|

Dell warns on 4Q

|

|

January 22, 2001: 1:23 p.m. ET

Computer maker cites slowing sales and sluggish economy; shares fall

|

NEW YORK (CNNfn) - Dell Computer Corp. warned Monday that earnings in the fourth quarter will fall well short of Wall Street forecasts, due to slowing computer sales and the weakening economy.

The world's biggest direct marketer of personal computers said it now expects profit of 18-to-19 cents a share for its fiscal fourth quarter ending Feb. 2, compared with Wall Street forecasts of 25 cents a share. The Austin, Texas-based company cited a "deterioration in global economic conditions and overall demand for computer systems and services."

The warning comes even as Dell said it expects fourth-quarter revenue to jump about 26 percent to as much as $8.6 billion, an increase that is considerably lower than the company has experienced in recent years. Quarterly shipments are expected to be more than 40 percent above a year ago, the company said, with gains in market share.

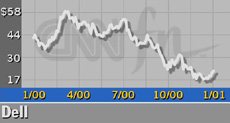

Dell (DELL: Research, Estimates) shares were down 69 cents, or 2.7 percent, at $24.94 in early-afternoon Nasdaq trade Monday.

Dell warned about the fourth quarter in October, citing weakness in Europe and sales to small businesses, but said at the time its earnings would come in a just a penny or two short of Wall Street forecasts. Dell warned about the fourth quarter in October, citing weakness in Europe and sales to small businesses, but said at the time its earnings would come in a just a penny or two short of Wall Street forecasts.

Many computer makers and chip and component manufacturers have been taking a hit as overall computer sales have slowed, forcing PC makers to scale back component orders.

Consumers have been spending less in general in recent months as a series of interest rate hikes, high fuel prices, and severe weather kept people out of the stores, particularly during the holiday season. In addition, there haven't been new software applications that provide a compelling reason for consumers to upgrade PCs they purchased within the past three years.

On Friday, two leading technology research firms released data confirming the sharp decline in PC unit shipment growth in the fourth quarter. Michael Dell, the Round Rock, Tex.-based company's chairman and chief executive, told CNNfn Monday the latest data reflect an industry consolidation. (219K WAV) or (219K AIFF)

With its warning, Dell becomes the latest in a string of computer hardware makers that will miss their previous revenue and earnings targets.

Hewlett-Packard (HWP: Research, Estimates), a leading maker of PCs, printers, storage devices and UNIX servers, warned on Jan. 11 that its latest quarterly financial results will fall short of Wall Street's expectations, blaming weaker economic conditions and a slowdown in corporate and consumer technology spending. For its fiscal first quarter ending Jan. 31, the company said it expects to report earnings per share in the range of 35 cents to 40 cents. The consensus estimate of analysts surveyed by earnings tracker First Call had been 42 cents.

On the same day, personal computer maker Gateway (GTW: Research, Estimates) missed lowered fourth-quarter earnings estimates, cut its forecast for 2001, and announced more than 3,000 layoffs meant to streamline operations.

For the first time in Gateway's history, its personal computer business lost money, with all of the company's profit coming from "beyond-the-box" services, such as Internet access. The direct computer retailer earned $37.6 million, or 12 cents per share, excluding a special charge. Analysts surveyed by First Call had lowered their forecasts to 37 cents a share from 62 cents a share after a Nov. 29 earnings warning from the company.

Along the same lines, a huge revenue shortfall in last year's holiday season caused Apple Computer to record its first quarterly loss in three years -- a loss that was deeper than analysts had expected following an earnings warning from the company last month. Apple reported on Jan. 17 that its revenue plunged 57 percent to $1 billion from $2.34 billion in last year's first quarter.

Merrill had predicted warning

In an example of luck or good foresight, Merrill Lynch analyst Steve Fortuna issued a research note Monday morning predicting that Dell would issue an earnings warning for the January quarter.

"We believe Dell will preannounce a miss for the January quarter, most likely within the next two weeks. We also think the company will use the opportunity to lower next year's sales growth outlook from 20 percent to 15-20 percent," Fortuna wrote.

However, Fortuna underestimated the extent of Dell's earnings shortfall in his note. He predicted that the company would earn 23 cents per share, compared with the 18-to-19 cents the company now estimates.

"We continue to believe that Dell's model remains fundamentally advantaged and that the company's prospects are bright with respect to an increasing mix of enterprise hardware, but we think it is appropriate to exercise some caution on the stock at these levels owing to the current uncertainty," the Merrill analyst wrote. "We retain our 'buy' rating on Dell shares and would view any significant weakness in the shares in the wake of a pre-announcement as a buying opportunity in particular."

|

|

|

|

|

|

|