|

Active funds healthy in 3Q

|

|

September 27, 2000: 7:10 a.m. ET

Financials, health prove a boon; telecom hammers international funds

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - As in life, money and health proved a winning combination for fund investors in the third quarter, but investments abroad and in communications firms kept some funds awash in red. In large part, a worldwide downturn in telecom stocks proved the culprit, analysts say.

Learn more about the steep losses in international funds; see why tech funds are up but not much, and why active management and value investing offered protection from large-cap woes.

Financial funds, with an average return of 18.7 percent, and healthcare funds, with a gain of nearly 11 percent, are the top two performing categories for the quarter according to preliminary data through Sept. 25 from Chicago-based fund tracker Morningstar.

Financial stocks were set for a rebound after a weak patch in 1999, while interest in the financial sector continues to be generated by mergers among giants such as J.P. Morgan and Chase, said Russ Kinnel, Morningstar's director of fund analysis. Financial stocks were set for a rebound after a weak patch in 1999, while interest in the financial sector continues to be generated by mergers among giants such as J.P. Morgan and Chase, said Russ Kinnel, Morningstar's director of fund analysis.

Another factor that may have helped the sector was the fact that the Fed didn't raise interest rates during the quarter, said Sheldon Jacobs, editor of The No-Load Fund Investor.

Health funds, meanwhile, continued to benefit from a rally begun in late 1999, when stocks in the sector looked cheap relative to technology plays, which were "already long in the tooth," Kinnel said. What's more, he added, investors are more confident that healthcare companies and even biotech firms can either turn a profit or at least are much closer to doing so than many businesses in the once beloved Internet sector.

Year to date, health funds remain the unrivaled No. 1 performing category, with a 58.2 percent gain. Real estate funds, which gained 6 percent in the third quarter, are a distant second with a rise of nearly 20 percent.

Small/mid-cap value funds keep their lead

The rest of the mutual fund winners' circle in the third quarter, which officially ends Sept. 30, looks to be filled with some solid returns, although not for many large-cap stock funds, which have been laggards all year.

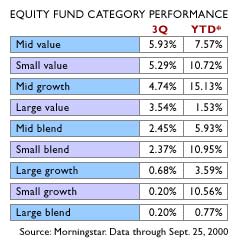

Some top-performing categories include mid-cap value funds, up 5.9 percent; small-cap value, up 5.3 percent; and mid-cap growth, up 4.74 percent. Some top-performing categories include mid-cap value funds, up 5.9 percent; small-cap value, up 5.3 percent; and mid-cap growth, up 4.74 percent.

Small- and mid-cap value stocks are doing better because "earnings are picking up," Jacobs said.

Partly, too, he added, "you're getting a rotational effect, and you're seeing the more conservative areas of the market do better."

Investors are becoming somewhat more wary of stocks that trade with a high price-to-earnings ratio, he explained. "And wherever there are earnings disappointments, the stocks are getting killed."

Some improvement overall, for active managers

The effects of market rotation and earnings disappointments can be seen in part on the S&P 500, which is down 1.29 percent for the year through Sept. 25. More than 77 percent of all U.S. diversified funds have beaten the S&P 500, according to Morningstar.

In that sense it has been a good year for active fund management, particularly when it comes to picking small-cap and mid-cap stocks, Jacobs said, since the S&P 500, like many benchmark indexes, is capitalization weighted and has followed the fortunes of large-cap equities. In that sense it has been a good year for active fund management, particularly when it comes to picking small-cap and mid-cap stocks, Jacobs said, since the S&P 500, like many benchmark indexes, is capitalization weighted and has followed the fortunes of large-cap equities.

General stock funds also showed improvement on a quarter-to-quarter basis with the average U.S. equity fund up 2.5 percent in the third quarter versus a loss of 2.6 percent in the second quarter.

Tech funds inch up

Improvement can also be seen in technology funds, which squeezed out a 1.29 percent return, well above the 11.5 percent average loss in the previous quarter.

"It's a mixed bag in tech," Kinnel said, noting that there were widely divergent performances in the sector. Business-to-business stocks have been rallying strongly off their lows in the second quarter and some networking stocks are making a comeback, he explained, while companies like Intel and others in the personal computer realm have experienced blowups recently.

All in all, the tech sector as a bellwether in the market has provided "a rather exciting route to rather boring results" for the average fund investor, whose overall portfolio may be up just a few percentage points, he said. Not that some technology fund investors won't have reason to celebrate. Pimco Global Innovation, for instance, has gained 117 percent year to date.

International funds all about loss

Meanwhile, international stock funds, particularly those focused on Asia, took it on the chin - and the solar plexus - in the third quarter, further solidifying their place as the worst-performing funds year to date.

With international equity funds posting an average decline of roughly 7.5 percent for the quarter, Latin American funds distinguished themselves as the best of the bunch, with a loss of only 3 percent.

Europe stock funds shed 6.7 percent, while Pacific/Asia diversified funds including Japan averaged a 12.8 percent loss and those excluding Japan did even worse, sinking 14.4 percent. Europe stock funds shed 6.7 percent, while Pacific/Asia diversified funds including Japan averaged a 12.8 percent loss and those excluding Japan did even worse, sinking 14.4 percent.

There's no specific reason why Latin funds outperformed, said Morningstar analyst Kunal Kapoor, except perhaps that investors have grown slightly more comfortable with the political climate in the region.

As for the whole of the international fund category, both diversified and region specific, the downturn in large-cap telecom stocks was a major factor. "They've had a horrid third quarter," Kapoor said of the telecoms, which are top holdings for U.S. portfolio managers who invest abroad.

In Europe, a weak euro was certainly a factor in funds' sagging returns, he added, while in Asia reduced faith in Japan's recovery hurt fund performance, as did a general souring in the technology and telecom stocks that led the markets higher in 1999.

More winners and losers

Among other specialty sector funds, the worst performing for the quarter were communications funds, down 6.76 percent, and precious metals funds, which fell 8.28 percent on average.

Communications funds were hurt by disappointments from AT&T and other big telecom plays, Kinnel said, noting that expectations for the sector had gotten quite high.

On the fixed-income side, bond funds sat squarely in the middle of the pack between top winners and losers for the quarter. Emerging market bond funds, for instance, rose about 2.9 percent on average during the quarter, bringing their year-to-date gain to 9.8 percent through Sept. 25. Intermediate term bond funds posted a 2.26 percent gain; they're up 5.3 percent for the year. And high-yield bond funds slipped into the red, declining 0.18 percent. They are down 1.9 percent for the year.

|

|

|

|

|

|

|