|

Asian markets tumble

|

|

October 11, 2000: 6:18 a.m. ET

Chipmakers drag Tokyo down; telecom, tech stocks dive in Hong Kong

|

LONDON (CNNfn) - Asian markets sank Wednesday as technology and telecom shares slid in line with their U.S. counterparts, which posted their fourth straight decline on the Nasdaq market Tuesday.

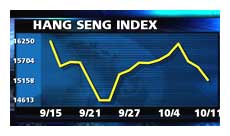

In Tokyo, the benchmark Nikkei 225 average fell 2 percent to close at 15,513.57. In Hong Kong, the Hang Seng index slid 2.8 percent to end at  15,127.00. 15,127.00.

Singapore's Straits Times index fell 3.5 percent to 1,846.56.

In the currency market, the U.S. dollar strengthened against the Japanese yen to ¥107.89 from ¥107.73 in late New York trade Tuesday.

In the U.S. Tuesday, the technology-heavy Nasdaq composite index tumbled 3.4 percent, to 3,240.53 and the Dow Jones industrial average slipped 0.4 percent to 10,524.40.

Tokyo market slides

Tech shares pulled Tokyo's Nikkei index lower, with chipmaker and electronics manufacturer NEC shedding 5.3 percent and rival Fujistu down 5.2 percent. Tokyo Electron was down 6.1 percent.

Nippon Telegraph and Telephone lost 5.1 percent and its separately quoted unit NTT DoCoMo, the world's second-largest mobile phone company, was down 1.8 percent.

Retailer Daiei ended down 9.8 percent. The debt-strapped firm said late on Tuesday that its president, Tadasu Toba, had been demoted to director amid a scandal over his trading of shares in a company affiliate, leaving the post of president vacant until the next shareholders' meeting in May.

Hikari Tsushin plunged 11.3 percent. The troubled Internet investor and mobile-phone subscription agent said on Tuesday it had paid extra tax after failing to declare accurate income in the three years to August 1999. Traders said the shares were also hurt by news that the company faced a lawsuit in the U.S. along with Crayfish, an affiliate that provides e-mail services. Crayfish shares were unchanged from Tuesday.

Fast Retailing was up 7 percent after the discount clothing retailer announced a 400 percent jump in parent company net profit for the year ended in August to ¥34.51 billion ($320 million).

Tech woes blight Hong Kong

Hong Kong shares extended a two-day losing streak as concerns over technology issues rattled investors.

Internet and telecom firm Pacific Century CyberWorks fell 6 percent following continued uncertainty over its planned joint venture with Australian telecom firm Telstra.

Hang Seng index heavyweight HSBC Holdings was down 4 percent after the bank's London-traded shares dropped 1.8 percent on Tuesday.  HSBC's affiliate Hang Seng Bank fell 1.2 percent. HSBC's affiliate Hang Seng Bank fell 1.2 percent.

Shares of China Mobile, mainland China's biggest wireless telephone operator, fell 3.6 percent amid worries that its planned sale of up to $5.1 billion in shares later this month will dent the value of the existing stock. The share offer is designed to help fund the acquisition of seven mobile networks from China Mobile's mainland parent.

SmarTone Telecommunications was down 2.4 percent.

Telecom-to-property conglomerate Hutchison Whampoa fell 1.5 percent while its parent company Cheung Kong Holdings slipped 0.8 percent.

Elsewhere in Asia

In Singapore, technology gloom hit Chartered Semiconductor Manufacturing, which plunged 15 percent after a key customer, U.S. telecom equipment maker Lucent Technologies, said Tuesday that it expects fourth-quarter earnings to be below analysts' estimates. Chartered Semiconductor derives some 10-15 percent of its revenue from Lucent (LU: Research, Estimates).

Chartered's sister company ST Assembly Test Services dropped more than 8 percent.

Electronic contract manufacturer Omni Industries, which supplies U.S. computer makers, was down 5.5 percent.

In Taipei, the Taiwan Weighted index closed down 2.7 percent at 6,040.55. Taiwan Semiconductor Manufacturing ended down 3.3 percent and rival United Microelectronics shed 3.1 percent.

Seoul's Kospi index plunged 5.3 percent to end at 557.18 as Samsung Electronics dived 12 percent and SK Telecom, South Korea's main mobile-phone operator, skidded 6.6 percent.

Australia's S&P/ASX 200 index shed 0.2 percent, retreating for the sixth consecutive session as concerns about the outlook for the U.S. semiconductor industry weighed on the market, although gains for retail and banking shares cushioned the index's fall.

Telecom operator Telstra fell as investors awaited details of its planned partnership with Hong Kong's PCCW. Its ordinary shares dropped 3.4 percent while the partly-paid shares slumped 7.4 percent.

Ordinary shares in media firm News Corp. dropped 0.7 percent.

In other markets, Bangkok's SET index ended down 2.5 percent at 250.60, its lowest close since Oct. 8, 1998, as international investors sold energy, banking and technology shares.

The JSX index in Jakarta slipped 0.1 percent and in Kuala Lumpur, the KLSE Composite fell 0.4 percent. Manila's PHS Composite ended 0.5 percent lower.

--from staff and wire reports

|

|

|

|

|

|

|