LONDON (CNNfn) - Asia's markets revved up Friday, as electronics makers lifted Japan's leading index and property stocks topped blue-chip risers in Hong Kong.

Tokyo's benchmark Nikkei 225 index climbed 172.12 points, or 1.3 percent, to close at 13,867.61, marking its first advance in two trading days in the new year after last year's 27-percent drop. Electronics vendor Sony rose 4.5 percent and mobile-phone operator NTT DoCoMo climbed 6.8 percent.

In Hong Kong, the Hang Seng index ended up 212.58 points, or 1.4 percent, at 15,447.61. Global bank HSBC, the largest stock in the index, ended at a record closing high of HK$118.50, up 2.2 percent, and property company New World Development blasted up 10.1 percent.

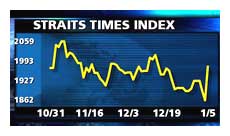

Singapore's Straits Times index rallied 54.07 points, or 2.8 percent, to close at 1,974.82, with network systems integrator Datacraft jumping 17 percent, continuing its rebound after hitting a 16-month low Wednesday.

Among other leading Asian markets, Seoul's KOSPI index roared up 4.1 percent. Samsung Electronics, a leading global memory chip maker, gained 3.2 percent. Taipei's Taiwan Weighted index rose 3.1 percent with† computer maker Acer and chip maker Taiwan Semiconductor each rising† 6.5 percent.

Australia's S&P/ASX 200 nudged up 0.2 percent to close at 3,300.4. Heavyweights News Corp., a media conglomerate, and telecom group Telstra each rose 2 percent.

Asia's markets gain came despite a 1.9 percent drop for the U.S. tech-heavy Nasdaq composite index and a 0.3 percent decline for the blue-chip Dow Jones industrial average overnight.

After the close of Wall Street's trading day, the U.S. Federal Reserve reduced its discount rate by a quarter percentage point to 5.5 percent, adding to the previous day's unexpected move to cut the discount rate to 5.75 percent and the fed funds rate by a half-point to 6 percent.†

In the currency market, the dollar fetched ¥116.74, up sharply from ¥114.16 from the end of the previous business day in Tokyo. Market experts cited continuously weak fundamentals in the Japanese economy.

"We've got to remember that Japan is still struggling, its economy is facing a setback," Jane Foley, a currency strategist at Barclays Capital told CNN. "Exporters seem likely to keep their money abroad... over the longer term, people are looking at 120 or even 130 (against the dollar) for the yen."

Tokyo techs rise

Traders said the Tokyo market's feeble start to the new year Thursday, even though the Fed move that sparked a 14-percent rise on the Nasdaq, showed Japanese shares will need more than a spike in the U.S. market to revive.

†"Of course an interest rate cut is positive for the U.S. economy and for

†global equities, but Japan also has its own problems," said Kazunori Jinnai,

†general manager of equities at Daiwa Securities SB Capital Markets.

He said selling of cross-shareholdings among group companies, expected to increase ahead of the financial year end on March 31, would cap any

significant gains for the next few months.

Select technology stocks revived Friday. Among Sony rivals, Matsushita Electrical Industries, parent of Panasonic, climbed 3.9 percent, Hitachi added 4.3 percent and Fujitsu gained 3.4 percent.

In Hong Kong, property stocks, which are especially sensitive to U.S. interest rates, were the biggest gainers. Hysan Development rose 8.9 Sino Land rallied 9.2 percent and Wheelock rose 5.4 percent.

Singapore Telecommunications jumped 1.1 percent to power the Straits Times index higher. Contract electronics maker Venture Manufacturing† rose 3.1 percent as chip firm Chartered Semiconductor rose 7 percent.

Elsewhere in Asia, Jakarta's JSX index rose 2.2 percent, Manila's PHS composite fell 0.4 percent, the KLSE composite in Malaysia added 0.95 percent, the Bangkok SET gained 2.9 percent and Mumbai's BSE Sensex rose 1.7 percent.

-- from staff and wire reports

|