|

Mutual fund targets DNA

|

|

October 9, 2000: 9:57 a.m. ET

GenomicsFund.com focuses on volatile sub-sector of the biotech industry

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - For the past year, Wall Street has been entranced by genomics - an emerging field within the biotechnology industry that's been touted as no less than the future of medicine. Now, a mutual fund focused exclusively on genomics companies hopes to capitalize on the craze.

The GenomicsFund.com (GENEX), a small mutual fund launched earlier this year with about $31.3 million in assets, is the only investment vehicle of its kind - a fund with 100 percent of its holdings in companies primarily focused on genomics, the study of the structure and function of genes.

Many investors, on the hunt for a hot new sector after Internet stocks took a nosedive, have turned to genomics companies - which make gene analysis equipment, compile massive gene databases and in some cases, develop their own proprietary drugs and diagnostic tests. Scientists are combing through genetic material in hopes of developing tests that can screen for an array of diseases at the genetic level as well as create potent new biotech drugs that target mutant genes linked to cancer, depression and other illnesses.

The GenomicsFund.com was launched by Steven Newby, who runs an asset management firm outside Washington, D.C., in Gaithersburg, Maryland, near the headquarters of many top-name genomics companies including Celera Genomics Group (CRA: Research, Estimates) and Human Genome Sciences Inc. (HGSI: Research, Estimates) as well as the National Institutes of Health.

Newby does not have a scientific background - he has a B.S. in economics from the University of Maryland. But - like many investors - he became intrigued by genomics last year amid news reports of advances in decoding the human genome and genomics' potential for revolutionizing the drug industry. Newby does not have a scientific background - he has a B.S. in economics from the University of Maryland. But - like many investors - he became intrigued by genomics last year amid news reports of advances in decoding the human genome and genomics' potential for revolutionizing the drug industry.

"As I got more into studying genomics, I found it was very difficult to identify which companies were going to be the major beneficiaries of this," he said. "I thought a mutual fund approach might make sense."

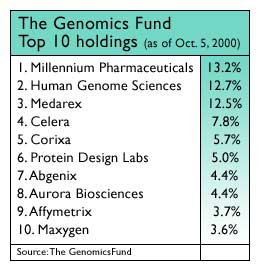

The fund contains 23 holdings, dominated by some of the leading firms in the field, such as Millennium Pharmaceuticals Inc. (MLNM: Research, Estimates) (the top weight with 13.2 percent), Human Genome Sciences (12.7 percent), Medarex Inc. (MEDX: Research, Estimates) (12.5 percent) and Celera (7.8 percent). Those four core holdings comprise about 40 percent of the fund's value.

But the genomics sector is one of the most volatile in all of the market, and the GenomicsFund.com is no exception. The fund has had a rocky performance since its March launch, sliding 33 percent in its first month amid a major sell-off in biotech stocks. But in June, the genomics sector was again on fire, ahead of an announcement that Celera Genomics and government scientists would jointly announce the completion of a rough draft in the sequencing of the human genome.

The fund finished the second quarter with a whopping 39 percent gain, compared with a 13.3 percent drop in the Nasdaq composite and a 2.7 percent decline in the S&P 500 during the same period.

For the recently completed third quarter, the fund rose nearly 14 percent. That compares with a 7 percent gain for the Nasdaq Biotech Index, which tracks about 200 firms throughout the biotechnology sector.

Too volatile?

But despite some of the fund's recent eye-popping gains, analysts caution about investing in it, saying as a rule most individual investors should be leery of highly specialized funds. And in an emerging industry such as genomics, they point out, investors often buy and sell stocks in the sector in tandem, with little differentiation yet among strong and weak companies. That type of investor attitude toward a sector can make a niche fund even more risky.

Morningstar analyst Emily Hall, who tracks biotech funds, says she does not recommend the GenomicsFund, saying it is too volatile for most investors. The fund is also run by an untested group that has little in the way of a research department to select investments, she cautions.

"We are really talking about an extremely aggressive offering," she said. "It's not something that I encourage people to consider generally."

Check your mutual funds on CNNfn.com.

Morningstar does not have a rating on the fund. The fund analysis company only issues its star ratings for funds that have been around for at least three years. For the three months ended Oct. 4, the fund had a trailing three-month return of 5.71 percent, putting it in the middle of the health-care fund category, Hall said.

Newby says the fund is risky, but he thinks it's a way to play the volatile sector by tapping into some of the leaders in the growing industry.

"Nobody is ever recommending that this should be the keystone of somebody's portfolio," he said. "Genomics is probably the most volatile area of the stock market, and probably will be for some time to come."

Newby said he focuses on the established leaders in the field, such as top-holding Millennium Pharmaceuticals, which is still in the red and posts modest revenues. But the company has sealed numerous alliances with major drug companies in hopes of developing new treatments resulting from its gene discoveries, meaning its potential royalty revenue could skyrocket if successful drugs go on the market.

"Most of our names would be considered leaders in the industry," Newby said. "We're not trying to find the scientist that has cooked up the cure to AIDS in his bathtub or anything."

The fund contains only one international holding, drug delivery technology company Transgene SA (TRGNY: Research, Estimates) of Strasbourg, France. Newby said he is looking at potentially expanding to include other companies in Europe.

Newby also notes that he is forming a scientific advisory panel for the fund and said he plans to announce a chief technology officer for the fund next week.

The GenomicsFund is a no-load fund with a minimum initial investment of $5,000.

|

|

|

|

|

|

|