|

Specialty retailers warn

|

|

January 4, 2001: 1:28 p.m. ET

Weak holiday sales mean 4Q shortfalls for many; Talbots raises estimates

|

NEW YORK (CNNfn) - Several specialty apparel retailers warned Thursday that fourth-quarter earnings will miss Wall Street forecasts chiefly because of disappointing holiday sales.

The disappointing sales figures mirrored those of the nation's biggest retailers, which also reported December sales Thursday.

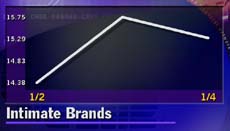

Intimate Brands (IBI: Research, Estimates), owner of Victoria's Secret, said it expects fourth-quarter earnings of 44-to-48 cents a share, compared with average forecasts of 59 cents a share, according to First Call, which tracks estimates by Wall Street analysts. Earnings for 2000 now are predicted to be between 86 and 90 cents a share compared with forecasts of $1.01.

The Columbus, Ohio-based company said net sales for the five weeks ended Dec. 30 rose 4 percent to about $1.1 billion. But sales at stores open at least a year, known as same-store sales, fell 3 percent from a year earlier. The Columbus, Ohio-based company said net sales for the five weeks ended Dec. 30 rose 4 percent to about $1.1 billion. But sales at stores open at least a year, known as same-store sales, fell 3 percent from a year earlier.

"We were unhappy with holiday results at Intimate Brands," Chairman Leslie Werner said. ""Our new holiday product assortments were not compelling enough to outperform the strong offerings of a year ago, particularly in an unforgiving economic environment."

Kloppenburg said the company suffered as consumers looked for more silk and cotton pajamas instead of Victoria's Secret's sheer, sexy lingerie. Strong competition also hurt bra sales, she said.

Intimate Brands shares lost 88 cents to close at $14.88 Thursday.

Shopping mall staple The Limited Inc., which owns 84 percent of Intimate Brands, said it expects fourth-quarter earnings of 53 to 57 cents a share, compared with First Call estimates of 70 cents a share. For the year, the company now sees earnings of 95-to-99 cents a share, compared with expectations of $1.13. Net sales for the December rose 2 percent to $1.9 billion but same-store sales were flat with the year-ago month.

The Limited (LTD: Research, Estimates) shares slipped $2 to $15.94 Thursday. The Limited (LTD: Research, Estimates) shares slipped $2 to $15.94 Thursday.

And Gap Inc. (GPS: Research, Estimates), owner of Gap, Old Navy and Banana Republic stores, reported lower same-store sales compared with an increase a year earlier. Gap, along with many of the nation's largest retailers, blamed steep discounts and heavy promotions during the holiday period for eroding margins and profitability.

Gap shares edged fell 81 cents to $29.50 Thursday.

AnnTaylor Stores Corp. (ANN: Research, Estimates) also reported a decrease in December same-store sales. The company also said fourth-quarter earnings would fall within the lower end of analysts' estimates of 38 cents to 42 cents a share.

AnnTaylor shares slipped 31 cents to $28 Thursday.

Abercrombie & Fitch (ANF: Research, Estimates) same-store sales plummet 11 percent compared with a slight increase a year earlier. That caused the chain, which caters mainly to teen-agers and young adults, to revise its fourth-quarter earnings expectations to between 73 cents and 75 cents a share, compared with analysts' forecasts of 82 cents a share.

But Kloppenburg was upbeat on the long-term outlook for the company, noting its margins were strong at 29 percent, and were forecast to increase since it has streamlined, cutting expenses by ditching unprofitable businesses. But Kloppenburg was upbeat on the long-term outlook for the company, noting its margins were strong at 29 percent, and were forecast to increase since it has streamlined, cutting expenses by ditching unprofitable businesses.

A&F shares increased $2.50 to $22.75 in trading Thursday.

The company also issued a backhanded fourth-quarter earnings warning, saying it can achieve Wall Street estimates, but "the possibility of an even more aggressive promotional environment" suggests it could fall 3 cents-to-5 cents short.

Separately, luxury goods retailer Tiffany & Co. also warned about earnings, citing sluggish holiday sales and tough comparisons with last year. The New York-based company said it expects a profit of 56 cents a share for the quarter, well below Wall Street forecasts of 64 cents a share, according to First Call.

Tiffany (TIF: Research, Estimates) said same-store sales for November and December rose 2 percent.

Tiffany shares shed $6.44 to $30.69 Thursday.

Bucking the trend, upscale women's apparel retailer Talbots Inc. (TLB: Research, Estimates) reported a 12.9 percent increase in December same-store sales, and subsequently raised its fourth-quarter earnings expectations to between 46 cents and 48 cents a share, compared with analysts' forecasts of 43 cents a share.

Talbots was one of the few companies that managed to post strong sales without heavy discounting, which helped maintain gross margins and boost profitability. Talbots was one of the few companies that managed to post strong sales without heavy discounting, which helped maintain gross margins and boost profitability.

Shares of Talbots gained $2.38 to $51.62 Thursday.

Despite a last-minute rush for holiday gifts, many retailers expected December sales to fall short of forecasts as consumers cut back on spending.

Retailers and shareholders were cheered Wednesday when in a surprise move, the Federal Reserve decided to slash interest rates, boosting consumer confidence and making it easier for them to buy goods.

But analysts said the rate cut would do little to boost retail earnings and stocks in the short term, but going forward, they expect a recovery in the second half of 2001 as the Fed imposes further rate cuts and retailers have much easier comparisons heading into the next holiday season.

"It's not sustainable in the short term. We'll probably see a sell-off over next 30 days. But as the Fed continues further rate cuts, that will prompt the economy to come back ... let's say, in August and September. Then we think you can get some upside," said Janet Kloppenburg, specialty retail analyst with Robertson Stephens.

|

|

|

|

|

|

|