|

Bristol to face the Street

|

|

September 27, 2000: 1:59 p.m. ET

Drug company to hold analysts meeting amid rumors of planned divestitures

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - Drug maker Bristol-Myers Squibb Co., beset by a sagging stock price and a series of product setbacks, plans to hold its first analysts' meeting in three years Thursday, amid speculation that the company may sell some of its non-pharmaceutical assets to lift its share price.

Analysts say the No. 3 U.S. drug company may use the forum to announce a major shift in strategy, which could include plans to sell or spin off its Clairol beauty care products unit, Mead Johnson Nutritionals business or Zimmer medical device unit.

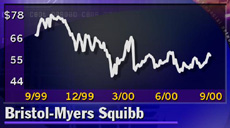

Bristol-Myers stock has been one of the weakest performers in the drug sector this year, plagued by a regulatory setback for experimental heart drug Vanlev and anticipated loss of patent protection for Taxol, the world's best-selling cancer medicine.

New York-based Bristol-Myers (BMY: Research, Estimates) declined comment on the meeting agenda. Company spokesman Charles Borgognoni said only: "It's a meeting where our chairman and members of the senior management team will provide a strategy going forward."

The meeting will put the spotlight on Chairman and Chief Executive Officer Charles A. Heimbold Jr., who has said he plans to retire next year. The event will also give the investment community an opportunity to hear from the company's president, Peter Dolan, who was appointed last year and widely seen as the heir-apparent to the outgoing Heimbold. The meeting will put the spotlight on Chairman and Chief Executive Officer Charles A. Heimbold Jr., who has said he plans to retire next year. The event will also give the investment community an opportunity to hear from the company's president, Peter Dolan, who was appointed last year and widely seen as the heir-apparent to the outgoing Heimbold.

For several years, Bristol-Myers has been rumored to be considering selling or spinning off some of its non-pharmaceuticals businesses, which account for about 30 percent of the company's total revenue. The company is no longer as reliant on these non-core businesses as it was a decade ago, when its pharmaceutical business was weak and needed help from diversified assets, said Mara Goldstein, a drug industry analyst at CIBC World Markets who has a "buy" rating on the stock.

"Does it [Bristol-Myers] really need to hang on to these profitable, but lower-growth businesses?" Goldstein said. "They may indeed have something to say about that. There's pressure on the stock and they need to get their focus."

In a research report earlier this month, Deutsche Banc Alex. Brown analyst Barbara Ryan also speculated the company may use the meeting to announce a new corporate structure, including cost-cutting efforts and disposals of non-core assets. "We do not expect a business-as-usual tone," she wrote.

In April, Bristol-Myers was forced to withdraw its application for Vanlev, a promising hypertension drug, after some patients in clinical trials developed severe facial swelling. Bristol-Myers is now conducting a large-scale study of the drug in an effort to prove the drug is safe and has said it plans to resubmit its application to the Food and Drug Administration in early 2001.

Earlier this month, Bristol-Myers lost a legal battle to stave off generic competition to Taxol, a seven-year-old drug used to fight ovarian and breast cancer. Generic drug maker Ivax Corp. (IVX: Research, Estimates) plans to introduce the first generic competitor to Taxol later this year, a move that is expected to sharply dent Taxol's roughly $1 billion in annual sales.

Bristol-Myers is also expected to lose patent exclusivity next year for diabetes drug Glucophage, one of its biggest-selling products.

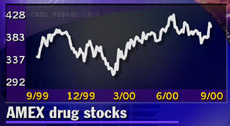

Bristol-Myers stock closed Tuesday at $57.19, down 28 percent from its 52-week high. The stock is down 11 percent since January, compared with a 16 percent gain for the American Stock Exchange Pharmaceutical Index, which tracks the performance of a basket of large-cap drug stocks. Bristol-Myers stock closed Tuesday at $57.19, down 28 percent from its 52-week high. The stock is down 11 percent since January, compared with a 16 percent gain for the American Stock Exchange Pharmaceutical Index, which tracks the performance of a basket of large-cap drug stocks.

Bristol-Myers has largely been left out of merger speculation in a year that has seen the merger of Pfizer Inc. (PFE: Research, Estimates) and Warner-Lambert Co., creating the world's largest drug company, and the combination of Pharmacia & Upjohn and Monsanto Co., forming the new Pharmacia Corp. (PHA: Research, Estimates)

Goldstein said Bristol-Myers could be an attractive merger partner for a number of other drug makers, but said the stock has fallen so low that the company likely would not want to negotiate a deal from its weak position.

Meanwhile Wednesday, Bristol-Myers announced a partnership with biotech firm Lexicon Genetics Inc. (LEXG: Research, Estimates) that gives the drug maker access to Lexicon's genetic database for use in uncovering new gene targets.

Lexicon stock jumped $2.63 to $32.63 in afternoon trading, while Bristol-Myers shares slipped 44 cents to $56.75.

|

|

|

|

|

|

Bristol-Myers Squibb

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|