|

Drugs, techs lift Europe

|

|

December 28, 2000: 12:54 p.m. ET

Financials also up; telecom decline tempers gains in London, Frankfurt, Paris

|

LONDON (CNNfn) - European stock markets closed modestly higher Thursday as tech and drug stocks advanced, but cell phone operators eased amid litigation concerns.

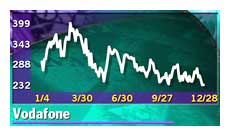

London's benchmark FTSE 100 index was little changed at 6,223.2, after falling as much as 0.7 percent earlier in the session. Declines from Vodafone Group (VOD) and British Airways (BAY) held back gains from drugmaker GlaxoSmithKline (GSK)

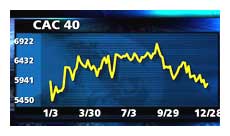

In Paris, the blue-chip CAC 40 rose 63.45 points, or 1.1 percent, to 5,920.6, with drugmaker Aventis (PAVE) and consumer electronics maker Thomson Multimedia (PTMM) topping gainers. In Paris, the blue-chip CAC 40 rose 63.45 points, or 1.1 percent, to 5,920.6, with drugmaker Aventis (PAVE) and consumer electronics maker Thomson Multimedia (PTMM) topping gainers.

Frankfurt's Xetra Dax closed 43.48 points higher, or 0.69 percent, at 6,371.64, with software firm SAP (FSAP) and drugmaker Bayer (FBAY) leading the way forward.

Trading was sparse as markets in London and Frankfurt were set to trade for just a half day Friday ahead of the New Year holiday. All European markets will be closed Monday.

Amsterdam's AEX index rose 0.9 percent and Zurich's SMI edged up 0.9 percent, while Milan's MIB30 index gained 0.4 percent.

Amsterdam's AEX index rose 0.9 percent and Zurich's SMI edged up 0.9 percent, while Milan's MIB30 index gained 0.4 percent.

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, inched 0.7 percent higher, with its drugs sub-index up 1.5 percent and the computer and software sector rising 1.1 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

U.S. markets inched higher at midday Thursday. The tech-laden Nasdaq composite gained 0.25 percent to 2,545.65 while the blue-chip Dow Jones industrial average added 0.1 percent to 10,816.81.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

In the currency market, the euro slipped modestly against the dollar to 92.57 U.S. cents from 93.11 cents in late New York trading Wednesday.

"The year's bad performers will come under extra pressure as people offload them, while the good performers will get an additional boost from players wanting to make the books look good," said Commerzbank strategist Achim Matzke.

London market leader Vodafone Group (VOD) was down 1.9 percent after a report in The Times newspaper that the company was among several mobile phone makers facing a billion dollar legal action in the U.S. brought by people with brain tumors who claim radiation from the devices causes cancer. London market leader Vodafone Group (VOD) was down 1.9 percent after a report in The Times newspaper that the company was among several mobile phone makers facing a billion dollar legal action in the U.S. brought by people with brain tumors who claim radiation from the devices causes cancer.

Other telecom operators also came under pressure, Deutsche Telekom (FDTE), which is buying VoiceStream Wireless (VSTR: Research, Estimates), fell 1.5 percent in Frankfurt, while France Telecom (PFTE) slipped more than 2 percent in Paris.

But telecom equipment maker Alcatel (PCGE) gained 1.5 percent, and Finland's Nokia, the world's biggest handset maker, rose 1.2 percent in Helsinki.

Europe's leading software maker SAP (FSAP) climbed 2.5 percent in Frankfurt, while French consumer electronics maker Thomson Multimedia (PTMM) jumped 4.5 percent and software house Autonomy (AU-) gained 2.4 percent in London.

Drugmaker Aventis (PAVE) was 3.5 percent higher, rival Bayer (FBAY) climbed 2.4 percent and GlaxoSmithKline (GSK), the world's biggest drug company by sales, rose 2.3 percent. And Britain's biggest biotech company, Celltech (CLT), rose 4.4 percent.

Anglo-Australian mining leader Rio Tinto (RIO) dropped 1.5 percent a day after the company said it was buying St. Louis-based Peabody Group's Australian mining interests for $555 million, including $100 million in assumed debt. Anglo-Australian mining leader Rio Tinto (RIO) dropped 1.5 percent a day after the company said it was buying St. Louis-based Peabody Group's Australian mining interests for $555 million, including $100 million in assumed debt.

Investors seemed unsure whether retailers had enjoyed a good Christmas or not: in London Marks & Spencer (MKS) fell 2.6 percent while French retailer Carrefour (PCA) added 2.5 percent.

Auto stocks had a dramatically diverse day, Renault (PRNO) raced to the top of the French leader board, rising 4.7 percent and Volkswagen (FVOW) rallied almost 4 percent in Frankfurt. But BMW (FBMW) was a big loser, dropping 5.8 percent.

British Airways (BAY) fell 2.7 percent after Moody's Investors Service downgraded its debt rating late Wednesday.

Financial stocks registered strong gains, Barclays (BARC) and Standard Chartered (STAN) rose 1.5 percent each, BNP Paribas (PBNP) edged up 0.9 percent each and Dresdner Bank (DRB) jumped 2.9 percent, while rival Deutsche Bank (FDBK) gained 1.2 percent.

German insurer Munich Re rose 2.2 percent, French rival AXA (PCS) climbed 4.3 percent and domestic counterpart AGF (PAGF) gained 3 percent.

--from staff and wire reports

|

|

|

|

|

|

|