|

European techs surge

|

|

January 4, 2001: 12:36 p.m. ET

Bourses charge higher on U.S. rate cut, led by technology and banking stocks

|

LONDON (CNNfn) - European bourses closed higher Thursday as the previous day's unexpected interest-rate cut by the U.S. Federal Reserve revived battered technology stocks.

London's FTSE 100 index rose 145.7 points, or 2.4 percent, to 6,185.6, led by business phone operator COLT Telecom Group (CTM), which rose 18.2 percent. Eight of the 10 leading stocks registered double digit gains.

The blue-chip CAC 40 in Paris jumped 131.94 points, or 2.3 percent, to 5,815.99, a day after closing at an 11-month low. Franco-Italian chipmaker STMicroelectronics (PSTM) sprang back from the doldrums, rising 12.7 percent, and broadcaster TF1 (PTFI) climbed 15.3 percent, the index's leading gainer. The blue-chip CAC 40 in Paris jumped 131.94 points, or 2.3 percent, to 5,815.99, a day after closing at an 11-month low. Franco-Italian chipmaker STMicroelectronics (PSTM) sprang back from the doldrums, rising 12.7 percent, and broadcaster TF1 (PTFI) climbed 15.3 percent, the index's leading gainer.

Frankfurt's electronically traded Xetra Dax, which closed late enough Wednesday to benefit from the Federal Reserve rate cut, slipped 0.5 percent to 6,401.41. The Dax had risen 2.3 percent by the previous day's close.

Among other European markets, the AEX index in Amsterdam added 1.4 percent, lifted by a 13.9 percent gain for electronics powerhouse Philips Electronics. The SMI in Zurich was little changed at 8,116.8, while the MIB30 in Milan gained 1.8 percent as telecom holding company Olivetti rose 7.8 percent.

Among other European markets, the AEX index in Amsterdam added 1.4 percent, lifted by a 13.9 percent gain for electronics powerhouse Philips Electronics. The SMI in Zurich was little changed at 8,116.8, while the MIB30 in Milan gained 1.8 percent as telecom holding company Olivetti rose 7.8 percent.

The HEX General index in Helsinki jumped almost 9 percent, fueled by a 11.3 percent gain for cell-phone maker Nokia. Sweden's OMX index climbed 6.8 percent as Nokia's rival Ericsson jumped 13.3 percent.

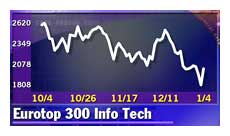

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, jumped 1.5 percent. The information technology hardware sub-index jumped 11.7 percent, while the telecom service sub-index added 6.8 percent. The tobacco, food, beverage and drug sectors all fell.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

Among Europe's high-growth markets, the pan-European Easdaq index rose 5.1 percent and London's TechMark jumped 4.9 percent, while the Neuer Markt index in Frankfurt fell 2.5 percent.

U.S. markets were mixed Thursday at midday. The tech rich Nasdaq composite slipped 0.3 percent to 2,608.43, after rocketing 14 percent following the Fed's half-percentage-point rate cut. The blue-chip Dow Jones industrial average edged up 0.1 percent to 10,958.87.

click here for the biggest movers on the techMARK 100 in London click here for the biggest movers on the techMARK 100 in London

click here for the biggest movers on the Neuer Market in Frankfurt click here for the biggest movers on the Neuer Market in Frankfurt

click here for the biggest movers on the Nouveau Marché in Paris click here for the biggest movers on the Nouveau Marché in Paris

In the currency market, the euro traded higher against the dollar at 94.39 U.S. cents, up sharply from 92.86 in late New York trade a day earlier.

In the immediate aftermath of the Federal Reserve's announcement Wednesday, the dollar registered its biggest-ever one-day jump against the euro as investors flooded into dollar-based securities. But the euro sprang back Thursday, as traders re-evaluated the implications of the narrower spread between U.S. and euro-zone interest rates. In the immediate aftermath of the Federal Reserve's announcement Wednesday, the dollar registered its biggest-ever one-day jump against the euro as investors flooded into dollar-based securities. But the euro sprang back Thursday, as traders re-evaluated the implications of the narrower spread between U.S. and euro-zone interest rates.

Typically, higher interest rates in a country tend to support that nation's currency by increasing yields on fixed-income investments such as bonds. The European Central Bank decided to keep interest rates on hold at 4.75 percent.

Techs back in fashion

An array of technology and telecom shares soared in London. Chip designer ARM Holdings (ARM) rallied more than 10 percent, while software developer Sage Group (SGE) jumped 12.4 percent and computer consultant Misys (MSY) leapt 12.3 percent.

Cellular-phone operator Vodafone Group (VOD), the most heavily weighted share on the FTSE 100 index, soared 6.2 percent, while network equipment maker Marconi (MNI) jumped 8.1 percent and network operator Energis (EGS) added 12.9 percent.

The leading decliner in London was cigarette maker British American Tobacco (BATS), dropping 8.7 percent, while Imperial Tobacco (IMT) fell 4.4 percent. Among food firms, Diageo (DGE) fell 6.4 percent and candy and drinks maker Cadbury Schweppes (CBRY) lost 7.4 percent.

Nestle, the world's biggest food company, fell 5.4 percent in Zurich. Deutsche Bank cut its earnings per share forecasts for Nestle to 174 Swiss francs ($108.70) from 182 in 2001, and to 185 Swiss francs from 193 in 2002.

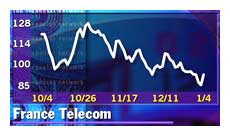

In Paris, index heavyweight France Telecom (PFTE) notched up a 7 percent rise, rival telecom and construction firm Bouygues (PEN) climbed 14.2 percent and computer consulting company Cap Gemini (PCAP) gained 5.1 percent. Network equipment maker Alcatel (PCGE) rose 14.3 percent. In Paris, index heavyweight France Telecom (PFTE) notched up a 7 percent rise, rival telecom and construction firm Bouygues (PEN) climbed 14.2 percent and computer consulting company Cap Gemini (PCAP) gained 5.1 percent. Network equipment maker Alcatel (PCGE) rose 14.3 percent.

Frankfurt techs also rose. Electronic component maker Epcos (FEPC) gained 6.5 percent, the Dax's leading gainer, while chipmaker Infineon Technologies (FIFX) added 5 percent.

Deutsche Telekom (FDTE), Europe's biggest phone company by sales, jumped 2.4 percent, while Europe's biggest software maker SAP (FSAP), dropped 9.4 percent, after rising earlier in the day.

Banking stocks with operations in North America also received a boost from the Fed's decision to slash Interest rates.

Dresdner Bank (FDRB), Germany's third-largest bank, rose 3.6 percent, the country's biggest bank Deutsche Bank (DBK) traded 3 percent higher, Commerzbank (FCBK) was up 3.8 percent and HypoVereinsbank (FHVM) gained 4.5 percent.

Dutch bank ABN-Amro rose 6.9 percent, Britain's HSBC Holdings (HSBC) jumped 9 percent, while CS Group gained 6.6 percent and UBS climbed 6.9 percent in Zurich.

Spanish banks with exposure to Latin American markets, which are thought to be hurt by any downturn in the U.S., also tacked on strong gains. Banco Santander Central Hispano rose 5.8 percent and Banco Bilbao Vizcaya Argentaria leapt 7.5 percent.

Automakers shot up a gear on hope the depressed U.S. car market may be revived with the cost of loans falling. Volkswagen (FVOW), Europe's biggest car maker, rose 5.9 percent, while luxury automaker BMW (FBMW) jumped 3.8 percent.

Drug and oil companies were among Europe's biggest losers, having benefited recently from the sluggish demand for technology and telecom stocks.

Drugmaker AstraZeneca (AZN) fell 4.5 percent in London and rival GlaxoSmithKline (GSK) shed 6.5 percent. French counterpart Sanofi-Synthelabo (PSAN) dropped 5.5 percent, chalking up the biggest decline on the CAC 40, while Germany's Schering (FSCH) fell of 6.8 percent. Drugmaker AstraZeneca (AZN) fell 4.5 percent in London and rival GlaxoSmithKline (GSK) shed 6.5 percent. French counterpart Sanofi-Synthelabo (PSAN) dropped 5.5 percent, chalking up the biggest decline on the CAC 40, while Germany's Schering (FSCH) fell of 6.8 percent.

In the oil sector, Britain's Shell Transport & Trading (SHEL) fell 0.6 percent, France's TotalFina Elf [PAR:PFP and Italy's ENI dipped 2 percent.

-- from staff and wire reports

|

|

|

|

|

|

|