|

Tokyo gains, HK pains

|

|

November 30, 2000: 6:26 a.m. ET

Japan rises as NTT, banks climb; tech woes hit Hong Kong and Singapore

|

LONDON (CNNfn) - Tokyo's market withstood the latest bout of tech sector jitters Thursday, with gains for banking stocks and cell phone firm NTT DoCoMo lifting the Nikkei average, but new woes for U.S. computer and semiconductor makers depressed blue-chip indexes in Hong Kong and Singapore.

In Tokyo, the benchmark Nikkei average of 225 stocks closed up 140.87 points, or 1 percent, at 14,648.51. NTT DoCoMo rose 3.3 percent, and announced after the close of trading it would buy 16 percent of U.S. cell-  phone company AT&T Wireless for about $9.8 billion. phone company AT&T Wireless for about $9.8 billion.

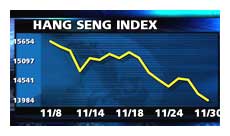

Hong Kong's Hang Seng index closed down 184.67 points, or 1.3 percent, at 14,008.56, as losses for property companies and banks – such as a 2.8-percent decline for index heavyweight HSBC Holdings – added to weakness for tech shares.

The Straits Times index ended down 8.48 points, or 0.4 percent, at 1,952.23, with electronics manufacturer Omni Enterprises sinking 9.4 percent.

In Australia, the S&P/ASX 200 index fell 1 point to 3,274.6. Investors ground up shares of Sausage Software, sending the stock reeling 11 percent.

In other Asian markets, the KOSPI index in Seoul fell 1.4 percent, while the Taiwan Weighted index in Taipei dropped 1.2 percent as computer maker Acer slipped 1.9 percent.

The dollar rose against the yen, buying ¥110.73, up from ¥110.18 late Wednesday in Tokyo.

Leading indexes closed mixed on Wall Street on Wednesday, with the Dow Jones industrial average tacking on 1.2 percent while the Nasdaq composite slid 1 percent. After the closing bell, U.S. chipmaker Altera Corp. and computer maker Gateway Inc. warned of slowing sales in the October-December quarter.

Computer blues felt in Asia

"The news of a slowdown in sales of personal computers in the U.S. is a worry for earnings of Japanese computer and chip makers," Masatoshi Sato, a manager at Mizuho Investors Securities' equity division, told Reuters.

Major Japanese high-tech issues fell, with electronics company Sony slumping 1.8 percent, rival Fujitsu down 3.6 percent and chipmaker NEC dropping 2.1 percent.

Internet investor and telecom firm Hikari Tsushin sank 7 percent, while Softbank, which has holdings in many Nasdaq-listed companies, fell 1.9 percent.

Telecom stocks in Tokyo were mostly higher, with NTT DoCoMo's parent Nippon Telegraph and Telephone rising 3.2 percent and fellow telecom operator KDDI up 5.7 percent, although Japan Telecom fell 2.6 percent.

Top bank stocks underpinned the Nikkei average, bouncing back from a poor performance a day earlier. Sanwa Bank rose 3.5 percent, Tokai Bank added 3.9 percent and Bank of Tokyo-Mitsubishi also gained 3.9 percent.

Arabian Oil, Japan's leading oil company, plunged 15.8 percent, continuing its retreat from a sharp gain in recent weeks amid hopes it would land key production rights in the Middle East.

Rebound for China Mobile

In Hong Kong, China's biggest mobile-telecom operator China Mobile climbed 5.7 percent, after falling nearly 20 percent since over the past 8 days on reports that the government will stop phone companies charging subscribers for incoming mobile-phone calls. Brokers speculated that the Tracker Fund of Hong Kong was buying China Mobile stock to reflect its increased market value after its multibillion-dollar share sale early this month.

Fellow mobile-phone company SmarTone Telecommunications fell 2.4 percent.

Computer maker Legend Holdings shed 3.6 percent and Internet and  telecom company Pacific Century CyberWorks fell 5.8 percent, hit by Wednesday's fall in the Nasdaq composite index, said analysts. telecom company Pacific Century CyberWorks fell 5.8 percent, hit by Wednesday's fall in the Nasdaq composite index, said analysts.

Conglomerate First Pacific shed 4.7 percent, while ports-to-telecom conglomerate Hutchison Whampoa dropped 3.6 percent and Cheung Kong Holdings fell 2.5 percent.

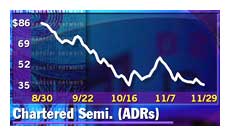

In Singapore, chipmaker Chartered Semiconductor dropped 5.7 percent to a new low for the year, while industry counterpart Venture Manufacturing fell 5.9 percent. Singapore Telecommunications shed 1.4 percent.

On other Asian markets, the KLSE composite index in Kuala Lumpur drifted 0.3 percent, Bangkok's SET index dropped 1.8 percent and the PHS composite in Manila shed 0.9 percent. But Mumbai's BSE Sensex rose 0.15 percent and the JSX index in Jakarta rose 0.9 percent.

-- from staff and wire reports

|

|

|

|

|

|

|