LONDON (CNNfn) - It was gloom and doom for European markets Wednesday, with Paris plunging more than 3 percent at the close to fall below last year's closing level after U.S. networking equipment maker Lucent Technologies issued a profit warning and Yahoo! disappointed investors with its earnings.

The CAC 40 blue chip index in Paris plunged 187.18 points to close at 5,956.12, led by network equipment maker Alcatel (PCGE) and index heavyweight France Telecom (FTE).

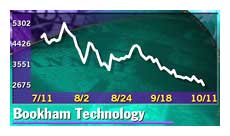

London's FTSE 100 fell 130.1 points, or 2.1 percent, to 6,117.6, with fiber-optic component manufacturer Bookham Technology (BHM) and the world's No. 1 mobile-phone company, Vodafone Group (VOD), among the leading decliners. London's FTSE 100 fell 130.1 points, or 2.1 percent, to 6,117.6, with fiber-optic component manufacturer Bookham Technology (BHM) and the world's No. 1 mobile-phone company, Vodafone Group (VOD), among the leading decliners.

Frankfurt's Xetra Dax dropped 111.52 points, or 1.67 percent, to 6,561.63 amid weakness for firms including engineering and electronics powerhouse Siemens (FSIE) and phone company Deutsche Telekom (FDTE).

Amsterdam's AEX also fell 2.6 percent, Milan's MIB30 dropped 2.1 percent and the SMI in Zurich lost about 1.9 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, fell 2.1 percent, with its information technology sub-index sliding 6.5 percent and its telecom sector sliding 4.5 percent.

In the currency market, the euro rose slightly to 87.26 U.S. cents from 87.17 cents in New York late Tuesday.

In the U.S. Wednesday, the technology-heavy Nasdaq composite index plunged for a fifth consecutive day, dropping 2.6 percent to 3,157.58 at midday, while the Dow Jones industrial average slipped 1.2 percent to 10,401.21.

European tech shares bore the brunt of Wednesday's sell-off. Fiber-optic component maker Bookham Technology (BHM) slid 14.1 percent, reacting to a warning from Lucent (LU: Research, Estimates), citing disappointing revenue in its optical systems business among the factors that would lead to a drop in fourth-quarter earnings. Analysts had expected quarterly profit to rise from the equivalent period of 1999. European tech shares bore the brunt of Wednesday's sell-off. Fiber-optic component maker Bookham Technology (BHM) slid 14.1 percent, reacting to a warning from Lucent (LU: Research, Estimates), citing disappointing revenue in its optical systems business among the factors that would lead to a drop in fourth-quarter earnings. Analysts had expected quarterly profit to rise from the equivalent period of 1999.

The shock news took a bit out of British network equipment maker Marconi (MNI), which lost 6.4 percent, while its French rival Alcatel shed almost 9 percent in Paris.

Mobile phone maker Nokia plunged 6.9 percent and Ericsson dropped 6.2 percent after the world's No. 2 mobile phone maker, Motorola Inc. (MOT: Research, Estimates), lowered earning forecasts for the fourth quarter, full year and 2001, blaming slower sales growth and weakness in the euro.

French chipmaker STMicroelectronics (PSTM) dropped 4.2 percent, with its German competitor Infineon (FIFX) losing 4 percent.

Chip designer ARM Holdings (ARM) gave up the valiant attempt to buck the sector's downward trend for most of the day, declining 2.3 percent despite reporting third-quarter profit doubled from a year earlier to £8.8 million ($12.8 million).

Construction and engineering firm Bouygues [PAR: ] topped the losers board in Paris, declining 9.1 percent, and German electronic component maker Epcos (FEPC) dropped 10.2 percent in Frankfurt.

France Telecom (PFTE) dropped 6.7 percent after confirmed it is in talks to buy data network operator Equant, although it said no deal is likely "under current market conditions." Equant fell 7.3 percent.

Britain's Vodafone fell 5.8 percent. The company agreed to sell its Italian fixed-line telephone business Infostrada to power company Enel for $10.6 billion in cash, bonds and debt. Enel shares rose 2 percent in Milan. Britain's Vodafone fell 5.8 percent. The company agreed to sell its Italian fixed-line telephone business Infostrada to power company Enel for $10.6 billion in cash, bonds and debt. Enel shares rose 2 percent in Milan.

Deutsche Telekom (FDTE) was caught up in the rout in the telecom sector, declining more 2.6 percent.

On Germany's tech-rich Neuer Markt growth market, the sell-off continued unabated with the Neuer Markt All Share index falling 6.9 percent to a new year-low of 4,064.50 points, less than half its March all-time high of 8,546.19.

Neuer Markt heavyweight T-Online was down 8.35 percent at  21.30. 21.30.

In the software sector, Europe's largest developer, SAP [FSE:SAP3], fell 4.9 percent and French information technology consultant CAP Gemini (PCAP) dropped 4.8 percent. In Britain, Logica (LOG) slipped 7.8 percent, rival Sema Group (SEM) fell 5.8 percent, and CMG (CMG) dropped 5.5 percent.

Bank shares take a beating

Financial-services shares also were lower, with asset management company Schroders (SDR) down 6.2 percent in London and Germany's Deutsche Bank (FDBK) losing 7.5 percent. Deutsche's head Rolf Breuer denied the bank is losing money on junk bond financing, telling the newspaper Boersen-Zeitung in an interview published Wednesday that he blamed "disruptive maneuvering" for rumors that have hit its share price. Deutsche Bank shed 2.9 percent Tuesday.

Dresdner Bank (F) fell more than 6 percent in Frankfurt while Royal Bank of Scotland (RBOS) slid 3.1 percent in London. France's Société Générale (PGLE) was down 7.7 percent.

A rise in crude oil prices boosted oil producers' shares, cushioning the declines on key indexes. Shell Transport & Trading (SHEL) was up 2.7 percent in London, BP Amoco (BP-) gained 1.8 percent and Italian gas firm ENI advanced 0.2 percent.

-- from staff and wire reports

|