|

Intel edges estimates

|

|

January 16, 2001: 7:48 p.m. ET

Investment gains credited for penny-per-share upside; weaker 1Q looms

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Greater-than-expected gains on its investments helped Intel Corp. report a fourth-quarter profit that narrowly beat Wall Street's expectations, but the chip giant warned that first-quarter revenue will fall far short of previous estimates.

After the close of trading Tuesday, Intel said it earned 38 cents per share in the fourth quarter, excluding acquisition-related charges. That compares with 35 cents per share during the same period a year earlier and is a penny more than the 37 cents per share analysts surveyed by earnings tracker First Call had expected Intel to report for the fourth quarter.

However, Intel included a gain on investments of $799 million in its reported earnings for the quarter, which is more than the $675 in investment gains it had previously told analysts to expect, accounting for the penny-per-share upside.

At $8.7 billion, Intel's fourth-quarter revenue was up 5 percent from the same period a year earlier but flat with the third quarter.

In the first quarter, of 2001, Intel said it expects revenue to be roughly 15 percent below fourth quarter levels, which is drastically lower than the roughly 1 percent decline Wall Street had expected, according to the First Call survey. In the first quarter, of 2001, Intel said it expects revenue to be roughly 15 percent below fourth quarter levels, which is drastically lower than the roughly 1 percent decline Wall Street had expected, according to the First Call survey.

Because of stronger sales of personal computers and other electronics during the holidays, Intel's first-quarter revenue has historically fallen from fourth-quarter levels. However, over the past three years, that decline has been between 2.3 percent and 7.8 percent.

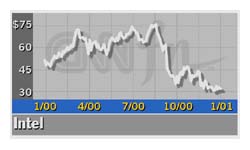

Shares of Intel (INTC: Research, Estimates), which fell 75 cents to $31.38 on the Nasdaq ahead of the earnings news, rose $1 to $32.38 in spite of the reduced revenue forecast.

Click here to check on other chip stocks

Intel is the world's largest supplier of microprocessors for personal computers. And, as did most companies with a heavy exposure to that market, the company warned in December that weaker-than-expected holiday sales would weigh on its fourth-quarter results.

The Santa Clara, Calif.-based company at that time said revenue for the fourth quarter would be flat, "plus or minus a couple of percentage points." Prior to the warning, executives had said they expected to log a sequential fourth-quarter revenue increase between 4 percent and 8 percent.

Most PC-related companies have been stung by what turned out to be one of the weakest holiday seasons in recent memory, with sales in December being particularly dismal.

Because of that weakness, which market watchers attributed in large part to softness in the U.S. economy combined with a maturing PC market, most of the leading PC vendors have warned investors that their quarterly results will fall below previous expectations.

Just last week, Hewlett-Packard and Gateway added their names to the list, each of them pinning the blame on especially weak sales at the end of the quarter.

"The fourth-quarter results were in line with our December outlook and reflect the pervasive impact of a slowing worldwide economy," Andy Bryant, Intel's chief financial officer, said in a teleconference Tuesday evening.

In an interview on CNNfn's Moneyline News Hour Tuesday, Bryant stressed that current economic conditions make it extremely difficult to forecast results moving ahead and the first-quarter guidance reflects Intel's best estimate, given the high level of uncertainty. (113K WAV) or (113K AIF)

Despite the anticipated revenue decline and uncertain economic environment moving into 2001, Bryant said Intel plans to step up its capital spending in 2001 to $7.5 billion, up from $6.5 billion in 2000.

Research and development spending, excluding in-process R&D, is expected to be approximately $4.3 billion in 2001, up from $3.9 billion in 2000, Bryant said.

Intel will focus its spending on developing manufacturing technologies that will enable it to efficiently produce more powerful microprocessors, Bryant said, noting that Intel's large cash reserves and strong market position put it in a strong position to weather any industry downturn.

Since its founding in 1968, Bryant said Intel's practice during industry downturns has been to continue to invest in technology, focus on reducing non-essential spending and prepare to meet customer requirements when the economy strengthens.

"Our response to this downturn will be similar to others in our history," Bryant said. "It may sound a bit trite, but Intel has the financial strength and management conviction to continue to invest in its key products and processes through these difficult times and emerge a better, more competitive company."

In addition to the revenue decrease, Intel is expecting its gross margin in the first quarter to drop to 58 percent, down from 63 percent in the fourth quarter.

Some industry observers have warned recently that Intel's gross margins could be hurt because it will need to become more aggressive in pricing its microprocessors, especially in the low end of the consumer market, as it faces a growing competitive threat from rival Advanced Micro Devices (AMD: Research, Estimates) and the PC market continues to weaken.

But Bryant said the bulk of the anticipated gross-margin decline will come as a direct result of lower volumes, not because of a reduction in prices.

"Approximately one-third of our costs per unit is the labor and overhead," he said. "As we see some softness and transition to newer products, we have a period of time where we have more labor and overhead per unit. It's really as simple as that."

Including acquisition-related charges, Intel said its fourth-quarter net income was $2.2 billion, or 32 cents per share, compared with $2.1 billion, or 30 cents per share, during the same period a year earlier.

For all of 2000, Intel reported an operating profit of $12.1 billion, or $1.73 per share, up from $8.1 billion, or $1.17 in 1999. Net income in 2000 was $10.5 billion, or $1.51 per share, compared with $7.3 billion, or $1.10 in 1999.

Total revenue in 2000 was $33.7 billion, up 15 percent from the $29.4 billion in revenue Intel reported in 1999.

|

|

|

|

|

|

|