|

M&A awaits spring thaw

|

|

December 24, 2000: 7:00 a.m. ET

Volatile market, regulatory climate subdue merger activity, for now

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - For the acquisitive-minded investor, 2000 was no year for the faint-of-heart.

Roiled by plunging stocks, an increasingly difficult regulatory climate and unpredictable valuations, the mergers-and-acquisitions market seemingly became less stable by the day, leaving industry experts to predict a painfully slow start during the new year.

"If we keep getting more bad news and the Fed doesn't act on rates soon, I think the market is going to be very jittery and very hard to read during the next two months," said Tom Burnett, director of research firm Merger Insight. "One way or the other, we're going to have a slower M&A period for the first six months of next year than we had in 2000."

Click here for more on the Year in Review Special Report

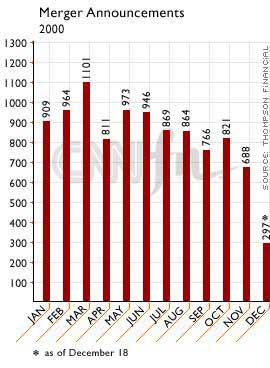

Indeed, after starting the year on a breathtaking pace, M&A activity slowed to a trickle during the last few months of 2000. The 688 mergers announced during the month of November, as compiled by Thompson Financial Corp., comprised the lowest monthly total since the 676 recorded in July 1995.

That tally could easily be undercut during December, however. Through the first 18 days of the month, only 297 mergers had been recorded, and industry sources said few were likely to emerge before year's end. That tally could easily be undercut during December, however. Through the first 18 days of the month, only 297 mergers had been recorded, and industry sources said few were likely to emerge before year's end.

Some believe that pace could not only lead to a slow start to the new year, but also keep M&A activity at a snail's pace through at least the first quarter.

"I think that for a variety of reasons you see an unsettled M&A market right now," said Gary Finger, the director of mergers and acquisitions for Houlihan Lokey Howard & Zukin. "It's a function of perceived uncertainty on several fronts."

The biggest unknown is the mood on Wall Street, which has turned from ebullient to glum, shattering corporate valuations and throwing the merger market into disarray.

"There's a fair amount of M&A talking going on between parties," said David Golden, managing director of mergers and acquisitions for Chase H&Q. "It's the jumping around that makes it hard. In a volatile market, it's very hard to get deals over the finish line."

The volatility has made parties on both sides of the negotiating table a little gun-shy, Golden said. Buyers are now more leery of using stock as the primary currency for an acquisition, fearing a negative reaction from their shareholders. Meanwhile, those being acquired are seeking specific price protections to protect premiums that can quickly evaporate.

Jittery investors -- already battered by a steep drop in the Nasdaq and Dow industrials indexes since Labor Day -- no longer seem willing to accept deals that negatively impact earnings, even in the short-term.

Click here to see a list of the largest mergers announced during 2000

One of 2000's last big merger announcements -- Ciena Corp.'s proposed $2 billion acquisition of Cyras Systems -- no doubt provided a painful case in point. On the surface, Ciena's purchase of the optical-switching equipment maker seemed as solid as they come. Analysts hailed the deal as a strong strategic fit that would instantly enhance the company's core optical-networking capabilities and drive long-term growth.

Investors, however, immediately latched onto a statement buried near the bottom of the merger announcement noting the deal would likely cut 19 cents to 22 cents off Ciena's fiscal 2001 profits before adding to earnings thereafter.

Ciena's stock, fanned in part by yet another Nasdaq tumbling act, fell a whopping 24 percent that day and instantly shaved more than $600 million off the merger's valuation, amplifying the new set of pitfalls that await those brave enough to tread the choppy M&A waters these days.

"The ironic thing is, this is a deal that a few months ago might have driven the stock up," said Steven Levy, an analyst with Lehman Brothers who follows Ciena. "So it's interesting to see how the market psyche has changed."

Regulatory muscle

Another factor impacting the market psyche was the concerted effort by regulators on both sides of the Atlantic to flex their muscles a bit more during the merger review process -- an effort that delayed, and in some cases scuttled, several of 2000's largest deals.

Perhaps nowhere was that effort more evident than with the year's largest deal, America Online's blockbuster acquisition of Time Warner Inc. (TWX: Research, Estimates).

Announced in January, the union still awaits regulatory clearance from the U.S. Federal Communications Commission, although it has cleared its largest regulatory hurdles in the U.S. Federal Trade Commission and the European Union -- but not without a heavy cost. Announced in January, the union still awaits regulatory clearance from the U.S. Federal Communications Commission, although it has cleared its largest regulatory hurdles in the U.S. Federal Trade Commission and the European Union -- but not without a heavy cost.

Along the way, Time Warner was forced to at least temporarily abandon its joint-venture plans with record label EMI Group PLC, while AOL (AOL: Research, Estimates) agreed to a series of unprecedented concessions that will allow the FTC to monitor the company's efforts to provide competitors access to its extensive high-speed Internet lines.

Along the way, investors pummeled the stocks of both companies, cutting the deal's valuation nearly in half, to roughly $88.6 billion.

Regulators were busy on other fronts as well, particularly in the rapidly consolidating telecom field, where they effectively blocked Worldcom's $117 billion acquisition of smaller rival Sprint Corp.

Deutsche Telekom's $28.6 billion acquisition of VoiceStream Wireless Corp. has also become mired in the review process in Washington. In the meantime, investors have shaved nearly $18 billion off the deal's valuation, occasionally even pushing Telekom's below the level where VoiceStream (VSTR: Research, Estimates) can walk away from the deal.

Still, industry experts are fairly confident that the regulatory climate will ease somewhat under the incoming Bush administration, which is expected to adopt a more business-friendly tone.

"It seems likely that the new administration will be less enforcement oriented," said Harvey Goldschmidt, a Columbia University Law School professor and close watcher of the U.S. regulatory climate. "Businesses will be looking at a four-year period when things might be a little easier."

Goldschmidt said he also expects President-elect Bush to make new appointments to the FTC and FCC rather quickly, as opposed to letting the process drag on until late spring as some have predicted.

A slow start

With perhaps a friendlier environment emerging in Washington, industry observers said merger activity could begin to pick up toward the latter part of the first quarter, particularly given the rock-bottom valuations emerging in many industries, making strategic acquisitions a cheaper proposition.

"You'll see a change in valuations because there is less debt available and stock prices have declined," Finger said. "It's going to have a dampening effect on value."

The struggling dot.coms and ever-merging energy companies are expected to be among the most active consolidators, although other "old economy" industries, whose stocks tend to hold up well as the economy slows, could also follow suit.

One thing remains certain, those looking to buy will likely have to finance any deal at least partially with cash to help reduce wild swings in the merger's valuation. The expected elimination of pooling-of-interest accounting next spring will put cash-buyers on even footing with stock-buyers for the first time.

"What you won't see as much of is the frothy currency being rapidly exploited," Golden said. "The sellers almost always wanted stock. Those discussions have now shifted."

|

|

|

|

|

|

|