|

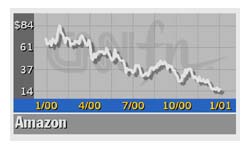

Amazon bucks downgrades

|

|

January 9, 2001: 3:25 p.m. ET

Online retailer's shares rise despite raft of negative reports, downgrades

|

NEW YORK (CNNfn) - Amazon.com's positive pre-announcement Monday may not have been so positive after all – at least in the eyes of some analysts who let loose a raft of negative comments and downgrades on the Internet retailer's stock.

At least five firms issued reports Tuesday citing concerns about Amazon's near-term prospects for growth, and three downgraded their ratings on the company's shares.

Even so, Amazon shares advanced, rising 88 cents, or 5.9 percent, to $15.81 in heavy-volume Nasdaq trade Tuesday afternoon.

After Monday's close, Amazon announced that its fourth-quarter sales and earnings will be in line with the company's previous guidance.

Saying they expect to report sales "exceeding $960 million," and a pro forma operating loss that is less than 7 percent of sales, Amazon executives said they were quite proud of the results, citing the economic slowdown that caused many of their brick-and-mortar counterparts to fall short of their sales and earnings targets.

But the $960 million revenue figure, while within the $950 million to $1.05 billion range the company had told the Street to expect during the quarter, was a disappointment to some analysts. But the $960 million revenue figure, while within the $950 million to $1.05 billion range the company had told the Street to expect during the quarter, was a disappointment to some analysts.

Others said they were concerned about the company's gross margins, which may have been dragged down by promotional programs such as free shipping as well as a larger proportion of sales of less profitable items such as consumer electronics.

Goldman Sachs was among those firms downgrading its rating on Amazon Tuesday. The firm changed its recommendation to "market outperform" from "buy."

In a research note to clients, Goldman analyst Anthony Noto said that while Amazon's performance shows good progress toward its long-term business goals, its annual revenue growth raised concerns about the company's growth opportunity in 2001 and potentially beyond that.

"We believe the lower top-line growth in Q4' 00 versus expectations and uncertainty over Amazon's top-line growth going forward will overshadow the operational achievements that we felt were necessary to achieve operating profitability by Q4 ' 01 and subsequently could have driven stock price appreciation," Noto said.

Robertson Stephens reduced its rating on Amazon to "market performer" from "attractive." Analyst Lauren Cook Levitan also noted that the company's revenue-growth rate was below her expectations and said she thinks the company's gross margins were hurt its free shipping promotion and higher sales mix of consumer electronics items.

| |

|

|

| |

|

|

| |

With much of the mystery surrounding Amazon's quarter now behind us, we are as challenged as ever to identify a positive catalyst for the stock until we approach next year's holiday season.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Lauren Cook Levitan

Robertson Stephens |

|

"With much of the mystery surrounding Amazon's quarter now behind us, we are as challenged as ever to identify a positive catalyst for the stock until we approach next year's holiday season, when Amazon expects to achieve profitability for the first time," Levitan said. "Despite trading near its low, shares of Amazon are currently trading at a 22 percent premium to a group of best-of-breed retailers, all of which are profitable."

Similarly, Salomon Smith Barney reduced its rating on Amazon shares to "outperform" from "buy," saying the company's fourth-quarter revenue fell short of its expectations.

"We still believe, with retailing disasters everywhere, Amazon's Christmas was not too bad," the firm said in a note to clients. "The problem is that things get worse in [the first half of 2001] with few events to jumpstart the stock."

Elsewhere, Credit Suisse First Boston cut its 12-month price target on Amazon shares to $45 from $60. U.S. Bancorp Piper Jaffray slashed its price target for Amazon on half to $25 from $50, although it maintained a "buy" rating on the stock.

Separately, research firm PC Data reported Tuesday that consumers spent $10.7 billion online during the 2000 holiday season, which was up over 100 percent from $5.2 billion in 1999.

"Despite the downswing in the economy in recent weeks, online spending during the holiday met most expectations," Cameron Meierhoefer, Internet analyst for PC Data, said.

"Thanks to strong and early Web spending this season in areas such as apparel and an impressive post-Christmas kick, overall spending topped $10 billion."

During the last week of December, consumers spent $878 million online, compared with $542 million during the same period in 1999, PC Data said.

|

|

|

|

|

|

|