|

Going to the chapel …

|

|

August 11, 2000: 6:09 p.m. ET

How to save for retirement when you get hitched

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - When newlyweds Jim and Stephanie Laubner stepped off the plane in Tahiti, the last thing on their minds was how they were going to save for retirement. Swimming in clear blue waters, sipping cool drinks on the verandah and dancing by candlelight was their agenda for a two-week honeymoon in June.

But when they returned home to Yardley, Penn., they knew now was the best time to look at their finances -- together -- and start saving for their golden years.

"I have to say, it's a little bit scary," combining our accounts, said Jim, 31. "I'm a little bit more conservative and concerned with retirement and savings. Although she doesn't take it lightly. I am the nagger though." "I have to say, it's a little bit scary," combining our accounts, said Jim, 31. "I'm a little bit more conservative and concerned with retirement and savings. Although she doesn't take it lightly. I am the nagger though."

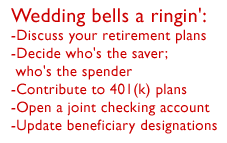

Experts say couples like Jim and Stephanie should discuss their retirement before walking down the aisle so they're on the same page. Retirement may be many moons away and you'd like to have children, buy a new home and car even before then, but now is the time to create a long-term nest egg even if it's one kernel at a time.

"Both of us enjoy working and like what we do, but it would be wonderful to find a way to retire early," said Jim, who works in international policy for a pharmaceutical company. Stephanie, 26, is a senior account executive at a marketing firm.

401(k) it

Newlyweds are probably thinking about buying a home, having a baby or other short-term goals, but retirement planning should play a part of your overall financial picture.

"We want some kind of nest egg to pay for the education for a child, but we also want to have our 401(k)s chugging along as well as possible so we can retire earlier than our parents," Jim said.

The first place to start, experts agree, is a 401(k)-type of plan your employer may offer.

CFP Susan Freed suggests each of you should maximize your contributions -- usually 15 percent of your pre-tax dollars. Not everyone is able to do that, but at the least, you should be saving up to what your employer will match.

For example, let's say your salary is $50,000 and your company will match 50 percent of the first six percent of your contributions. That means that if you contribute six percent of your pre-tax dollars, or $3,000 in a year, your company will put in another $1,500, making your annual contribution $4,500.

If you contribute less than six percent, you would miss out on your company's full match.

Check out these top personal finance & retirement stories of the week on CNNfn.com!

Portfolio Rx: Planners give an A+ to a couple's savings plan

Day trading loses shine

Can I have a loan, Mom?

Real estate benefits techie

Crash and learn

Tap an invisible workforce

Combine and conquer your retirement savings

You share the toothpaste, the cooking and the bills, so doesn't it make sense to combine your assets? In some cases it does, but keeping autonomy during your marriage may also be prudent, planners say.

Firstly, CFP Wendy Hobbs notes that newlyweds don't always have that much money to consolidate.

"They're young and both starting out," she said. However, it's important that the newlyweds discuss how they want to save for their later years because the sexes often have differing views.

Click here to check your mutual funds

Women, who tend to be the separatists more concerned about losing their identity in the relationship, may be apprehensive to joining accounts, Freed says. Men, on the other hand, more typically view consolidating accounts as a sense of commitment.

"There's a lot of conflict when there's no predetermined approach of how to deal with expenditures," added CFP Jennifer Myers, who advises some newlywed clients in Wash., D.C. "The wife makes a large deposit into the joint checking account, the husband buys new golf clubs or a car. How do you make those decisions?"

So she suggests couples open a joint bank checking account to pay for monthly bills. Also, newlyweds may consider opening a mutual fund account in addition to their IRAs or 401(k)s to save together for long-term goals such as retirement.

It's important to note that combining assets doesn't apply to retirement plans such as the 401(k), IRA, or profit-sharing accounts. Spouses can discuss their allocation in their own plan, however the accounts are run separately and can be titled only in one name, Freed explains.

This is different from a joint bank checking account or joint brokerage account, which would carry both spouses' names and could be accessed by either individual.

Want to be considered for CNNfn.com's Portfolio Rx? Want to be considered for CNNfn.com's Portfolio Rx?

Click here to read the latest Portfolio Rx and learn how to get free financial advice on your retirement portfolio.

Having separate retirement plans at work though can be beneficial if the couple has different investment philosophies. For example, in the Laubner's case, Jim's more conservative approach will offset the choices Stephanie makes in her portfolio, which may be more aggressive.

And this is a good time to check the beneficiary designation on your retirement account.

You probably assigned a parent as the main beneficiary of your 401(k) when you established the plan several years ago. Now that you're married, you'll want to consider your spouse at the primary beneficiary. This holds true for your IRAs or profit sharing plans at work too, so it's a good time to review those designations, planners say.

Wedding bells a ringing

Jim and Stephanie apparently aren't the only newlyweds facing these issues about saving for retirement. The millennium is a popular year for weddings.

"A lot of people were captivated by getting married in the year 2000," said Millie Bratten, editor in chief of BRIDE'S magazine. "It's a festive time, and people like to tell their grandchildren that we got married at the turn of the century."

The Laubners, however, chose 2000 to get married before learning of the hype surrounding the millennium. They knew it was the right time to start a life together.

"I would be happy with having a second home," during retirement, Jim said. "I want to be safe, with a roof over our head, no worries about bills, or unmet medical needs. We want to be able to vacation and travel and enjoy life."

--Staff Writer Jennifer Karchmer covers news about retirement for CNNfn.com. Click here to send her email.

|

|

|

Top 3 financial mistakes - Aug. 3, 2000

May walks the aisle - July 3, 2000

Financing a family - June 30, 2000

The rise of prenuptials - June 27, 2000

Before the stork arrives - June 9, 2000

Getting your spouse to save - May 23, 2000

How to choose a financial planner - March 30, 2000

Age gap retirement - March 22, 2000

Battle of the $exes - March 2, 2000

GenX preps for retirement - Feb. 29, 2000

|

|

|

|

|

|

|

|