|

Europe mixed, insurers off

|

|

January 5, 2001: 12:32 p.m. ET

Insurance, retail stocks lead declines; telecom, banking stocks gain

|

LONDON (CNNfn) - European bourses were mixed Friday amid more profit warnings from U.S. companies indicating the world's biggest economy is waning.

London's FTSE 100 rose just 12.5 points, or 0.2 percent, to 6,198.1, with telecom and banking stocks leading gains, while insurer Royal Sun & Alliance (RSA) and retailer Dixons Group (DXSN) attempted to pull the benchmark index lower.

In Paris, the CAC 40 fell 57.97 points, or 1 percent, to 5,758.02. European Aerospace & Defense Co. (PEAD) and insurer AXA (PCS) were among the biggest fallers. In Paris, the CAC 40 fell 57.97 points, or 1 percent, to 5,758.02. European Aerospace & Defense Co. (PEAD) and insurer AXA (PCS) were among the biggest fallers.

Frankfurt's late-trading Xetra Dax index was up a meager 9.8 point, or 0.1 percent, to 6,386.40. Chemical and banking stocks registered gains, while insurers and retailers slid lower.

Elsewhere, Amsterdam's AEX index fell 0.5 percent and the SMI in Zurich dropped 1.6 percent as drug vendor Novartis shed 4.4 percent. In Milan, the MIB30 rose 0.6 percent as telecom holding company Olivetti rose 3.1 percent.

Elsewhere, Amsterdam's AEX index fell 0.5 percent and the SMI in Zurich dropped 1.6 percent as drug vendor Novartis shed 4.4 percent. In Milan, the MIB30 rose 0.6 percent as telecom holding company Olivetti rose 3.1 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

The broader FTSE Eurotop 300 index, composed of a basket of Europe's largest companies, fell 0.4 percent. The aerospace and defense sector plunged 3.8 percent and the insurance sub-index dipped 3.2 percent.

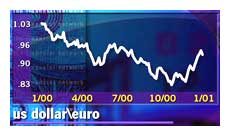

In the currency market, the euro briefly touched a new six-month high against the dollar at 95.95 U.S. cents, before slipping back to 95.27. The euro fetched 94.99 U.S. cents in late New York trading Thursday. In the currency market, the euro briefly touched a new six-month high against the dollar at 95.95 U.S. cents, before slipping back to 95.27. The euro fetched 94.99 U.S. cents in late New York trading Thursday.

"The market has to make its mind up what the Fed rate cut means," said Jane Foley, currency analyst with Barclays Capital, referring to the wild fluctuations for the euro against the dollar following the rate move. She said one view is that it could reverse the recent U.S. slowdown, while others believe it's a sign further declines are on the horizon.

"The market is trying to get to grips with which of the two schools of thought is right," Foley added.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

In the U.S. Friday, the Nasdaq composite index fell 132.77 points, or 5.2 percent, to 2,434.06, while the Dow Jones Industrial Average declined 2.1 percent to 10,687.22. About 30 companies including retail and technology issued profit warnings in the last 24 hours.

Insurance stocks dropped across Europe as investors exited defensive stocks. Britain's CGNU (CGNU) fell almost 6 percent and Royal Sun & Alliance (RSA) dipped 4.9 percent in London. French insurer AXA lost 3.6 percent and rival AGF (PAGF) shed 3.8 percent, Munich Re [FSE:F ] declined 5.3 percent and Allianz fell 2.9 percent in Frankfurt.

Retailers, which release Christmas sales results next week, were on the decline. Britain's biggest electrical retailer, Dixon, fell 3.4 percent, Metro (FMEO) lost 2.6 percent in Frankfurt, and France's Carrefour (PCA) declined 4.7 percent.

In Paris, defense and aerospace company EADS (PEAD), the parent of Airbus, fell 5.6 percent despite a news report that said the plane maker is close to inking a $2.3 billion sale of its new A380 superjumbo planes to U.S. delivery company Federal Express (FDX: Research, Estimates). Airbus declined to comment. BAE Systems (BA-), which owns 20 percent of Airbus, shed 5 percent in London. In Paris, defense and aerospace company EADS (PEAD), the parent of Airbus, fell 5.6 percent despite a news report that said the plane maker is close to inking a $2.3 billion sale of its new A380 superjumbo planes to U.S. delivery company Federal Express (FDX: Research, Estimates). Airbus declined to comment. BAE Systems (BA-), which owns 20 percent of Airbus, shed 5 percent in London.

Food companies and drug stocks across Europe were generally weaker. Britain's Unilever (ULVR) slipped 3 percent, France's Danone (PBN) shed 3.3 percent, and Nestle, the world's biggest food company, dropped 1.5 percent in Zurich.

French drug company Sanofi-Synthelabo (PSAN) dropped 3.3 percent, Britain's AstraZeneca (AZN) fell 1.9 percent, and GlaxoSmithKline (GSK), the world's biggest drugmaker by sales, slipped 1.2 percent.

Telecom stocks trek higher

Telecom stocks were among the top gainers in London after Deutsche Bank selected Vodafone Group, British Telecommunications, Deutsche Telecom and COLT Telecom among its top bets in the sector.

Business telecom services provider COLT (CLM) jumped 6.2 percent, one-time monopoly British Telecom (BT-A) rose 2.8 percent, and cable service provider Telewest Communications (TWT) gained 1.4 percent.

FTSE index heavyweight Vodafone (VOD), the world's biggest mobile-phone company, rose 1.4 percent and Deutsche Telekom (FDTE) rose 2.7 percent in Frankfurt.

Internet search systems provider Autonomy (AU-) rocketed 17.2 percent after CEO Michael Lynch said the company has experienced strong revenue growth in its fourth quarter. That bucks a weak trend for top tech firms. Internet search systems provider Autonomy (AU-) rocketed 17.2 percent after CEO Michael Lynch said the company has experienced strong revenue growth in its fourth quarter. That bucks a weak trend for top tech firms.

Banking stocks, which typically benefit from interest rate cuts because customers are more eager to take on cheaper loans, registered some solid gains.

BNP Paribas (PBNP) climbed 1.1 percent and rival Credit Lyonnais (PCL) gained 1.6 percent in Paris, while HypoVereinsbank (FHVM) rose 3.9 percent in Frankfurt.

In London, Britain's second biggest mortgage lender Abbey National (ANL) surged 3.1 percent after Lloyds TSB Group (LLOY), the country's No. 4 bank by assets, lodged a request with the Office of Fair Trading seek advice on a possible hostile offer for Abbey.

Auto stocks revved up a gear amid optimism lower U.S. interest rates may encourage drivers to buy new cars. PSA Peugeot-Citroen (PUG) rose 4.9 percent while Volkswagen (FVOW) gained 3 percent and BMW (FBMW) jumped 3.7 percent in Frankfurt.

Car parts maker Valeo (PFR) shot up 6.7 percent after reporting late Thursday that its revenue rose 18 percent last year to  9.1 billion ($8.7 billion). 9.1 billion ($8.7 billion).

-- from staff and wire reports

|

|

|

|

|

|

|