Fed has raised rates six times in the last two years, but has left rates unchanged at its last three meetings.

Wayne Ayers, chief economist for Fleet Boston Financial Corp, said the PPI report and another report on retail sales are signs that the Fed is being successful in its attempt to bring the economy in for the so-called soft-landing, slowing growth without causing a recession. Wayne Ayers, chief economist for Fleet Boston Financial Corp, said the PPI report and another report on retail sales are signs that the Fed is being successful in its attempt to bring the economy in for the so-called soft-landing, slowing growth without causing a recession.

"This is very good stuff. The good news is still continuing," he told CNNfn's Before Hours program. "I think the Fed is seeing exactly what it is wanting to see, and indeed exactly what it aimed its policy at starting last year." (270KB WAV) (270KB AIFF)

He said he believes the report due Friday on the Consumer Price Index, which is another closely watched inflation measure, should be very benign for both the Fed and investors. Briefing.com forecasts that both the CPI and core CPI should rise 0.2 percent in August, the same gains posted in July.

Investors cheered the reports Thursday, sending many equities higher in early trading. The Nasdaq composite index and the Standard and Poor's 500 index posted gains, although the more narrowly based Dow Jones industrial average was in negative territory.

"These are terrific numbers, absolutely great, a much needed breath of fresh air for the equities market," said Art Hogan, chief market analyst for Jefferies & Co., in comments to Reuters.

Retail sales growth slows

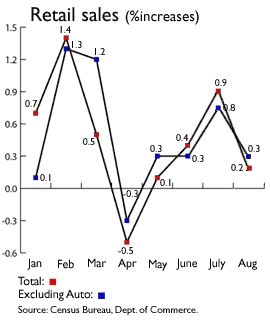

In a separate report, the Commerce Department said retail sales gained 0.2 percent in August to $271.2 billion, half the 0.4 percent gain forecast by Briefing.com's analysts.

Retail sales are driven by consumer spending, which accounts for about two-thirds of the nation's economy. Recent reports of a slowdown from many major retailers have been seen as one of the clearest signs of a slowdown in the economy. The report revised the July retail sales gain upward to a 0.9 percent gain. Retail sales are driven by consumer spending, which accounts for about two-thirds of the nation's economy. Recent reports of a slowdown from many major retailers have been seen as one of the clearest signs of a slowdown in the economy. The report revised the July retail sales gain upward to a 0.9 percent gain.

Excluding autos, retail sales gained 0.3 percent in the month to $204.1 billion.

Ayers said the slowing growth in sales should come as no surprise.

"We're into tenth year of the expansion," he said. "A lot of consumer demand, particularly for big ticket items, has been satiated."

In another report Thursday, jobless claims rose to 324,000 last week from a revised 311,000 the prior week.

|

|

|

|

|

|

|