|

Transmeta sets IPO terms

|

|

October 2, 2000: 2:25 p.m. ET

Silicon Valley chip startup will sell 13M shares for $11-$13 each

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Upstart chip maker Transmeta Corp. has set the terms for its initial public offering through which it plans to raise as much as $169 million.

Transmeta, which makes low-power microprocessors for portable computers and Internet access devices, plans to sell 13 million common shares priced in a range between $11 and $13 per share, according to documents filed with the Securities and Exchange Commission Monday.

After the IPO is complete, which lead underwriter Morgan Stanley Dean Witter & Co. expects to be during the week of Oct. 19, Transmeta will have more than 126 million common shares outstanding, according to the SEC filing.

Morgan Stanley and co-lead manager Deutsche Banc Alex. Brown have an over-allotment option of 1.95 million shares, according to the filing.

The Santa Clara, Calif.-based company was founded in 1995 and spent its first five years secretly developing its product, a new kind of microprocessor it dubbed "Crusoe."

Since it took took the wraps off Crusoe last January, the new chips have drawn a lot of interest.

Later this fall, Sony and Fujitsu both are expected to introduce ultralight notebook computers powered by Crusoe processors. IBM, Hitachi and NEC also have developed Crusoe-based ultralight notebooks, which they are expected to introduce over the next several months.

A Crusoe chip also is slated to be the brains behind Internet access devices Gateway is developing in partnership with America Online. Those are expected to be available before the end of this year.

Transmeta, which as of Aug. 15 had a staff of 313, competes with Intel (INTC: Research, Estimates) and Advanced Micro Devices (AMD: Research, Estimates) in the market for ultralight notebook chips, and National Semiconductor (NSC: Research, Estimates) in the Internet access device area.

A new kind of semiconductor

Transmeta's chips differ from competing products in the way they achieve their low-power characteristics.

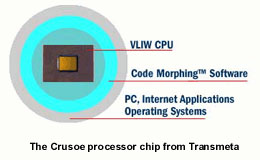

Crusoe chips are designed with a patented technique the company calls "code morphing," meaning they use software to translate the instructions typically handled directly by the transistors on other chips.

The code morphing technology allows the Crusoe processors to adjust the amount of power they consume for specific tasks, which Transmeta says enables them to use less power and run cooler than similar processors. The code morphing technology allows the Crusoe processors to adjust the amount of power they consume for specific tasks, which Transmeta says enables them to use less power and run cooler than similar processors.

For its part, Intel has introduced several low-power processors that offer similar power-consumption features using a technology it calls "SpeedStep," which enables them to operate at lower speeds when the computer is running on battery power and higher speeds when plugged in.

But the very fact that Transmeta has been making headway in a market that historically has been dominated by its cross-town neighbor has some market watchers expecting the company's IPO to be greeted enthusiastically.

"It's a deal that we have liked from the beginning," said David Menlow, president of IPOFinancial.com. "Anybody who comes knocking on the door of Intel is going to get a lot of media attention and a lot of press."

However, there has been much debate recently about the potential for growth in the chip industry. Several market analysts have turned bearish on the sector, saying it is on the verge of a cyclical downturn.

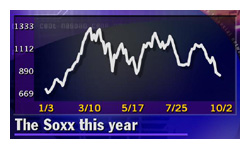

And semiconductor-related stocks, although still some of the strongest tech performers, have lost some of their luster. The Philadelphia Stock Exchange's semiconductor index, or Soxx, reached a 12-month peak of 1,362.1 last March and since has fallen more than 38 percent to around 837. And semiconductor-related stocks, although still some of the strongest tech performers, have lost some of their luster. The Philadelphia Stock Exchange's semiconductor index, or Soxx, reached a 12-month peak of 1,362.1 last March and since has fallen more than 38 percent to around 837.

Even so, Menlow said the Transmeta offering, which is one of a scant few technology names hitting the market this month, will overcome any negative sentiment.

"It think it's going to dampen some of the opening premium expectations, and maybe some of the aftermarket follow-through," he said. "But still, this will be a very solid deal. This will certainly be a stock at the upper end of our hot list."

During the first half of 2000, Transmeta recorded $358,000 in sales and a net loss of $43.4 million. However, because it began shipping the products only in January, the company said in its SEC filing it is difficult to gauge the value of its business at this time.

The company said it does not expect to achieve profitability in the near future, and expects to incur substantial non-cash charges relating to the amortization of deferred compensation.

Transmeta already has received financial backing from several technology companies including Gateway, AOL, Compal Electronics, Compaq, First International Computer, Phoenix Technologies, Samsung, Sony and Quanta Computer.

The company is expected to be listed on Nasdaq under the ticker symbol "TMTA."

|

|

|

|

|

|

|