|

U.S. unemployment steady

|

|

January 5, 2001: 11:52 a.m. ET

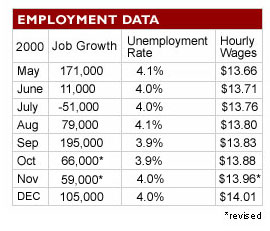

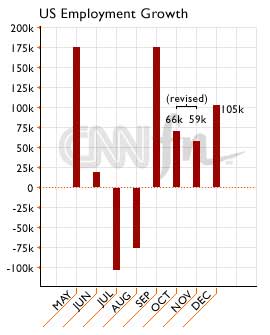

Job growth a modest 105,000 in December; jobless rate holds at 4%

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - U.S. companies added workers in December at the slowest pace in four months, while the average number of hours worked shrank and the jobless rate held steady -- all signs that the robust job market may be starting to lose some steam.

In a separate report, the Commerce Department reported that sales of new U.S. homes fell for the second straight month in November in a report suggesting a slowing but still strong U.S. housing market.

Some 105,000 new jobs were created in December, the Labor Department reported Friday, below analysts' forecasts of a 133,000 gain, but higher than the revised figure of 59,000 positions created a month before. More than half the new jobs were government positions. November's overall figure initially was reported as a 94,000 gain. Some 105,000 new jobs were created in December, the Labor Department reported Friday, below analysts' forecasts of a 133,000 gain, but higher than the revised figure of 59,000 positions created a month before. More than half the new jobs were government positions. November's overall figure initially was reported as a 94,000 gain.

Average hourly earnings -- a yardstick of inflation pressures -- gained 5 cents, or 0.4 percent, to $14.01 in December, a shade higher than analysts' forecasts of a 0.3 percent increase. The jobless rate held steady at 4 percent, countering expectations of an uptick to 4.1 percent.

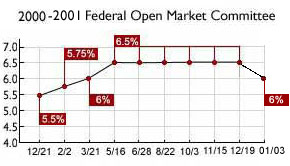

The numbers sealed a year in which the pace of job creation slowed dramatically, a trend partially spurred by the Federal Reserve's series of interest rate increases between May 1999 and June 2000. For the year, the economy generated 1.9 million new jobs, the report said, well below the 2.8 million positions created in 1999 and the 3 million generated in 1998.

Job growth averaged 160,000 a month in 2000, compared with 229,000 in 1999 and 251,000 in 1998.

Despite Friday's mixed bag of economic numbers, economists pointed out that the data affirmed the Fed's surprise move earlier this week to reduce short-term interest rates by a half point -- a move that eventually will spur consumers to spend more and businesses to ramp up their capital spending and expansion plans -- moves that generate new jobs.

"With the Fed maintaining an economic-weakness bias, Greenspan is more likely to be concerned with the signs of further economic weakness in this report rather than worrying about the increase in average hourly earnings," said John Ryding, senior economist with Bear Stearns, adding that he expects the Fed will cut rates by an additional quarter point at the end of their Jan. 30-31 policy meeting.

Fewer hours worked

"Although they were close to expectations and maybe a little bit weaker, the numbers confirm that the economy generally is slowing," said Hugh Johnson, chief investment officer with First Albany Corp. "The report also confirms that the manufacturing sector of the economy is contracting."

Indeed, in terms of the number of new jobs created, private industry added only 49,000 positions last month compared with 56,000 within government. That was the weakest number of new private jobs since the 17,000 positions created back in August.

The average hourly workweek meantime declined 0.2 percent to 34.1 from 34.3 in November, a decline economists equate to the loss of more than 100,000 jobs. Excluding the 1996 blizzard that paralyzed the Northeast, that was the lowest number of hours worked since April 1991, when the economy was emerging from its last recession. The average hourly workweek meantime declined 0.2 percent to 34.1 from 34.3 in November, a decline economists equate to the loss of more than 100,000 jobs. Excluding the 1996 blizzard that paralyzed the Northeast, that was the lowest number of hours worked since April 1991, when the economy was emerging from its last recession.

Many economists honed in more closely on the number of hours U.S. workers are putting in on the job because as consumer and business demand for products and services has waned in recent months companies have chosen to scale back hours rather than lay off employees.

"A one-tenth decline in the workweek is as powerful as a 350,000 decline in payrolls," said Steve Slifer, chief economist with Lehman Brothers. "The adjustment taking place now is more in hours worked because the labor market is still tight. If you lay someone off, you may not be able to get them back."

Negative market reaction

Manufacturing lost jobs for the fifth straight month, shedding 62,000 jobs in December after a 15,000 loss a month earlier. The figure comes after the National Association of Purchasing Management report released earlier this week showed that manufacturing in December slumped to the lowest level since the last recession in 1991.

Stock investors reacted negatively to the news, focusing on the larger-than-expected jump in average hourly earnings -- an indication that companies are paying their workers more, which could spark faster inflation as firms lift prices to offset their rising labor costs. Bonds were little changed.

A big issue for Fed Chairman Alan Greenspan and for financial markets has been compensation costs for companies, which can be a double whammy on the inflation front -- putting more money in workers' pockets, which increases their spending power, and forcing companies to raise prices to offset higher wage costs. A big issue for Fed Chairman Alan Greenspan and for financial markets has been compensation costs for companies, which can be a double whammy on the inflation front -- putting more money in workers' pockets, which increases their spending power, and forcing companies to raise prices to offset higher wage costs.

But so far that's not really happening. On a year-to-year basis, wages have risen 4.1 percent, according to Labor Department figures, the biggest gain since January 1999. However, to put that in context, wages have risen within a range of 3.2 percent to 4 percent during the past three years, suggesting that compensation costs aren't rising as quickly as some may think.

Anthony Chan, chief economist with Banc One Investment Advisers, told CNNfn's Before Hours that, while the rise in hourly wages was "troublesome" from a market point of view, further slowing in job growth should temper compensation costs going forward. (265KB WAV) (265KB AIFF)

The Fed factor

Labor Secretary Alexis Herman told reporters in her last post-report conference call as head of the Department of Labor that job creation going forward likely won't be as "spectacular" as it has been in months' past as the economy continues to slow. Nonetheless, she does see more stable employment growth as the Fed's rate cuts filter their way down into the economy.

"I usually don't comment on any moves by the Fed, but since this is my last report as labor secretary ..." she quipped. "I think [the Fed rate cut] does send the right signal that we need to keep consumers confident. Obviously, we don't expect to see direct results on the employment situation kicking in immediately, but I think it will make conditions more favorable in the medium term."

President-elect George W. Bush earlier this week appointed Linda Chavez to head the Department of Labor for his new administration. Herman was appointed labor secretary by President Clinton in 1993. President-elect George W. Bush earlier this week appointed Linda Chavez to head the Department of Labor for his new administration. Herman was appointed labor secretary by President Clinton in 1993.

New home sales fall

Separately, the Commerce Department reported that the number of new, single-family homes sold in November fell 2.2 percent to a seasonally adjusted annual rate of 909,000 from 929,000 in October.

Although the U.S. housing market has softened along with the rest of the economy, home sales have remained near record levels, bolstered by a steady decline in mortgage rates beginning in mid-2000. Sales of new, single-family homes in November were up 1.6 percent from the same time last year, the department said.

The median price of new, single-family homes fell for the first time since the summer, dropping slightly to $169,900 in November after reaching $170,000 in October. The median price a year ago was $172,900.

Sales of new, single-family homes dropped across the country except in the South, the largest housing market, where sales rose 3.5 percent in November. New home sales plummeted 20 percent in the Northeast. Sales dropped 7.6 percent in the Midwest and fell 3.3 percent in the West.

|

|

|

|

|

|

|