|

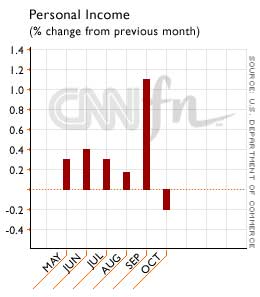

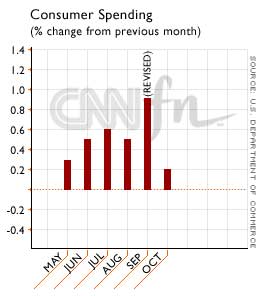

Income falls, spending up

|

|

November 30, 2000: 1:57 p.m. ET

Incomes fell unexpectedly last month while spending edged higher

|

NEW YORK (CNNfn) - Americans' incomes fell in October for the first time in nearly two years while consumer spending barely edged higher, pushing the savings rate to a record low, the government said Thursday – the latest signs of slower economic growth in the United States.

The numbers, combined with lower durable goods orders, declining consumer confidence, and shaky retail sales, leave many analysts believing the Fed is getting ready to either lower interest rates or at least move toward a neutral stance on inflation when it meets Dec. 19.

"This suggests the economy is due for a slowdown, much like the one we had in 1995," Paul Christopher, an economist with A.G. Edwards, told CNNfn's Before Hours. "It's quite possible they'll (the Fed) move in December; if not in December, then in January." He said the economy is certainly showing signs of a slowdown, but not because of any inherent trouble. [231KB WAV][231KB AIFF]

Personal incomes fell 0.2 percent last month to an annual rate of $8.41 trillion after rising 1.1 percent in September, the Commerce Department said. It was the first drop since December 1998, following a surge in government subsidies paid to farmers that had pushed up incomes in September.

Spending, which fuels two-thirds of the economy, rose just 0.2 percent to $6.88 trillion after a revised 0.9 percent increase in September. Spending, which fuels two-thirds of the economy, rose just 0.2 percent to $6.88 trillion after a revised 0.9 percent increase in September.

The rise in spending matched Wall Street forecasts, while economists had estimated that incomes also had risen 0.2 percent. The savings rate hit another record low of negative 0.8 percent.

Separately, new jobless claims jumped to 358,000 last week, the highest in more than two years, the Labor Department said. The number came in well above Wall Street forecasts, pointing to weaker demand in what has been a tight job market.

The data were the latest pointing to a slowdown in the United States.

Fed may like it, but investors are nervous

Stocks fell Thursday on concerns slowing economic growth would hurt corporate profitability, especially in the technology sector. Warnings about sales and profits from computer maker Gateway Inc. and chip maker Altera Corp. after the market closed Wednesday sparked heavy selling in the tech sector.

The Nasdaq composite index, weighted with tech issues, tumbled about 145 points, or 5.4 percent, to 2,560 at midday. The Dow Jones industrial average fell 178 points, or 1.7 percent, to 10,450.

Click here for more on the markets

The government reported Wednesday that the economy grew at the slowest rate in four years in the third quarter – the strongest signal yet that the Federal Reserve's six interest rate increases since mid-1999 have dampened growth in the world's largest economy.

After raising rates last year and early this year, the Fed has held short-term rates steady at its last four meetings. The central bank is weighing whether the rate increases were enough to slow the economy and head off inflation without pushing the country into recession. After raising rates last year and early this year, the Fed has held short-term rates steady at its last four meetings. The central bank is weighing whether the rate increases were enough to slow the economy and head off inflation without pushing the country into recession.

A price index in the spending report, which the Fed watches closely, showed little signs of inflationary pressures.

The index edged up 0.2 percent in October after a 0.4 percent gain in September. Excluding volatile food and energy prices, the index still rose 0.2 percent last month, following a 0.2 percent September gain.

-- from staff and wire reports

|

|

|

|

|

|

Commerce Department

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|