|

Unemployment edges up

|

|

February 2, 2001: 1:09 p.m. ET

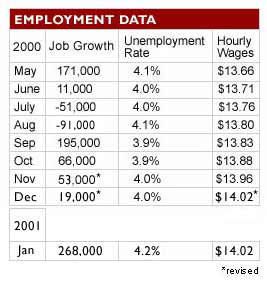

Jobless rate rises to 4.2% in January, while job growth posts surprising jump

|

NEW YORK (CNNfn) - The U.S. unemployment rate edged up to 4.2 percent last month, its highest level in 16 months, as the slowing economy triggered big layoffs in the auto and other manufacturing industries, the government reported Friday.

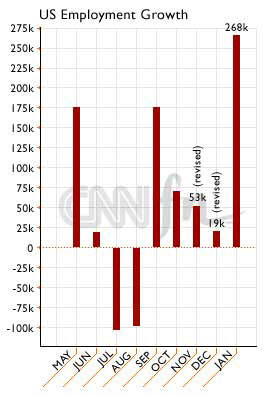

But, painting a mixed picture of the job market, the Labor Department also said job creation grew at a surprisingly strong rate in January, boosted by rebounding construction activity after extremely cold weather in November and December. Analysts said the data show that despite the economic slowdown, the economy continues to generate jobs.

The January jobless rate came in slightly higher than economists' forecasts of 4.1 percent, and posted its biggest one-month jump since April 1999. The last time the unemployment rate stood at 4.2 percent was in September 1999.

"The underlying tone is still weak," Brian Fabbri, chief economist at BNP Paribas, said of the report. "The underlying tone is still weak," Brian Fabbri, chief economist at BNP Paribas, said of the report.

Like many economists, he predicts the U.S. Federal Reserve will cut interest rates further in a bid to boost economic growth. "I would look for another rate cut, and a significant one, on the 20th of March," the date of the next Fed meeting, he told CNNfn's Market Call.

Despite rising unemployment, the Labor Department said the economy created 268,000 jobs last month, boosted by an increase of 145,000 jobs in the construction sector. Economic forecasters surveyed by Briefing.com had only expected an advance of about 80,000 jobs for the month.

The December figure was revised to a slim 19,000 from an initially reported 105,000.

Analysts largely discounted the January increase in job creation, citing the seasonal rebound, and said it likely is not a big enough gain to prevent the unemployment rate from edging up. Job growth has been declining as the economy has slowed, averaging only 160,000 a month in 2000, compared with 229,000 in 1999, according to government figures.

|

|

VIDEO

|

|

CNNfn's Fred Katayama reports from Washington on job growth. CNNfn's Fred Katayama reports from Washington on job growth. |

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

The Labor Department said manufacturers cut 65,000 jobs last month, including 38,000 in the auto sector, as carmakers have idled plants and laid off employees amid slowing sales. That brings the total number of U.S. manufacturing jobs lost to 254,000 since June.

Some analysts said the data show that the employment softness seems to be confined primarily to the manufacturing sector, and has not spilled over to the rest of the economy. The jobless rate is still near 30-year lows of 3.9 percent hit last fall.

"Most of the really alarming data has related to the manufacturing sector, which clearly is slumping," Bill Cheney, chief economist at John Hancock Financial Services, said in a research report. "But since it only accounts for about 15 percent of total employment, it isn't dragging everything else down."

Average hourly earnings -- a closely watched inflation gauge -- were unchanged at $14.02. That compares with analysts' forecasts of a 0.3 percent increase, according to the Briefing.com survey. The length of the average workweek, which had dropped in December, rebounded slightly to 34.3 hours in January, a bit longer than expected.

What will the Fed do?

The question now is what the latest report means for the future of short-term interest rates.

Some forecasters said the stronger-than-expected job creation data could discourage the Fed from cutting rates again before its next meeting in March. Amid growing signs that the economy is rapidly cooling, the Federal Reserve cut interest rates a half-percentage point Wednesday, its second such cut in less than month, and indicated it may lower rates again.

"The Fed is going to probably to continue to cut rates .. the question now is what's really holding the market back is how slow is our economy going to go?," said Bryan Piskorowski, a market analyst at Prudential Securities. "The Fed is going to probably to continue to cut rates .. the question now is what's really holding the market back is how slow is our economy going to go?," said Bryan Piskorowski, a market analyst at Prudential Securities.

Separately, the government reported Friday that orders received by U.S. factories rose 1.1 percent in December, compared with Wall Street forecasts for a slight decline. The increase was attributed to booming demand for new commercial aircraft.

Bond prices slipped in afternoon trading, after three days of solid gains. Stocks traded lower.

This has been a busy week for economic data, with several indicators pointing to signs of a potential recession in the overall economy. On Wednesday, the Commerce Department released its first estimate of gross domestic product, the broadest measure of the economy, for the fourth quarter. The data showed GDP rose at a 1.4 percent annual rate in the final three months of 2000, the slowest growth in more than five years.

Click here for the latest news on the markets

Fed Chairman Alan Greenspan told Congress last week he sees growth in the current first quarter as "close to zero." Most economists expect the economy will pick up steam in the second half of the year, forecasting annual GDP growth of about 2.5 percent.

Meanwhile, the nation's purchasing managers said Thursday that manufacturing activity slid sharply in January, and suggested that the weaker-than-anticipated figures signal that the overall economy failed to grow for the first time in nearly 10 years.

A private research group released a report Tuesday that showed consumer confidence in January fell to its lowest level in four years.

|

|

|

|

|

|

|