|

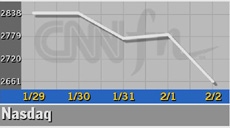

Nasdaq dives 4 percent

|

|

February 2, 2001: 4:58 p.m. ET

For stock investors, the job market may not be weak enough

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Nasdaq composite index tumbled to its first losing week in a month Friday after the latest economic figures dashed hopes for an immediate interest rate cut.

The nation's job market continued to weaken in January, the government said. But the figures, according to economists, weren't weak enough to force the Federal Reserve to lower borrowing costs before late March, disappointing investors frustrated by slumping corporate profits.

"In fact, there is a chance that the March rate cut might be just [a quarter-percentage point] and not the [half-percentage-point] the market expects," said Tony Crescenzi, analyst at Miller Tabak & Co.

The prospects for a less-aggressive Fed come amid other negatives. National Semiconductor became the latest chipmaker to say sales will fall short of estimates. Other chip stocks faltered. And the Nasdaq, which rose more than 12 percent in January, often pulls back after big gains. The prospects for a less-aggressive Fed come amid other negatives. National Semiconductor became the latest chipmaker to say sales will fall short of estimates. Other chip stocks faltered. And the Nasdaq, which rose more than 12 percent in January, often pulls back after big gains.

"I think this (sell-off) is a very natural reaction after a move like (last month's)," William Rhodes, chief investment strategist at Williams Capital, told CNNfn's market coverage.

The Nasdaq fell 122.29 points, or 4.4 percent, to 2,660.50, a two-week low. The index, down 4.4 percent over the last five sessions, posted its first losing week since Jan. 5.

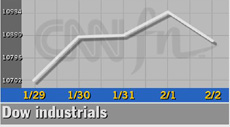

The Dow Jones industrial average dipped 119.53, or 1 percent, to 10,864.10, but ended 2 percent higher on the week. The S&P 500 lost 24 to 1,349.47, falling 0.4 percent over the last five sessions.

More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,710 to 1,376, as 1 billion shares traded. On the Nasdaq, losers topped winners 2,488 to 1,357. More than 1.7 billion shares changed hands. More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,710 to 1,376, as 1 billion shares traded. On the Nasdaq, losers topped winners 2,488 to 1,357. More than 1.7 billion shares changed hands.

In other markets, Treasury securities fell following three days of gains. The dollar was little changed against the euro and yen.

Techs fall after Jan. gains

Friday ends a busy week on Wall Street that began with hundreds of corporate profit reports, segued into a Fed meeting and ended with the government's monthly jobs report.

In it, the Labor Department said employers added 268,000 jobs in January, more than three times Wall Street expectations. But the unemployment rate rose to 4.2 percent, its highest level in more than a year. Wages stood still.

After a string of surprisingly weak data, the jobs report took a middle ground, showing that U.S. growth is slowing but not falling off a cliff. After a string of surprisingly weak data, the jobs report took a middle ground, showing that U.S. growth is slowing but not falling off a cliff.

Charles Payne, president of Wall Street Strategies, said he thinks the market could stay in "a holding pattern, with a slightly negative bias" until the next catalyst -- namely, the next Fed policy meeting, on March 20.

"Now the focus is back on individual stocks, their merit and their fundamentals," Payne said. "That's where the confusion comes in. Everyone's hoping for a strong second half, but everyone knows the near term will be sloppy at best."

Individual stocks faced problems Friday. And earnings reports for the current quarter, which ends in March, aren't expected to show strength.

National Semiconductor (NSM: Research, Estimates) fell $2.54 to $24.77 after saying it expects third-quarter revenue in the range of $475 million to $480 million, far short of expectations. Computer Network Technology (CMNT: Research, Estimates) declined $12.06. to $17.81. The maker of storage hardware and software forecast disappointing earnings for the next several quarters.

The two companies join a long list of technology firms -- including Applied Materials, Nokia and Texas Instruments -- that have recently readied Wall Street for shortfalls.

The Fed cut rates by a half-percentage point Wednesday -- its second such cut in a month -- in an effort to boost the economy, after reports showed consumer confidence, manufacturing and economic growth at the lowest levels in years.

This weakness aside, Brian Fabbri, chief economist at BNP Paribas, told CNNfn's Market Call that the latest job figures are not soft enough to prompt an inter-meeting rate cut like the Fed made on Jan. 3.

Anthony Chan, chief economist at Banc One Investment Advisors, told CNNfn's Before Hours, that the report's payroll growth and a lengthening workweek show the economy free from the dangers of recession that some have feared.

Still, Chan said that the flat wages will allow the Fed, ever wary of rising inflation, to keep cutting interest rates.

"It tells us the economy is in a sweet spot," said Chan, who forecasts another half-percentage-point rate cut at the Fed's late-March meeting.

This apparent delay may have hurt stocks Friday, particularly tech issues. JDS Uniphase (JDSU: Research, Estimates) lost $5.81 to $50, while WorldCom (WCOM: Research, Estimates) fell $2.06 to $20.13 and Cisco Systems (CSCO: Research, Estimates) declined $2.75 to $35.50. This apparent delay may have hurt stocks Friday, particularly tech issues. JDS Uniphase (JDSU: Research, Estimates) lost $5.81 to $50, while WorldCom (WCOM: Research, Estimates) fell $2.06 to $20.13 and Cisco Systems (CSCO: Research, Estimates) declined $2.75 to $35.50.

Both WorldCom and Cisco post quarterly results next week amid a tough time for profit reports. Of the 365 companies in the S&P 500 that have reported, 18 percent, or 65, have missed forecasts, according to First Call. While 192 have beat targets, many of those forecasts were downwardly revised. One-hundred and eight companies met estimates.

But not all companies are posting disappointments. UnitedHealth Group (UNH: Research, Estimates) rose $4.36 to $61.10 after saying its quarterly profit rose to $193 million, or 58 cents a share, topping forecasts by three cents a share.

Other health maintenance organization stocks also rose Friday. Cigna (CI: Research, Estimates) gained $4.50 to $118.50 while Oxford Healthcare (OXHP: Research, Estimates) advanced $2.38 to $34.51.

|

|

|

|

|

|

|