|

U.S. manufacturing slows

|

|

January 2, 2001: 1:23 p.m. ET

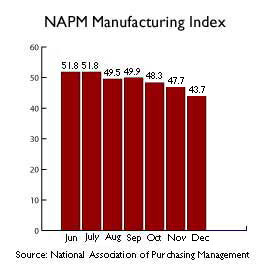

NAPM index of activity slips to 43.7 in December, fifth straight monthly drop

|

NEW YORK (CNNfn) - Activity at U.S. factories contracted for a fifth consecutive month in December, leaving output at its weakest level in almost a decade, a survey of purchasing managers showed Tuesday -- more evidence that the U.S. economy slowed significantly as 2000 wound down.

The National Association of Purchasing Management said its index of manufacturing output slipped to 43.7 in December, well below November's 47.7 reading and the 47.1 expected by analysts polled by Briefing.com. It was the lowest level for the index since April 1991 -- the end of the last recession in the United States – and dipped perilously close to recession-like levels. According to the NAPM, a reading below 42.4 percent would signal recession in the overall economy.

A reading below 50 indicates shrinking manufacturing activity; the index has been below that mark since August.

The report, which the Federal Reserve will examine closely as it weighs a possible interest rate cut, offered the latest piece of evidence that the world's largest economy is slowing significantly as demand for American-made goods at home and abroad slackens.

"The overall picture is one of continued softening in manufacturing activity during the month of December," said Norbert J. Ore, chairman of the NAPM's manufacturing business survey committee. "The overall picture is one of continued softening in manufacturing activity during the month of December," said Norbert J. Ore, chairman of the NAPM's manufacturing business survey committee.

"The manufacturing sector is definitely struggling at this point. It's certainly indicative of a downturn that we saw start five months ago and a deepening of that downturn," he said.

Most economists predict that Federal Reserve policy-makers, after six interest rate increases between May 1999 and June 2000 that have triggered a slowdown in economic growth, will cut short-term rates at their Jan. 30-31 meeting – if not before.

The manufacturing report "pretty much locks the case for the Fed to make an easing of monetary policy at the end of this month," said David Resler, chief economist at Nomura Securities in New York. "Deterioration in the index was so broad-based it really raises significant concerns about the vitality of this economy as we enter the new year."

The rate increases have made it more expensive for consumers and businesses to borrow and helped chop growth in half in the third quarter of last year. In response to higher rates, manufacturers have been paring production to reduce their excess inventories, which have swelled in the wake of slowing orders for things such as autos, dishwashers and other big-ticket items. Demand from overseas also is waning, according to Ore.

Bond prices jumped Tuesday as traders bet the latest manufacturing data would help persuade the Fed to cut rates later this month. The 10-year bond rose 1-15/32 of a point, pushing its yield, which moves inversely to the price, down to 4.92 percent from 5.11 percent late Friday.

Stock investors were much less sanguine, with both the Dow Jones industrial average and the Nasdaq composite index posting significant losses in the wake of the report. In afternoon trading, the Dow was down almost 1 percent while the tech-heavy Nasdaq was off more than 5 percent. Stock investors were much less sanguine, with both the Dow Jones industrial average and the Nasdaq composite index posting significant losses in the wake of the report. In afternoon trading, the Dow was down almost 1 percent while the tech-heavy Nasdaq was off more than 5 percent.

At issue now is exactly how much slower the U.S. economy is going to get, and whether a cut in short-term rates by the Fed will be able to prevent the economy from sliding into recession. By definition, a recession is two consecutive quarters of contraction, rather than growth -- something the U.S. hasn't seen since 1991.

Too much slowing?

The outlook for U.S. manufacturing going forward isn't particularly rosy, according to Tuesday's report.

NAPM's new orders index fell to 42 in December from 48.4 in November, while the inventories index fell to 39.8 from 42.2. The production index, a gauge of current output, fell to 42.4 in December from 49.6. The employment index fell to 42.8 from 46. The prices-paid index, which tallies what producers pay for raw materials, rose to 61.0 from 56.6.

"The Fed views potential inflation as last year's problem," said David Orr, chief economist with First Union Securities. "This year, they will be focused on promoting a rebound in growth."

At its last meeting, members of the Federal Open Market Committee did a 180-degree flip, signaling that recession, rather than inflation, poses the greatest risk to the record U.S. economic expansion. That prompted most Wall Street analysts to conclude that the Fed likely will lower rates, perhaps as soon as their next meeting in late January.

Recently, some economists have predicted that the Fed could step in before then to prevent the economy from weakening further. Bear Stearns economists Tuesday puts the odds "well above 50 percent" that the Fed will cut rates prior to Jan. 31, saying a cut could come as soon as this Friday following the release of the December jobs report.

|

|

|

|

|

|

|