|

Penney posts 4Q loss

|

|

February 22, 2001: 2:24 p.m. ET

Sales edge down, but improvement seen this year; Claiborne meets 4Q target

|

NEW YORK (CNNfn) - Struggling with a sagging U.S. economy and its own internal problems, J.C. Penney Co. Thursday reported a smaller fourth-quarter loss than Wall Street analysts had forecast, but said it expects its restructuring program to boost results in 2001.

The struggling No. 5 U.S. retailer said it lost 3 cents a share in the period, excluding one-time items, versus forecasts for a loss of 5 cents a share.

Including restructuring charges Penney reported a quarterly loss of $284 million, or $1.11 a share, compared with a loss of $12 million, or 8 cents a share, a year earlier.

The retailer also said it expects savings from its restructuring will help produce a profit of 70 to 80 cents a share in 2001, compared with average forecasts of 64 cents a share. For all of 2000, it earned 17 cents a share, excluding one-time items. The retailer also said it expects savings from its restructuring will help produce a profit of 70 to 80 cents a share in 2001, compared with average forecasts of 64 cents a share. For all of 2000, it earned 17 cents a share, excluding one-time items.

Plano, Texas-based J.C. Penney (JCP: Research, Estimates), hurt by strong competition from rival chains such as Target (TGT: Research, Estimates) and Kohl's (KSS: Research, Estimates), said sales edged lower to $9.75 billion in the quarter.

Although most retailers are suffering through a difficult time in the wake of weaker holiday sales marked by rising energy prices, bad weather and lower consumer confidence, Penney's woes were intensified by what analysts have called a stagnant corporate culture in which store designs and product offerings are not keeping up with consumers' tastes.

But Thursday's earnings report sparked cautious optimism among some analysts who believe the company is finally grasping what ails it.

"Sounds like they're getting their arms around the issues and that they've put a floor under what's going on. The real question is the timing of getting back to some normalized level of profitability," Morgan Stanley retail analyst Bruce Missett said. "The principal question is, where do we go from here?"

For the full year, Penney reported a loss of 409 million, or $1.68 a share, compared with earnings of $336 million, or $1.16 a share, including restructuring charges, the previous year.

Excluding the charges, the company reported full-year net income of 17 cents a share.

Sales for the year were relatively flat at $32.6 billion.

Under the leadership of Allen Questrom, the former Federated Department Stores (FD: Research, Estimates) CEO credited with turning the Macy's parent around, the company embarked on a massive restructuring in January, closing 47 under-performing stores, eliminating more than 5,000 jobs and re-focusing on private labels such as its popular Arizona jeans.

"I think the most encouraging part of what they're doing is that they have had now a certain amount of incremental time since Allen came on board to upgrade the executive suite, so to speak," Missett said. "The people are very experienced people that have a better sense of how a centrally managed business works."

Questrom said the restructuring charges reflected store closings, and work force reductions. Inventory markdowns related to the discontinuation of some items and narrowing of assortments in its stores also were a factor.

"During 2001, we will be focusing our efforts on merchandise assortments, enhanced marketing, and expense reductions," Questrom said. "Although it will be two to five years before we fully restore the profitability of our business to competitive levels, I am confident that incremental progress will continue to be made over the next several years."

Click here to check out other retail stocks

Eckerd Corp., the ailing drugstore chain owned by Penney, also has been a drag on the company's profits.

During the quarter, department store sales at stores open at least a year, or comparable-store sales, declined 1.6 percent and catalog sales fell 5.8 percent. Internet sales, which are included with catalog sales, increased to $126 million from $64 million a year earlier.

Eckerd comparable-store sales increased 8.1 percent, driven mainly by pharmacy sales.

Direct marketing profit edged up to $67 million from $66 million a year ago on a 2.8 percent sales increase. The company said it continues to explore strategic options for the business, including selling it outright.

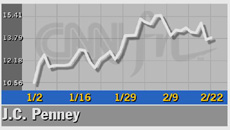

After earlier gains, J.C. Penney shares lost ground in Thursday afternoon trading with shares down 10 cents to $13.55.

Liz Claiborne on target

Separately, apparel maker Liz Claiborne Inc. (LIZ: Research, Estimates) matched fourth-quarter estimates, reporting net income of $39.5 million, or 96 cents a share, excluding special items, compared with net income of $49.8 million, or 85 cents a share, a year earlier.

Results exclude the impact of a $15.6 million restructuring charge the New York-based company took in the quarter that shaved earnings per share by 20 cents, the company said. Results exclude the impact of a $15.6 million restructuring charge the New York-based company took in the quarter that shaved earnings per share by 20 cents, the company said.

Net sales increased 11.4 percent to $754 million from $677 million in the year-ago quarter.

The company also reaffirmed 2001 targets of 5 to 7 percent sales growth and an 11 to 13 percent earnings per share increase.

Shares of Liz Claiborne climbed $1.30 to $48.18 in Thursday afternoon trading.

And electronics retailer RadioShack Corp. (RSH: Research, Estimates) fell short of expectations Thursday.

|

|

|

|

|

|

|