|

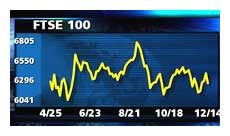

Europe falls, FTSE drops

|

|

December 14, 2000: 12:33 p.m. ET

Telecoms fall on loan warnings, banks hit by downgrade, oil stocks dip

|

LONDON (CNNfn) - European markets tumbled Thursday with technology stocks mirroring losses among their U.S. peers while banks slumped as analysts cut their recommendations.

London's benchmark FTSE 100 index dropped 2.2 percent, or 139.2 points, to 6,263.8, with computer services company CMG (CMG) and index heavyweight Vodafone Group (VOD) clocking up big losses. Nine out of the top ten decliners were technology, telecom and media stocks. London's benchmark FTSE 100 index dropped 2.2 percent, or 139.2 points, to 6,263.8, with computer services company CMG (CMG) and index heavyweight Vodafone Group (VOD) clocking up big losses. Nine out of the top ten decliners were technology, telecom and media stocks.

Frankfurt's late-trading Xetra Dax fell 126.18 points, or more than 1.9 percent, to 6,494.03, as chip maker Infineon Technologies (FIFX) and Deutsche Bank (FDBK) tumbled.

The blue chip CAC 40 in Paris slid almost 1 percent, or 56.64 points, to 5,905.65, led by broadcaster TF1 (PFTI) and bank BNP Paribas (PBNP).

In other European markets, Amsterdam's AEX index dropped almost 2 percent, with Royal KPN down 5.2 percent after agreeing to pay France Telecom

In other European markets, Amsterdam's AEX index dropped almost 2 percent, with Royal KPN down 5.2 percent after agreeing to pay France Telecom  500 million ($440 million) in cash to buy the 50 percent of KPN Orange, Belgium's third-largest mobile phone operator, that it does not already own. 500 million ($440 million) in cash to buy the 50 percent of KPN Orange, Belgium's third-largest mobile phone operator, that it does not already own.

Zurich's SMI was down 1.4 percent and Milan's MIB30 slipped 1.8 percent.

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, was down 1.8 percent, with the telecom sub-index dropping 3.9 percent and its banks component more than 2.7 percent lower.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

U.S. markets fell midday Thursday. The tech-laden Nasdaq composite shed 1.2 percent to 2,789.97 and the blue-chip Dow Jones industrial average slipped 0.9 percent to 10,695.47.

In the currency market, the euro slipped slightly to 88.71 U.S. cents from 87.64 cents in late New York trading on Wednesday.

Technology shares were among the biggest decliners. Bookham Technology fell more than 7.6 percent, CMG tumbled 13.3 percent, information technology consultant Logica (LOG) dipped 8.9 percent and Internet security company Baltimore Technology (BTM) descended 5.6 percent. Europe's largest software maker SAP (FSAP) fell 3.7 percent in Frankfurt.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

Telecom stocks were hit anew after the Bank of England said that risks for banks lending to the telecom sector have increased. Telecom companies are expected to spend more than  300 billion over the next five years to build third-generation mobile phone networks and acquire operating licenses, according to a report from Bear Stearns. 300 billion over the next five years to build third-generation mobile phone networks and acquire operating licenses, according to a report from Bear Stearns.

Vodafone Group (VOD), the world's biggest mobile phone operator, lost 5.6 percent, Telecom Italia Mobile dipped 2.5 percent and Deutsche Telekom (FDTE) lost 1.4 percent and France Telecom (PFTE) slipped 0.4 percent,

Companies expected to supply hardware for 3G networks also crumbled. Telecom equipment maker Marconi shed 3.6 percent and Sweden's Ericsson lost 1.6 percent and Finland's Nokia lost 1.2 percent.

European bank shares fell after Goldman Sachs cut its recommendations on five banks -- ABN Amro, BNP Paribas (PBNP) Crédit Lyonnais (PCL), Deutsche Bank (FDBK) and Société Générale (PGLE) -- saying that current earnings forecasts could prove too high because of weak capital markets and higher provisions for doubtful loans in 2001. European bank shares fell after Goldman Sachs cut its recommendations on five banks -- ABN Amro, BNP Paribas (PBNP) Crédit Lyonnais (PCL), Deutsche Bank (FDBK) and Société Générale (PGLE) -- saying that current earnings forecasts could prove too high because of weak capital markets and higher provisions for doubtful loans in 2001.

Deutsche Bank tumbled 4.5 percent, BNP Paribas dipped 4 percent, Société Générale lost 4.8 percent, Crédit Lyonnais declined 3 percent and ABN fell 5.4 percent.

Oil stocks came under pressure as Iraq began shipping crude Wednesday, some 12 days after halting supplies. Brent Crude for February delivery dropped 63 cents to $25.30 per barrel on London's International Petroleum Exchange.

BP Amoco (BPA) , the world's No. 3 oil producer by market capitalization, plunged 4.7 percent, Shell Transport & Trading (SHEL) dived 1.3 percent and France's Total Fina Elf (PFP) dipped 3.1 percent.

In corporate news. Granada News (GME) slumped 7.1 percent after U.K. broadcaster United News & Media (UNWS) demanded £1.25 billion ($1.8 billion) in cash in its planned sale of TV assets, spurning an all-share option from Granada Media. United News dropped 3.1 percent. Since the merger announcement in July, European investors have adopted a much more cagey approach to media shares, and Granada Media stock has fallen by a quarter to 439 pence.

Italian luxury goods maker Gucci Group fell 5.7 percent in Amsterdam. The company's third-quarter profits sailed past forecasts, but a weaker-than-expected outlook for next year knocked the shares.

--from staff and wire reports

|

|

|

|

|

|

|