NEW YORK (CNNfn) - The Nasdaq composite index surged more than 4 percent Thursday, as technology stocks were snapped up amid investor belief that much of the negative news about profit growth has been factored into the sector.

This was the Nasdaq's first three-session rally since a five-session winning streak in late August. The last two sessions have signaled optimism that the composite has reached the long-awaited bottom.

"You're getting a lot of positive sentiment in the market and a lot of rotational shifting toward growth," said Barry Hyman, chief market strategist with Weatherly Securities. "It doesn't say that earnings are going to be better but it does lead one to believe that a lot of the bad news may already be built in."

The Nasdaq composite index rallied 116.39 to close at 2,640.57. But the markets could be setting up for a rough opening -- after the market closed, Hewlett-Packard (HWP: Research, Estimates) warned its first-quarter earnings would fall short of expectations while Gateway reported fourth-quarter earnings well below estimates. The markets have typically had a knee-jerk reaction to such warnings in recent sessions. Hewlett-Packard shares ended up 63 cents at $32.38 while Gateway was up $2.96 to $22.90, ahead of the news. The Nasdaq composite index rallied 116.39 to close at 2,640.57. But the markets could be setting up for a rough opening -- after the market closed, Hewlett-Packard (HWP: Research, Estimates) warned its first-quarter earnings would fall short of expectations while Gateway reported fourth-quarter earnings well below estimates. The markets have typically had a knee-jerk reaction to such warnings in recent sessions. Hewlett-Packard shares ended up 63 cents at $32.38 while Gateway was up $2.96 to $22.90, ahead of the news.

Explaining the growing momentum in the Nasdaq, Weatherly's Hyman said, "This is the third 'up' day in a row and that's showing a direction. People are getting a little bit nervous -- it's been dangerous to pick bottoms before because it always turned back down."

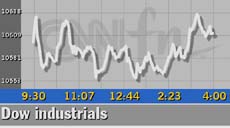

The buying spilled into the blue chips, lifting the Dow Jones industrial average modestly for its second straight session. The gains were tempered by selling in drug, tobacco and manufacturing stocks. The Dow advanced 5.28 to 10,609.55. The S&P 500 rose 13.55 to 1,326.82. The buying spilled into the blue chips, lifting the Dow Jones industrial average modestly for its second straight session. The gains were tempered by selling in drug, tobacco and manufacturing stocks. The Dow advanced 5.28 to 10,609.55. The S&P 500 rose 13.55 to 1,326.82.

"The last two 'up' days have been on higher volume so you've seen the confirmation of a rally," said David Beard, portfolio manager with Morgens Waterfall Vintiadis. "Stocks aren't going down on bad news anymore."

Market breadth was positive. On the New York Stock Exchange, advancers beat decliners 1,646 to 1,256, as more than 1.35 billion shares were traded. Winners topped losers on the Nasdaq 2,753 to 1,159, as more than 2.8 billion shares changed hands.

In other markets, Treasury securities were mixed. The dollar fell against the euro but rose versus the yen.

Tech rally shrugs off Yahoo!

A warning by Internet leader Yahoo! that its earnings for 2001 will fall short of expectations pressured tech stocks early, but investors quickly shrugged off the news.

"Obviously, Yahoo! started the Nasdaq off on the wrong foot and then we rebounded," said John Forelli, senior vice president and portfolio manager at Independence Investment Associates. "We're starting to see a pattern here of tech investors already having braced themselves for the bad news and the market strengthening as the day goes on."

Yahoo! (YHOO: Research, Estimates) tumbled $4.63 to $25.88 after it reported fourth-quarter earnings late Wednesday that were in line with expectations. But it said earnings for the first quarter of 2001 and all of the new year would be weaker than expected due to soft ad sales.

As quarterly results continue to be reported, Art Hogan, chief market analyst with Jefferies & Co., said the reports should provide a catalyst for stocks to move higher.

"It appears as though Yahoo! is Yahoo!, but I think the rest of the market will edge higher," he said. "I don't think there are as many nightmares out there and I also think the bar has been lowered enough that the earnings estimates are achievable."

Other technology companies were scheduled to post results after the market closes. DoubleClick (DCLK: Research, Estimates), the Internet advertising company, is expected to report a fourth-quarter loss of 2 cents a share, an improvement from a 3-cent loss a year earlier. After Yahoo!'s forecast, which renewed concerns about the online advertising environment, DoubleClick's shares fell $1.16 to $11.25.

Rambus (RMBS: Research, Estimates), the developer of specialized memory chips, is expected to report an increase in fiscal first-quarter income to 13 cents a share from 3 cents a year earlier. The company's stock rose $2.69 to $48.88.

Investors found buying opportunities in all tech sectors. One example, Cisco Systems (CSCO: Research, Estimates), surged $2.25 to $38.50, just one day after an analyst downgrade sent the networking giant 9 percent lower before starting to recoup its losses. Investors found buying opportunities in all tech sectors. One example, Cisco Systems (CSCO: Research, Estimates), surged $2.25 to $38.50, just one day after an analyst downgrade sent the networking giant 9 percent lower before starting to recoup its losses.

Dell Computer (DELL: Research, Estimates) gained $1.50 to $22.81, Microsoft (MSFT: Research, Estimates) jumped $2.13 to $55, and Applied Materials (AMAT: Research, Estimates) rose $1.63 to $46.38.

Pressuring the Dow were drug, tobacco and manufacturing issues. Johnson & Johnson (JNJ: Research, Estimates) fell $3.44 to $92.44, Philip Morris (MO: Research, Estimates) lost $2.50 to $41.63 and DuPont (DD: Research, Estimates) shed $1.88 to $45.

Favoring the Fed

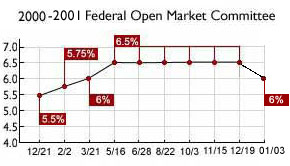

Analysts said investors were showing increased confidence that the Fed will step in and temper the economy if warranted.

Confidence in interest rate-sensitive financial issues rose, tempering the Dow's losses. J.P. Morgan Chase (JPM: Research, Estimates) gained $3.19 to $54.13 and American Express (AXP: Research, Estimates) jumped $1.19 to $47.88.

"The Fed is cutting rates and injecting liquidity into the market," said Independence's Forelli. "Financials are doing well because people are expecting a cut in rates."

Just last week, the Fed cut its rates by a half percentage point and signaled it would cut rates further in a bid to give the economy a lift. Lower rates tend to spur spending by businesses and consumers, boosting economic growth and fattening corporate profits.

In the day's economic news, the number of Americans filing new claims for unemployment benefits for the week ended Jan. 6 fell to 345,000 from a revised 381,000 the prior week, according to the U.S. Labor Department.

Economists surveyed by Briefing.com expected claims to have slipped to 370,000.

AOL, Time Warner nearing close

The Federal Communications Commission has a sufficient support to approve America Online's (AOL: Research, Estimates) $107.9 billion purchase of CNNfn's parent company, Time Warner (TWX: Research, Estimates), but delayed a final vote on the deal Thursday while officials there continued to wrangle over placing conditions on AOL's instant messaging service.

Time Warner shares rose $4.15 to $71.15, while AOL shares gained $2.34 to close at $47.23.

|