|

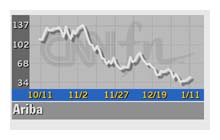

Ariba shreds estimates

|

|

January 11, 2001: 5:03 p.m. ET

E-commerce software maker easily beats first-quarter forecasts

|

NEW YORK (CNNfn) - Business-to-business e-commerce software maker Ariba Inc. reported Thursday fiscal first-quarter revenue and earnings that blew through analysts' estimates, and became the first "pure-play" B2B commerce company to report a profit.

Mountain View, Calif.-based Ariba (ARBA: Research, Estimates) reported first-quarter net income of $14 million, or 5 cents per share, before extraordinary charges, compared with a net loss of $5.6 million, or 4 cents a share, in the year-ago period. Its per-share net was more than double the mean analyst estimate of 2 cents per share, according to First Call/Thomson Financial.

The company said first-quarter revenue hit record levels, growing 625 percent to $170.2 million from $23.5 million in the year-ago quarter, as the company added new customers for its procurement and marketplace software. Analysts had expected Ariba's sales to be $155 million, according to First Call.

Ariba jumped $3.31 to $43.38 during the regular trading day. However, it's still well below its 52-week high of $183. The company's shares fell $2.12 to $41.25 in after-hours trading, even though it exceeded analysts' earnings estimates.

Ariba also gave guidance for its fiscal second quarter and all of fiscal 2001. For the fiscal second quarter ending in March, the company said it expects revenue in the range of $180 million to $185 million. That is slightly higher than the current mean analyst revenue estimate of $178.5 million, according to First Call. Earnings per share for that period are expected to be in the range of 6 cents per share, which is 2 cents above the mean analyst estimate.

For all of fiscal 2001, Ariba's revenue forecast is $780 million to $790 million, which is a bit lower than the $771 million that CIBC World Markets analyst Melissa Eisenstat had forecast. The company forecast earnings of 25 cents to 26 cents for the year, versus Eisenstat's estimate of 20 cents.

In the fiscal first quarter, Ariba's license revenue soared 717 percent to $128.9 million from $15.8 million. Maintenance-and-service revenue rose 437 percent to $41.3 million from $7.7 million.

Ariba said it expanded its market share globally in the quarter and signed a number of new contracts, including: American Airlines, American Cancer Society, Best Buy, PNC Bank, Sara Lee and USAA, among others.

Ariba runs a business-to-business electronic commerce network that enables buyers and suppliers to automate business transactions on the Internet. One of the company's applications automates the procurement of office supplies and other indirect materials, which has helped multinational companies reduce the time and expense associated with ordering those materials. Use of Ariba's software also helps companies cut down on purchases from nonauthorized vendors.

|

|

|

|

|

|

|