|

Tokyo slips, Asia rises

|

|

December 28, 2000: 5:34 a.m. ET

Sharp falls in NTT DoCoMo, Nomura hit Tokyo; Techs rebound elsewhere

|

LONDON (CNNfn) - Asian markets ended mostly higher Thursday as investors bought back into the tech sector, although Tokyo shares closed lower.

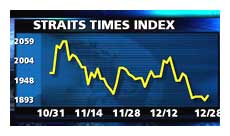

Tokyo's benchmark Nikkei 225 average closed 0.3 percent lower at 13,946.96 but Hong Kong's Hang Seng index ended 0.3 percent higher at 14,796.55. Singapore's Straits Times index added 0.4 percent to reach 1,900.53. Tokyo's benchmark Nikkei 225 average closed 0.3 percent lower at 13,946.96 but Hong Kong's Hang Seng index ended 0.3 percent higher at 14,796.55. Singapore's Straits Times index added 0.4 percent to reach 1,900.53.

In the currency market, the U.S. dollar strengthened against the Japanese yen, buying ¥114.47, from ¥114.12 late in New York the previous day.

In the U.S. Wednesday, the Dow Jones industrial average gained 1 percent to end at 10,803.16 while the technology-heavy Nasdaq composite index rose 1.8 percent to close at 2,539.35.

Tokyo slips in lackluster trade

In Tokyo, light trade ahead of the New Year holiday left the market vulnerable to upsets in leading issues.

"Market participants are not making large positions ahead of the holidays," said Yutaka Miura, deputy manager of Shinko Securities' equity information section.

Mobile operator NTT DoCoMo, the Nikkei's most valuable stock, slid 5.6 percent on renewed fears that a share offering expected next year could create an oversupply of stock and weigh on its long-term share price. DoCoMo shares closed at their lowest level for 22 months.

Nippon Telegraph and Telephone, the parent of NTT DoCoMo, shed 3 percent.

Nomura Securities fell 3.1 percent after Japanese market regulators slapped a two-month ban on some of its operations as punishment for trading securities on behalf of overseas clients without contracts.

In Hong Kong, market heavyweight HSBC Holdings rose 1.4 percent while the bank's affiliate Hang Seng Bank added 0.5 percent as investors bet on a cut in interest rates early in the new year.

Other interest-rate sensitive stocks were mixed, with property developer Sun Hung Kai Properties down 0.7 percent while rival Cheung Kong (Holdings) gained 1 percent.

Legend Holdings, China's largest computer maker, gained 3.9 percent, benefiting from an announcement earlier this week that Beijing would lower fees for Internet services, mobile phone surcharges, long distance calls, and leased lines.

But China Mobile, the mainland's largest mobile carrier, shed 1.4 percent after the company said Wednesday that profits in the first half of next year would be hit by changes to China's telephone tariff system.

Singaporean banking and property stocks were also higher, with the city-state's largest bank DBS Group Holdings up 2.7 percent while Overseas Union Bank added 1.3 percent.

Property developer City Developments jumped 3.3 percent and Hong Kong Land Holdings climbed 1.8 percent.

Contract manufacturer Venture Manufacturing surged 5.4 percent.

Bank merger expectations lift Taipei

In Taipei, the Taiwan Weighted index jumped 4 percent to end at 4,797.14 amid expectations the government would disclose measures to encourage bank mergers at the cabinet's year-end news conference Friday.

Chiao Tung Bank and Chinatrust Commercial Bank each rose by the daily 7 percent upward limit. Chiao Tung Bank and Chinatrust Commercial Bank each rose by the daily 7 percent upward limit.

The market's two most heavily weighted stocks, made-to-order chipmaker Taiwan Semiconductor Manufacturing and foundry United Microelectronics, also both ended limit-up.

Australia's S&P/ASX 200 index ended up 0.2 percent at 3,236.2.

Woolworths gained 2.2 percent after the retailer said its pre-Christmas weekend supermarket sales were better than expected.

Bangkok's SET index closed up 0.5 percent and Manila's PHS Composite ended 1.5 percent higher. Seoul's Kospi index, Kuala Lumpur's KLSE Composite and Jakarta's JSX index were all closed for public holidays.

--from staff and wire reports

|

|

|

|

|

|

|