|

Funds for IRA season

|

|

April 12, 2001: 6:23 a.m. ET

Adopt a long-term horizon when you're picking mutual funds

By Staff Writer Martine Costello

|

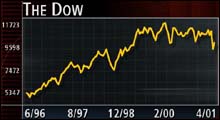

NEW YORK (CNNfn) - Imagine the world 30 years from now. There's a cure for cancer, people are living on the moon, the Dow is at 120,000 and the average mutual fund has increased 1,500 percent.

Suddenly, picking funds for your IRA doesn't seem so bad.

|

|

|

Has IRA season got you down because of market losses? Look at long-term returns. | | |

Still, many investors are finding themselves in a state of paralysis this IRA season, unable to open that IRA and decide on a fund, or unable to find a replacement for that high-flying Internet fund they bought when times were good on Wall Street.

"You tell yourself you're investing in a fund for the long term," said Mari Adam, a certified financial planner from Boca Raton, Fla. "If you're an IRA investor, it is very long term. Tell yourself you are getting some good bargains."

All about IRAs

How to fight IRA agony

Funds wipe out tax pain

New IRA distribution rules good for heirs

New IRA rules take effect

Time to recharacterize your IRA?

Whether you're a new IRA investor, an investor with a 10-year-old portfolio, or a newcomer still trying to figure out the difference between distributions and deductions, the main thing is to look for diversified funds.

Make sure you look for low-cost funds, since expenses add up over decades. Tax efficiency isn't as much of a priority, since an IRA is tax-deferred. So you might want to keep funds with a higher turnover rate, for example, in your IRA. You also should look at three- and five-year annualized returns – and look for funds that own solid companies.

"This past market has taught a lot of people that you can't afford to be in one sector," said Barbara Steinmetz, a certified financial planner from Burlingame, Calif. "They were heavily in the Nasdaq because they thought they understood it. They thought this was a brave new economy." "This past market has taught a lot of people that you can't afford to be in one sector," said Barbara Steinmetz, a certified financial planner from Burlingame, Calif. "They were heavily in the Nasdaq because they thought they understood it. They thought this was a brave new economy."

A good place to start, especially if you have only $1,000 in your IRA, is an index fund that mirrors the market, such as Schwab 1000, which invests in the 1,000 largest publicly-traded companies, Adam said.

Schwab also has several asset-allocation funds, such as Schwab MarketTrack All Equity Portfolio, which do the diversification for you, Adam said. Schwab Market Manager Growth and Vanguard Star are both "funds of funds" that invests in a handful of other mutual funds.

"Right now you want to get your feet wet and have a nice diversified portfolio of stocks that is going to be around for a while," Adam said.

A fund that has broad exposure to the U.S. market is a good bet because it can help you meet many goals and makes a good core holding, according to Peter Di Teresa, an analyst at Morningstar.

Adam also recommends Excelsior Value and Weitz Value, which performed well during growth eras and continue to hold their own this year. Another fund she likes is Dreyfus Appreciation as a good blue chip offering.

"It's not too exciting, plain vanilla, with good companies, good financial qualities," Adam said. "That gives you a core." "It's not too exciting, plain vanilla, with good companies, good financial qualities," Adam said. "That gives you a core."

The biggest mistake is to pick from the most recent list of winners, Adam said.

"The key is you don't want to pick something too wacky, like a sector fund, or something too aggressive," Adam said.

If you're retiring and need income-producing funds, you might want to consider PIMCO Total Return, PIMCO Real Return or Vanguard Intermediate-Term Bond Index, said Bud Kasper, a certified financial planner from Kansas City, Mo.

You might want to keep about 40 percent of your portfolio in funds to produce income you need in the next three to five years, Kasper said.

If you're not taking IRA distributions but you want to be more conservative, there's PIMCO Low Duration Fund.

Other funds that Kasper likes include Vanguard Asset Allocation, MFS Total Return, and Calamos Convertible Growth & Income, Kasper said. Growth & Income funds are less risky and are designed to produce long-term growth and income.

Kasper also recommends Oakmark Select, PBHG Large Cap Value, Artisan Mid Cap, Hartford Mid Cap, and PIMCO Renaissance. White Oak Growth, which held up well in 2000 with a gain of 3.6 percent despite widespread losses, is another good option, even though it's down 30 percent this year, he said. Kasper also recommends Oakmark Select, PBHG Large Cap Value, Artisan Mid Cap, Hartford Mid Cap, and PIMCO Renaissance. White Oak Growth, which held up well in 2000 with a gain of 3.6 percent despite widespread losses, is another good option, even though it's down 30 percent this year, he said.

Of course, all of the funds are doing poorly, Steinmetz said. Her list includes Selected American, Thornburg Value, Artisan International and Janus Worldwide.

The downturn also has proved the importance of having some fixed income in your lineup, such as Strong Advantage, Steinmetz said.

"That was a thing we were getting away from when the equity markets were on a tear," Steinmetz said. "Everybody thought you were a fool to get into anything else."

Real estate funds are another good bet for IRAs because they generate so much income, Steinmetz said. The income is taxed at your current income tax rate, so it makes sense to keep those funds in a tax-deferred account, she said. Real estate funds are another good bet for IRAs because they generate so much income, Steinmetz said. The income is taxed at your current income tax rate, so it makes sense to keep those funds in a tax-deferred account, she said.

"The key to keep in mind with IRAs is you're taking a long-term horizon," Steinmetz said. "You've got to go in thinking there's going to be ups and there's going to be downs."

* Disclaimer

|

|

|

|

|

|

|