|

Fresh-start GenX portfolio

|

|

September 5, 2000: 6:01 a.m. ET

Advice for a young couple with no savings, high income and $440K of debt

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Being young and successful today can come at a hefty price. For Shane and Regina Blackstone, a married couple in their mid-20s, that price is $190,000 in student loans.

That's part of the reason why they have no retirement savings or other investments. But they want to change that.

Newly settled in a $125,000-a-year job as a commercial litigation lawyer in Chicago, Shane is eager to get his retirement planning under way. So, too, is Regina, who is teaching elementary school for $30,000 a year. They are looking for the most effective asset allocation and the best mutual funds to help them meet their goals.

Those goals include being able to retire -- at least partially -- by 55, and to accelerate their school-loan repayment schedule. Otherwise, they will be paying $1,350 a month for the next 30 years.

Steeped in new-home debt

That's not all they'll be paying off.

They've just taken on a 30-year, $252,700 mortgage on a new condominium in a trendy area of Chicago known as Bucktown.

It was an impulse purchase, Shane admits, but he felt it would be a good investment since real estate prices are on the rise and the couple would get a tax break from their mortgage payments. They are just about to make their first $2,500 monthly payment. It was an impulse purchase, Shane admits, but he felt it would be a good investment since real estate prices are on the rise and the couple would get a tax break from their mortgage payments. They are just about to make their first $2,500 monthly payment.

Despite their high combined income, they only have $1,000 in their checking account. That's because they've used their cash to make the down payment on their home and to pay off credit card debt for home-related purchases, of which about $4,500 remains. They plan to pay that off in the next two months.

Positive cash flow helps

All told, Shane estimates their monthly expenses come to about $5,500, well below their combined take-home pay of $9,150. But three certified financial planners considering the Blackstones' situation say their monthly output is probably higher since most people underestimate how much they spend.

And the amount of debt they've taken on is a concern, to the couple and to the planners. And the amount of debt they've taken on is a concern, to the couple and to the planners.

So, too, is the fact that they bought their apartment on impulse, said CFP Scott Kahan, president of Financial Asset Management Corp. in New York. Although the condo may prove a good investment, "impulse purchases (in general) can be expensive and they should be careful going forward," he said.

In any case, the Blackstones are fortunate to have positive cash flow.

"The good news is he (Shane) is in a profession where he can make a lot of money," said CFP Mark Groesbeck of the Stanford Group in Houston. "They're in a position where they can be saving and paying down their debt."

First things first

Investing is not in the couple's blood. "We come from very blue-collar families with little to no investments," Shane said. Nevertheless, he added, "I'm not risk-averse."

Nor is he oblivious to the market. He reads quite a bit of financial press and has taken an interest in companies involved in fuel-cell technology.

The planners agree that the Blackstones' priorities, given their goals, should run in the following order: maximize contributions to their retirement plans; establish an emergency fund so they don't rely on credit cards; and increase payments on their student loans.

Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification and asset allocation. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification and asset allocation. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information.

For Shane, that means paying $10,500 a year, or $875 a month, into his 401(k) plan, for which his employer does not offer matching contributions.

Regina, who has a 403(b) plan, likely will not be allowed to put in more than 10 percent to 15 percent of her salary, or $250 to $375, a paycheck.

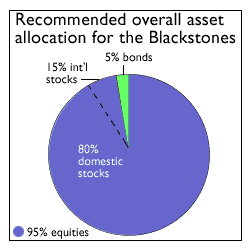

Both spouses should invest 95 percent of their retirement portfolios in stocks: 80 percent in domestic equities and 15 percent in international, said Groesbeck and Marc Collier, a CFP with Wellesley Financial Architects in Wellesley, Mass.

Kahan recommends they skip the bonds altogether and invest 100 percent in equities since they are so young, and put 25 percent of that money in international stocks.

Start with solid funds

The planners recommend the Blackstones stick with mutual funds since their small portfolios offer more diversity than individual stocks can. And they felt the couple should not make any investments outside their retirement plans until they have built up their emergency fund and reduced their debt significantly.

Regina has very few choices in her 403(b) plan, so the planners recommend she stick with whatever fund offers the greatest diversified growth.

Shane has more than 10 funds in his plan plus the option of a brokerage window, which lets him invest in anything Schwab offers. The planners feel he could do well if he stayed within the plan given its solid fund choices. Shane has more than 10 funds in his plan plus the option of a brokerage window, which lets him invest in anything Schwab offers. The planners feel he could do well if he stayed within the plan given its solid fund choices.

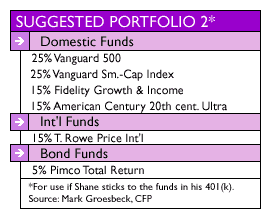

Groesbeck and Kahan suggest he invest in the Vanguard 500 Index fund, the Vanguard Small-Cap Index fund, American Century 20th Century Ultra fund and T. Rowe Price International fund.

Additionally, Groesbeck thinks Shane should put 15 percent of his money in Fidelity's Growth and Income Fund and 5 percent of his money in the Pimco Total Return bond fund.

"This mixture of mutual funds is pretty evenly mixed with value and growth. And ... it is slightly less risky than the market as a whole," Groesbeck said.

Venturing outside the fold

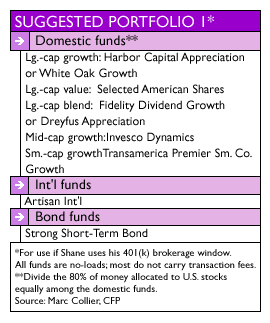

Should Shane wish to use his brokerage window, he will have to pay a $100 annual fee in addition to commission and transaction fees. That's about 0.95 percent of his $10,500 contribution.

But, Collier said, "That's not a big cost to be able to get into some good funds."

He recommended a portfolio of no-load, mostly no-transaction-fee funds. He recommended a portfolio of no-load, mostly no-transaction-fee funds.

For the 80 percent of Shane's portfolio devoted to domestic funds, Collier thought he should divide his money evenly between large-cap growth, large-cap value, large-cap blend, mid-cap growth and small-cap growth funds.

His suggestions: Harbor Capital Appreciation or White Oak Growth; Selected American Shares; Fidelity Dividend Growth or Dreyfus Appreciation; Invesco Dynamics; and Transamerica Premier Small Company Growth.

For the 15 percent of Shane's money going into international equities, Collier recommends Artisan International; and for the 5 percent investment in bonds, he likes Strong Short-Term Bond Fund.

Get liquid cash, lose the loans

After paying their contributions to their retirement plans and paying their bills, they should use the money left over to build up an emergency money market account of at least $15,000, Kahan and Groesbeck said. Collier didn't think they needed more than $10,000 to be safe.

Once they've done that, the planners recommended they devote all extra money every month to accelerating their debt repayment schedule, which carries a 7.625 percent interest rate.

Click here to read last week's Checks & Balances column.

Click here to read an earlier Portfolio Rx profile.

If they put in an extra $2,000 on top of their $1,350 monthly payment, they can pay off the balance in just under 6 years, Groesbeck said.

If $2,000 is too steep, just paying an extra $500 a month will pay the debt off in less than 10 years. And an extra $200 a month will let them clear their debt in 20 years.

If they want to start building the emergency fund and paying down the debt simultaneously, they can set split the surplus between the two goals, Groesbeck added.

Curb lifestyle expenses

Retiring early is a possibility, but it's still too early to tell if they can meet that goal, Kahan said, especially if they plan on having kids and paying for their educations.

Still, Groesbeck said, "I think they'll be OK." But given their high combined income and the consumer pressures that come with big salaries, he cautioned that they should "be careful not to spend their surplus on their lifestyle."

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name in an upcoming story. Please include a daytime phone number so we may reach you.

* Disclaimer

|

|

|

|

|

|

|