|

Funds: The party's over?

|

|

December 26, 2000: 5:57 a.m. ET

Tech, growth sectors are among the top losers in a dark year for mutual funds

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - Mutual fund investors had the kind of experience in 2000 that is like a bad New Year's Eve party. Everybody wound up with a hangover and nobody had a good time.

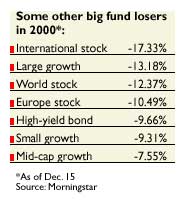

Virtually every type of stock mutual fund suffered steep losses of up to 33 percent year-to-date as of Dec. 15, as fund managers couldn't escape the tidal wave of bad news on Wall Street.

Technology funds, the darlings of many portfolios, fell the hardest. After 16 years of chart-topping returns that lured many investors to abandon diversification, tech funds are set to end their first year in the red since 1984. Technology funds, the darlings of many portfolios, fell the hardest. After 16 years of chart-topping returns that lured many investors to abandon diversification, tech funds are set to end their first year in the red since 1984.

But the good news, if there is any, is that this year's performance numbers are an indication of what may do well in 2001, according to fund analysts, managers and market watchers.

"What we went through is a classic bubble," said Sheldon Jacobs, editor of the investing newsletter No-Load Fund Investor. "I don't think 2001 is going to be a fantastic year."

Biotechs and battered value names

Value funds, the Rodney Dangerfields of Wall Street, finally got some revenge after years of lagging behind growth funds.

Mid-cap value funds earned 9.55 percent year to date as of Dec. 15, according to fund-tracker Morningstar, while small value gained 8.94 percent in the same time. Large value edged up 1.41 percent. Mid-cap value funds earned 9.55 percent year to date as of Dec. 15, according to fund-tracker Morningstar, while small value gained 8.94 percent in the same time. Large value edged up 1.41 percent.

By contrast, large growth funds, a longtime portfolio favorite, lost 13.18 percent this year, while small growth gave up 9.31 percent and mid-cap growth shed 7.55 percent.

While health funds soared 45.91 percent this year, thanks to strong performance by biotechs, the only other stock-side winners in 2000 were categories considered to be value-oriented, like real estate funds, up 23.09 percent, financial funds, up 17.98 percent, and natural resources funds, up 17.66 percent, according to Morningstar.

Click here to see the winning and losing growth, value and blend funds this year.

"Nearly everything that had done well in 1999 has done poorly this year, and vice versa," said Scott Cooley, an analyst at Morningstar. "I think the problem is perception lags reality with investors. Throughout this year, we've seen strong flows into technology and growth funds, and the stocks haven't done well. You wonder when investors will start chasing performance and go to value."

Cooley said this is one of the worst examples he's seen where investors rushed to one sector and got burned. Part of the problem is that many people didn't realize how overweighted they were in sectors like technology, Cooley said.

People may own several different funds and not realize that the same tech or growth names are in all of them. People may own several different funds and not realize that the same tech or growth names are in all of them.

"It's fine to make a bet on a sector, but you should know what bets you're making," Cooley said. "The biggest lesson this year is diversification. What that means right now is to have exposure to a lot of major market sectors and not just chase health care because it did well."

Cooley doesn't recommend wholesale portfolio changes because of the negative returns in 2000. Just make sure your portfolio still fits your goals by doing some rebalancing.

Aggressive investors: Sit tight

Lion-hearted investors who want a high-octane portfolio should understand that a loss of 15-to-25 percent in a year is normal, said Ron Roge, a certified financial planner and president of R. W. Roge & Co. in Bohemia, N.Y.

"If you're an aggressive investor you're going to want to stick to your guns," Roge said. "You could be down 30 percent. It could get nasty."

Click here to see winning and losing international funds and sector funds this year. Sector funds include technology, health, real estate and financials.

If you're out of the market for even a month, it could have a huge impact on your long-term returns, Roge said. For example, the S&P 500 has earned average annual returns since 1926 of about 11 percent. But a study showed that if you exclude the best month out of every year from the calculation, the  average annual returns are just 1.39 percent. average annual returns are just 1.39 percent.

Looking abroad, international funds took it on the chin in 2000 in part because of the weak euro, Roge said. But if the Federal Reserve starts cutting interest rates in 2001, the euro should strengthen against the dollar.

"International funds should do well next year," Roge said.

Likewise, Cooley, Roge and Jacobs agree value will do well next year.

Jacobs is recommending a list of funds for 2001 that have had double-digit returns in both 2000 (a value year) and 1999 (a growth year). The funds include Oakmark Select, Third Avenue Value and Longleaf Partners International. (See chart).

"I think we'd be very fortunate in 2001 to get returns of 10 percent," Jacobs said. "Double-digit returns are a thing of the past."

Bonds on a roll

On the fixed-income side, most bond funds had a good 2000 and are poised to have another strong year in 2001, analysts said.

Click here to see some winners and losers in bond funds and hybrid funds this year.

Among the biggest winners were municipal bond funds, up as much as 11.97 percent this year, according to Morningstar. Eric Jacobson, a bond fund analyst at Morningstar, said the category bounced back in 2000 after a sluggish 1999. A shrinking supply of municipal bonds also helped performance.

Jacobson said he wouldn't necessarily recommend people jump into muni bond funds because they have already had such a strong run. The average long-term muni fund earned 9.5 percent this year.

"That's an especially high number for a sleepy market," Jacobson said. You have to be really convinced that interest rates are going to continue to fall to make a big play there."

Click here to read more of the Year in Review

In general, when interest rates are falling, bonds that are longer in maturity and higher in quality do well, Jacobson said.

The only losing category was high yield, down an average of 9.66 percent. Jacobson said the bad returns are a hangover from they heady years between 1996 and 1998.

Do you need help with retirement planning? Click here for CNNfn.com's special report, The Road to Riches.

Investors in the late 1990s rushed to high yield because the spread, or the difference between the yield on junk bonds and ultra-safe Treasury bonds, had narrowed to 350 basis points. (A basis point is 1/100 of a percentage point.) By mid-1998 the market turned and it hasn't recovered since.

"It's not unlike what happened in tech," Jacobson said. "The better they do, the more people buy. What happens is the price gets really high and the compensation you get for taking on the extra risk goes down."

In 2000, a lot of companies that had issued bonds in 1997 and 1998 defaulted, Jacobson said. Many of the companies weren't that strong financially.

The "$10 million question" is what will happen to high yield in 2001, Jacobson said. The market looks like a bargain, but he's not convinced the carnage is over. Moody's Investor Service is predicting more defaults next year, he said.

For people who already have a small percentage of their portfolio – 5 percent or less – in high yield, it might make sense to hold onto the shares, Jacobson said.

"Things could level off, or it could continue to a death spiral," Jacobson said. "I think nobody knows how it will end up."

|

|

|

|

|

|

|