|

Wall St.'s got the blues

|

|

March 22, 2001: 8:13 a.m. ET

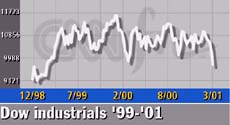

Selloff of blue-chip issues shows few signs of diminishing; Dow at 2-year low

|

NEW YORK (CNNfn) - Now that blue-chip issues have fully joined Wall Street's selling spree, investors will be looking for something -- anything -- to turn the markets around Thursday.

But there were few signs the search will be successful. Nasdaq-100 futures fell modestly after taking fair value into accounting, pointing to a flat or weak start for the Nasdaq market. Standard & Poor's futures fell more broadly, indicating an initial drop for the S&P 500 and Dow Jones industrial average.

The Dow industrials will start at their lowest point in two years, The Dow industrials will start at their lowest point in two years,

9,487, after Wednesday's 2.4 percent drop. Financial services issues led the decline Wednesday, reflecting investor concern that banks will have trouble lending due to the slowdown in the economy.

The decline also reflected unhappiness with the Federal Reserve's decision Tuesday to cut interest rates by half a percentage point. Many investors wanted stronger action to help turn the economy around -- and give a boost to corporate profits -- faster.

Douglas Cliggott, U.S. equity strategist with J.P. Morgan, cautioned investors to diversify their portfolios in such an environment.

"Our mantra for a while, and I guess this is even more true right now, is to have a diversified portfolio of assets, own bonds," Cliggott told CNNfn's Before Hours Thursday. "People are putting money into money market funds. It's a good idea. Within equities spread your money around. Don't have every egg in one basket."

The Nasdaq composite index is at its lowest point since November 1998, 1,830.23, following Wednesday's 1.5 percent dip, while the S&P 500 begins at 1,122.14 after dropping 1.8 percent.

The Conference Board's Index of Leading Indicators, to be released shortly after the market open, could provide some guidance. Economists surveyed by Briefing.com expect a 0.2 percent decline for February, compared with the 0.8 percent increase in January.

Tokyo's markets retreated Thursday from the whopping 7.5 percent rise in the Nikkei index in the prior session. European markets mimicked their American counterparts early Thursday, with "old economy" issues leading a downturn.

Treasury prices rose slightly, shaving yields. The 10-year note yield fell to 4.75 percent from 4.77 percent late Wednesday, while the 30-year bond yield slipped to 5.27 percent from 5.28 percent.

The dollar gained against the euro and fell slightly versus the yen. Brent oil futures rose 4 cents to $25.04 a barrel in London.

Tribune Co. (TRB: Research, Estimates), the publisher of the Chicago Tribune and Los Angeles Times, said late Wednesday that it expects first-quarter earnings to be below expectations because of weak ad sales. The company shares fell $1.55 to $36.20. Tribune Co. (TRB: Research, Estimates), the publisher of the Chicago Tribune and Los Angeles Times, said late Wednesday that it expects first-quarter earnings to be below expectations because of weak ad sales. The company shares fell $1.55 to $36.20.

If you can wait awhile, you'll get a positive earnings surprise from a semiconductor maker. Micron Semiconductor (MU: Research, Estimates) said it will report operating profit for the second quarter ended March 1, rather than the loss analysts expected. But the company delayed its actual report until next week. Micron Semi's shares rose $1.41 to $42.01 Wednesday.

Electronics distributor Avnet agreed to buy competitor Kent Electronics for $550 million in a move that will expand its reach in North America, the companies said Thursday. But Avnet also said it expects quarterly earnings to fall short of estimates due to slowing demand. Shares of Avnet (AVT: Research, Estimates) slipped 90 cents to $23.55 Thursday.

|

|

|

|

|

|

|