|

Asian techs tumble

|

|

December 14, 2000: 6:03 a.m. ET

Technology shares sink across region; China Mobile, HSBC losses hit HK

|

LONDON (CNNfn) - Asia's main markets sank Thursday as investors dumped technology shares after a slide on the U.S. Nasdaq market a day earlier, and also sold some "old-economy" stocks.

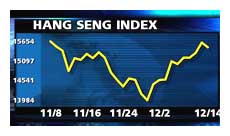

In Tokyo, the Nikkei 225 average fell 1.6 percent to 14,927.19, breaking a three-day rally. In Hong Kong, the Hang Seng index closed down 0.8 percent at 15,496.99. Singapore's Straits Times index shed 1.6 percent to reach 1,980.544.

In the currency market, the U.S. dollar edged higher against the Japanese yen to ¥112.51 from ¥112.25 at the end of the previous day in New York. In the currency market, the U.S. dollar edged higher against the Japanese yen to ¥112.51 from ¥112.25 at the end of the previous day in New York.

In the U.S. Wednesday the tech-heavy Nasdaq Composite index tumbled 3.7 percent to 2,822.77 while the Dow Jones industrial average inched up 0.2 percent to 10,794.44.

In Tokyo, investors took flight after a profit warning from the world's top PC maker Compaq Computer Corp. (CPQ: Research, Estimates) in the U.S.

Selling also hit a range of "old-economy" stocks, including makers of ceramics, steel and pulp after Wednesday's "tankan" business sentiment poll suggested Japanese corporate confidence is beginning to waver after surging earlier this year.

Internet investor Softbank, which has holdings in several Nasdaq-listed start-ups, dived 8.5 percent. The stock is down more than 90 percent from its high, reached in February.

"The Nasdaq market's sell-off was a disappointment," said Tsuyoshi Segawa, general manager for Sakura Securities' equity derivatives division.

NEC the nation's largest computer maker, fell 4.7 percent, after gaining 10.9 percent over the previous three days. Its rival Fujitsu was down 5.7 percent and electronics giant Sony lost 1.6 percent.

Japan Telecom runs out of gas

Japan Telecom slid 11 percent after surging some 40 percent over the previous two days on reports that Vodafone Group, the world's largest mobile-phone operator, planned to take a stake in the firm, and British Telecommunications was interested in buying AT&T's stake in the company.

Cell-phone operator NTT DoCoMo fell 4.4 percent.

Tire maker Bridgestone ended down 0.5 percent, leaving it nearly 60 percent down from a high in early February. On Thursday the company cut its profit estimate for this year by 80 percent, citing higher expected losses at its troubled U.S. subsidiary Bridgestone/Firestone.

Tomy, Japan's second-largest toy maker, rose by its daily limit of 17.4 percent, extending a 15 percent gain on the previous day, after the company agreed with Walt Disney's (DIS: Research, Estimates) Japanese unit exclusively to develop and sell goods based on Disney characters there starting in April.

Nintendo was up 3 percent, adding to Wednesday's 4.6 percent gain. The video-game maker said it planned to produce 24 million Game Boy Advance hand-held game machines in the year following its launch on March 21.

HSBC, China Mobile weigh on HK

In Hong Kong, China's biggest mobile-phone operator China Mobile was down 1.9 percent while international bank HSBC Holdings fell 0.9 percent.

Internet investment and telecom firm Pacific Century CyberWorks tumbled 3.4 percent.

Property stocks were stronger, with Cheung Kong (Holdings) up 1 percent, and Hang Lung Development also 1.5 percent higher. Property stocks were stronger, with Cheung Kong (Holdings) up 1 percent, and Hang Lung Development also 1.5 percent higher.

Bank of East Asia rose 2.4 percent.

In Singapore, chipmaker Chartered Semiconductor Manufacturing slid 4.1 percent while electronics maker Venture Manufacturing tumbled 5.7 percent. Singapore Telecommunications fell 2.5 percent.

Taipei's Taiwan Weighted index finished down 1.2 percent at 5,320.16, breaking a five-day winning streak, as investors got the jitters after the Nasdaq's fall.

Chipmaker Winbond Electronics fell 3.7 percent and Mosel Vitelic dropped 2.8 percent.

In Seoul, the KOSPI slumped 1.9 percent to 547.38, led by a sharp fall in market heavyweight Samsung Electronics. The computer memory chip maker fell 4.2 percent, following a 6.5 percent drop Wednesday on the Philadelphia Stock Exchange's semiconductor sub-index.

South Korea's biggest mobile-phone operator SK Telecom shed 2.8 percent while state-run Korea Telecom fell 3.1 percent ahead of the awarding of third-generation mobile-phone licenses Friday.

In Sydney, the S&P/ASX 200 slipped 0.6 percent to 3,277.0 as an increasingly gloomy earnings outlook depressed investor confidence.

Banking stocks retreated from recent highs, with media shares also weaker.

Ordinary shares of the index's most heavily weighted company, Rupert Murdoch's media empire News Corp., shed 2.6 percent.

News from Australia's biggest bank National Australia Bank that its profits were running ahead of budget did little to inspire its share price, which fell 0.6 percent.

Elsewhere, Bangkok's SET index dipped 0.2 percent, Jakarta's JSX index fell 0.3 percent, the KLSE Composite index in Kuala Lumpur lost 0.9 percent and the PHS Composite index ended up 0.3 percent in Manila.

--from staff and wire reports

|

|

|

|

|

|

|