|

Europe tacks on gains

|

|

December 18, 2000: 1:11 p.m. ET

London gets tech, banking lift as Paris consumer products firms gain

|

LONDON (CNNfn) - Europe's top bourses closed higher Monday, with technology service providers lifting London's key index, while Paris got a boost from consumer products vendors.

European banking stocks got a lift from expectations that the U.S. Federal Reserve may ease its stance about interest rates on Tuesday, following recent signs of cooling in the U.S. economy. Drug stocks across Europe were lower.

Leading the way was the FTSE 100 index, closing up 70.7 points, or 1.1 percent, at 6,246.5, with an array of banking stocks underpinning the index and information technology service firm CMG (CMG) up 6.5 percent.

In Paris, the CAC 40 blue chip index rose 47.95 points, or 0.8 percent, to close at 5,887.49. Yogurt company Groupe Danone (PBN) rose 5.9 percent.

Frankfurt's electronically traded Xetra Dax closed up 0.93 percent to 6,390.25. Retailer Karstadt Quelle (FKAR) added 5.5 percent.

In Amsterdam the AEX index climbed 1.2 percent, while the SMI in Zurich was 1.4 percent higher and the MIB30 in Milan shed 0.9 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, was down 0.6 percent, with its personal care component rising 2.9 percent.

Wall Street was mixed as European markets closed. The Nasdaq composite index was down 0.7 percent, but bouncing back from a loss Friday, the Dow Jones industrial average climbed 182.77 points, or 1.8 percent, to 10,617.73.

Wall Street was mixed as European markets closed. The Nasdaq composite index was down 0.7 percent, but bouncing back from a loss Friday, the Dow Jones industrial average climbed 182.77 points, or 1.8 percent, to 10,617.73.

"After a 240-point fall on the Dow, people are expecting a bounce," George Hodgson, an equity market strategist at ABN Amro, told CNNfn.com before the U.S. market open Monday.

Mixed bag for telecom firms

Vodafone Group (VOD), the world's biggest mobile phone group, rose 1.5 percent after winning a license to operate third-generation mobile services in Sweden. But Swedish national telecom company Telia tumbled 12 percent after it failed to win a license in its own country.

Italian telecom holding company Olivetti tumbled 9.1 percent and its separately traded Tecnost unit sank 10.7 percent after Olivetti unveiled plans on Monday to raise up to  3 billion through a bond sale and a capital increase. Both shares briefly were halted. 3 billion through a bond sale and a capital increase. Both shares briefly were halted.

Olivetti, which owns 73 percent stake of Tecnost, used it as an investment vehicle to buy 55 percent of Telecom Italia, and is now buying the rest of Tecnost so that it can use dividends from Telecom Italia to pay off debt.

Computer software and technology stocks rebounded from losses on Friday, triggered by Microsoft's warning it would miss its earnings target. U.K. computer services company Misys (MSY) climbed 5.5 percent, while in Paris, consultant Cap Gemini (PCAP) gained 2.6 percent.

Top tech and telecom decliners included U.K.-based Internet search systems provider Autonomy (AU-), down 6.5 percent, while Dutch network operator Equant (PEQU) shed 4.5 percent in Paris trading. In Frankfurt, electronics equipment maker Epcos (FEPC) tumbled 7.1 percent and Deutsche Telekom (FDTE) shed 2.4 percent.

Banks brighten across Europe

Banking stocks were among the strongest gainers. Britain's HSBC added 3.6 percent as the stock recovered its poise after last week's heavy losses, while Bank of Scotland (BCST) jumped 4.8 percent and Barclays (BARC) improved 3.4 percent.

In Paris, Société Générale (PGLE) added 2.1 percent and Crédit Lyonnais gained 1.1 percent, while Deutsche Bank rose 1.9 percent and Dresdner Bank climbed 2.7 percent.

Spirits company Diageo (DGE) rose 2.3 percent. A Diageo-Pernod team is set to sign a deal on Monday in New York to buy Seagram's wines and spirits empire for around $8.2 billion, industry sources said, predicting the alliance would beat out a rival bid from a Bacardi-led consortium.

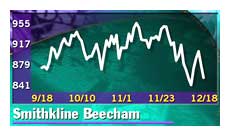

Drug company SmithKline Beecham (SB-) fell 2.4 percent while Glaxo Wellcome (GLXO) shed 2.6 percent. The companies said the U.S. Federal Trade Commission cleared their $67 billion merger, creating one of the world's top pharmaceutical companies. The new firm, GlaxoSmithKline PLC, will come into being on Dec. 27.

Among other drug companies, France's Sanofi-Synthelabo (PSAN) shed 1.5 percent and Germany's Schering (FSCH) fell 1.4 percent.

DaimlerChrysler, the world's fifth-largest automaker, fell 1.5 percent after unveiling a forecast that implies its troubled U.S. unit Chrysler will drop into the red to the tune of about $1.25 billion in the last quarter of the year, compared with a loss of $512 million in the third quarter.

Pearson (PSON), which owns the Financial Times, fell 3.6 percent, after an earlier rally of more than 4 percent. The company said its business was on track to show substantial growth in operating profit and revenues.

TF1 (FTI), France's biggest publicly traded broadcaster, added 3.2 percent, while hair products maker L'Oreal jumped 4.2 percent.

Luxury goods company LVMH Moet Hennessey Louis Vuitton (PMC) shot up 4.9 percent after announcing plans to buy a key licensor of Donna Karan International apparel for $450 million and offering to buy the U.S. fashion house itself for $195 million.

--from staff and wire reports

|

|

|

|

|

|

|