|

U.S. manufacturing slows

|

|

February 1, 2001: 4:20 p.m. ET

Spending, income both above forecasts; weekly jobless claims jump

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - U.S. manufacturing slowed again in January, the nation's purchasing managers said Thursday, a big drop that suggested the overall economy failed to grow for the first time in nearly 10 years.

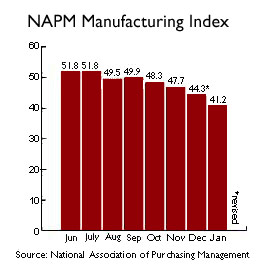

The National Association of Purchasing Management, in the first major reading on the economy's performance last month, said manufacturing activity slipped to the lowest levels since March 1991, the end of the last recession. Manufacturing has weakened so much that the figures suggest the entire U.S. economy has contracted for the first time in 117 months, marking the end of the record economic expansion, the group said.

Wall Street economists say it is still too early to tell whether the economy has fallen into a full-fledged recession, defined as two consecutive quarters of negative growth. But they think the weaker-than-expected manufacturing data could further persuade the Federal Reserve to cut interest rates again to revive economic growth.

"It's not guaranteed that we're going to get a recession now, though I have to say that the evidence from NAPM is not encouraging," said Ian Shepherdson, chief economist at High Frequency Economics in Valhalla, N.Y.

The manufacturing group reported that its index fell to 41.2 percent, its sixth consecutive monthly decline, from a revised 44.3 percent in December. The manufacturing group reported that its index fell to 41.2 percent, its sixth consecutive monthly decline, from a revised 44.3 percent in December.

A reading below 50 indicates a shrinking manufacturing sector; a reading below 42.7 percent points to a contraction in the overall economy.

Wall Street forecasters polled by Briefing.com had predicted the index would come in at 43.8 percent. The index is now at its lowest level since a 40.8 percent reading in March 1991.

Norbert Ore, who heads the NAPM's surveys, said manufacturing was "definitely weak" in January but added that the data indicate "that manufacturing is getting close to the bottom." The group surveys buyers of materials from computers to cardboard at the nation's big manufacturers.

The slide in manufacturing activity "corresponds to a -0.6 percent annual decrease in real gross domestic product," Ore said.

GDP, the broadest measure of the U.S. economy, grew at a 1.4 percent rate in the fourth quarter of 2000, the slowest pace in more than five years, according to government estimates Wednesday. Some analysts believe growth will contract in the current first quarter, while Fed Chairman Alan Greenspan has predicted growth "close to zero." Most economists predict that GDP will grow at a rate of roughly 2.5 percent this year.

The manufacturing report comes a day after the Federal Reserve, as expected, cut interest rates by a half-percentage point in an effort to reinvigorate the economy and prevent a recession. The Fed also indicated it wasn't done cutting rates.

Some analysts said the weak manufacturing numbers could provide further encouragement for a rate cut, perhaps prior to the Fed's next regularly scheduled policy-making meeting March 20. Wednesday's rate reduction follows a surprise half-point rate cut Jan. 3, a day after the NAPM released December data showing a major contraction in manufacturing activity.

Click here for the latest market news

"I think like many people in the market, they (Fed policy makers) are well aware that the manufacturing sector is soft right now," said Michael Moran, chief economist at Daiwa Securities in New York. "I think it would reinforce in their (the Fed's) minds that aggressive doses of stimulus are needed right now."

But Moran said he does not expect the Fed to move again on interest rates until at least early March, saying the central bank likely wants to review additional economic data. More data are expected in the next few weeks on retail sales, industrial production and other closely watched sectors.

Manufacturing activity accounts for roughly one-fifth of the U.S. economy, and the NAPM index traditionally has been a closely monitored gauge for the nation's overall economic health. While manufacturing has slowed to recession levels, it's uncertain whether that has spilled over into the rest of the economy, said Shepherdson.

"Just because something has happened in the past, doesn't mean it will happen in the future," he said. "It's not guaranteed that NAPM is going to tell you the whole story."

In fact, separate data released Thursday showed construction spending rose 0.6 percent in December, compared with forecasts for a slight decline. That follows higher-than-expected figures for new home sales released Wednesday

Meanwhile, consumer spending rose 0.3 percent while personal income increased 0.4 percent, the Commerce Department said Thursday, above forecasts for readings of 0.2 percent for both numbers, according to Briefing.com. Spending is watched closely since it fuels about two-thirds of the U.S. economy. The savings rate hit a negative 0.8 percent.

New jobless claims jumped to 346,000 last week from a revised 314,000 the prior week, the Labor Department reported. The figure was above analysts' estimates.

Treasury bonds continued to rally Thursday, amid optimism that further rate cuts may be in store. The 30-year bond gained nearly a full point in price, pushing down the yield to 5.45 percent. Stocks traded higher. The Dow Jones industrial average gained 95.86 points to 10,983, while the Nasdaq composite edged up 10.06 points to 2,782.

|

|

|

|

|

|

|