|

Wall St. Greenspan-ready

|

|

February 13, 2001: 6:09 a.m. ET

Markets await Fed chief's Senate testimony for hints on rate, tax position

|

NEW YORK (CNNfn) - It may not have the allure of "Survivor," but Tuesday's televised Senate testimony of Federal Reserve Chairman Alan Greenspan will draw rapt attention from U.S. stock investors trying to outwit, outplay and outlast the recent market doldrums.

Early indications point to a mixed opening for the markets. The Nasdaq-100 futures were moderately higher, with fair value taken into account, indicating an initial gain for the Nasdaq market. But Standard & Poor's leaned lower, hinting at a slow start for the S&P 500 and Dow Jones industrial average.

But any early activity could give way after 10 a.m. ET, when Greenspan is scheduled to give his semi-annual pronouncement on the nation's monetary well-being to the Senate Banking Committee. Economists expect few surprises in the testimony, since the Fed chairman has been forthcoming in recent weeks about such matters as diminished economic growth and his more positive attitude toward a tax cut such as the $1.6 trillion proposal put forth by the Bush administration.

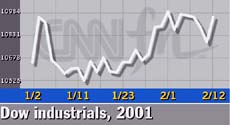

Any Greenspan hints at further reductions in interest rates would be welcome by investors. Since the Fed's half percentage-point cut late last month, the second such cut this year, the major indexes yielded all of their 2001 gains prior to a rally Monday.

The Dow Jones industrial average begins the day at 10,946.77 after a The Dow Jones industrial average begins the day at 10,946.77 after a

better than 1.5 percent gain Monday. The Nasdaq composite index opens

at 2,489.66, the beneficiary of a three-quarters of a percent increase.

The S&P 500 stands at 1,330.31 following a more than 1 percent advance.

Treasury prices rose in early Tuesday trading, sending yields lower. The 10-year note yield slipped to 5.03 percent from 5.05 percent late Monday, while the 30-year bond yield faded to 5.41 percent from 5.42 percent.

The dollar gained against the euro but dipped versus the yen. Brent oil futures in London fell 5 cents to $27.60 a barrel.

Major Asian markets closed mostly higher Tuesday. European markets were mixed in early trading.

The Commerce Department releases its data on January retail sales before the markets open. Economists surveyed by Briefing.com expect a 0.5 percent increase for the month, a stronger showing than the 0.1 percent gain posted for December.

Among the companies scheduled to report results before Tuesday's open is MetLife (MET: Research, Estimates), the insurer that went public last year. Fourth-quarter earnings are expected to be about 51 cents a share. MetLife shares closed Monday at $33.11, up 66 cents. Among the companies scheduled to report results before Tuesday's open is MetLife (MET: Research, Estimates), the insurer that went public last year. Fourth-quarter earnings are expected to be about 51 cents a share. MetLife shares closed Monday at $33.11, up 66 cents.

After the closing bell comes Applied Materials (AMAT: Research, Estimates), a maker of semiconductor fabricating equipment. Analysts expect fiscal first-quarter earnings to increase to 62 cents a share from 39 cents a year earlier. Applied Materials closed Monday at $44, up $1.37.

Citigroup's Citibank unit agreed Monday to acquire the European American Bank division of ABN Amro for $1.6 billion plus the assumption of $350 million in preferred stock. European American's branches are located predominantly on New York's Long Island. Citibank shares finished Monday at $55.45 after a $1.40 gain, while American depositary receipts (ADRs) of ABN rose 44 cents to $24.64.

|

|

|

|

|

|

|