|

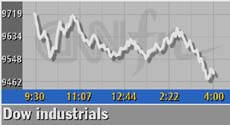

Dow hits a two-year low

|

|

March 21, 2001: 4:34 p.m. ET

Worries about economic slowdown and profit growth sparks sell-off

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The Dow Jones industrial average plunged to a two-year low Wednesday, helped by a late sell-off of financial issues over concerns that the slowing economy may have an adverse effect on bank lending.

The sell-off comes just one day after the Federal Reserve cut short-term interest rates by half a percentage point.

"With a slowing economy, banks loan less," explained Peter Green, market analyst with Gerard Klauer Mattison & Co. "It's disappointing that the market can't rally on rate cuts."

Adding to the pressure, concerns about corporate profitability growth in a slowing economy that had been hurting technology issues spilled into the blue chip index, just one day after the Fed's latest rate cut disappointed those expecting a more aggressive move.

"There's a recognition factor that any of the so-called economic problems that faced the tech stocks also face any other company," said Charles Payne, head analyst with Wall Street Strategies. "Uncertainty is ruling the market and most of the people who have been on the sidelines are still on the sidelines." "There's a recognition factor that any of the so-called economic problems that faced the tech stocks also face any other company," said Charles Payne, head analyst with Wall Street Strategies. "Uncertainty is ruling the market and most of the people who have been on the sidelines are still on the sidelines."

The Dow industrials tumbled 233.76 to 9,487.00, its lowest level since the March 4, 1999, close of 9,467.40.

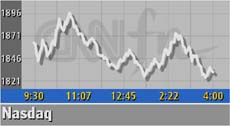

The Nasdaq composite index did not fare much better, setting a 28-month low, as tech stocks flip-flopped throughout the session within a tight range. The tech-heavy index fell 27.28 points to 1,803.16, after spending the session fluctuating 30 points on either side of breakeven.

The S&P 500 slid 20.49 to 1,122.13.

All three major indexes plunged late Tuesday, just after the Fed announced its rate cut. But Wednesday's action vacillated between those believing the Fed did enough and those that felt the Fed's action fell short.

"What you're seeing today is that swing back and forth," said Alan Kral, portfolio manager with Trevor Stewart Burton. "There's always a range of expectations, which means he'll (Fed Chairman Alan Greenspan) always disappoint somebody, and a lot of that disappointment was reflected yesterday." "What you're seeing today is that swing back and forth," said Alan Kral, portfolio manager with Trevor Stewart Burton. "There's always a range of expectations, which means he'll (Fed Chairman Alan Greenspan) always disappoint somebody, and a lot of that disappointment was reflected yesterday."

The sellers won out again Wednesday, gaining momentum and signaling overriding disappointment that the rate cut wasn't more aggressive.

"The decline has taken on a life of its own just as last year's rally took on a life of its own," said David Katz, chief investment officer with Matrix Asset Advisors.

Market breadth was negative. On the Nasdaq, losers beat winners 2,487 to 1,228 as more than 2.08 billion shares were traded. Decliners outpaced advancers on the New York Stock Exchange 2,212 to 859 as more than 1.3 billion shares changed hands.

In other markets, Treasury securities edged lower. The dollar rose against the yen and euro.

Dour Dow

Remaining negative sentiment among traders overpowered any tentative nibbling by investors.

Explaining the lack of investor participation, John Hughes, market analyst with Shields & Co., told CNNfn's The Money Gang, "investors aren't willing to commit money because they're trying to recover what they lost."

As pressure increased on the downside, analysts said it will take more time for the interest rate cuts to filter through the economy.

"The Fed cut 100 basis points (one percentage point) in January and we've got another 50 under our belt now," said Bryan Piskorowski, market analyst with Prudential Securities. "Monetary policy is a slow moving beast and ultimately it's going to take some time to turn this economy around."

Dow issues bore the brunt of the selling, with interest rate sensitive financial stocks sharply lower.

American Express (AXP: Research, Estimates) fell $2.28 to $34.99, J.P. Morgan (JPM: Research, Estimates) shed $2.39 to $40.20.

Three leading Wall Street brokers -- Morgan Stanley Dean Witter (MWD: Research, Estimates), Lehman Brothers (LEH: Research, Estimates) and Bear Stearns (BSC: Research, Estimates) -- all reported sharply lower first-quarter profit. Three leading Wall Street brokers -- Morgan Stanley Dean Witter (MWD: Research, Estimates), Lehman Brothers (LEH: Research, Estimates) and Bear Stearns (BSC: Research, Estimates) -- all reported sharply lower first-quarter profit.

Shares of Morgan Stanley fell $1.86 to $54.64, Lehman stock shed $2 to $63.90 and shares of Bear Stearns slipped $1.25 to $45.50

Hoping the economy was in better shape than it looks, some investors cautiously stepped up to the plate in the technology sector.

JDS Uniphase (JDSU: Research, Estimates) gained 94 cents to $22.44, IBM (IBM: Research, Estimates) advanced 78 cents to $89.08, but Microsoft (MSFT: Research, Estimates) shed $2.75 to $49.94.

Disappointing corporate results were shrugged off but warnings still sparked selling.

Express carrier FedEx (FDX: Research, Estimates) gained $2.35 to $42.60 after it saw profits slip in its fiscal third quarter, citing a worsening economic environment throughout the period, but said it still should be able to meet or beat fourth-quarter forecasts.

But Deere (DE: Research, Estimates) skidded $2.16 to $38.17 after it warned that earnings for the latest quarter will fall from a year earlier, missing Wall Street forecasts, and said it is scaling back production in its heavy equipment business.

There were some other corporate developments besides results and warnings. There were some other corporate developments besides results and warnings.

Sun Microsystems (SUNW: Research, Estimates) gained $1 to $18.38 after it unveiled its latest weapon in the ongoing battle for market share among the leading suppliers of network servers used to power Internet-based businesses.

IBM (IBM: Research, Estimates) and Hewlett-Packard (HWP: Research, Estimates) have introduced competing mid-range servers.

Procter & Gamble (PG: Research, Estimates) fell $2.70 to $63.20 after it said it is considering a work force cut of as much as 20 percent in the face of slower economic growth, the Wall Street Journal reported Wednesday.

Tame CPI

One day after the Fed continued its rate-cutting campaign, the government's Consumer Price Index was slightly above expectations but garnered little reaction.

The CPI, the government's main inflation gauge, rose 0.3 percent last month, due largely to increases in food and clothing costs. Wall Street was looking for a 0.2 percent rise, according to economists surveyed by Briefing.com.

Analysts said the data were largely being ignored and having no impact on trading activity.

But investors still want more economic proof that the Fed will step in and be aggressive if the data warrant it. Analysts say it's not a dire scenario but investors are not convinced.

"The Fed disappointed us short term," said Art Hogan, chief market analyst with Jefferies & Co. "The economy looks better than it did in December and the Fed knows more than we do."

|

|

|

|

|

|

|